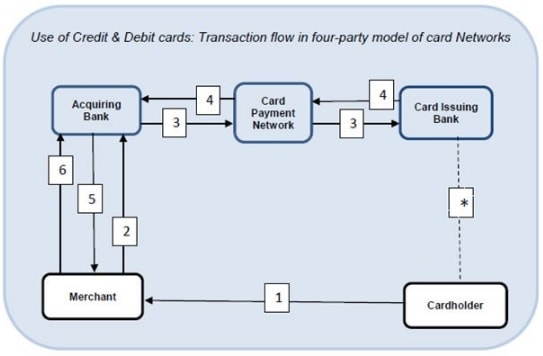

The RBI is not in favour of cutting debit card charges aggressively, a proposal the government has made to the regulator, as it thinks such a move will impact the banks’ businesses negatively, according to a report in The Economic Times. The proposal to reduce the charges was made by the government in various meetings and video conferences it held with the RBI officials and bankers. [caption id=“attachment_3152268” align=“alignleft” width=“380”]  Reuters[/caption] The move is aimed at smooth transition into cashless economy after the demonetisation of Rs 500 and Rs 1000 notes. The government has already waived the charges until 31 December this year. The government now wants to either cut the charges more aggressively until 31 March 2017 or just do away with them completely. According to R Gandhi, one of the deputy governors at the RBI, the move is likely to render business unsustainable for the banks. The charges mentioned here is the merchant discount rate , which the central bank had capped at 0.75 percent for transaction values up to Rs 2,000 and at 1 percent for transaction values above Rs 2000. MDR is the merchant fees for debit card transactions. Card payments are indeed a complex process for banks. A simple grahic below (source RBI concept paper) explains how the transaction flow in a four-part model card networks.  “When a customer makes a transaction using cards at a merchant establishment, banks are the ones which incur a cost to process the transaction. MDR helps them compensate for this. That is the reason why the banks are not very happy about extending the MDR waiver,” explains Kalpesh Mehta, partner, Deloitte India. An earlier report in The Economic Times had said that bankers see Rs 1000 crore loss if the government forces them to waive off the charges or extend the present waiver beyond 30 December. “The government is in a hurry. Banks are requesting the government not to sacrifice commercial considerations,” a payments industry official has been quoted as saying in the ET report. It seems the banks will have to make a few sacrifices as India transitions to the cashless mode.

In the government’s hurry, banks seem to be sacrificing a bit too much

Advertisement

End of Article

)

)

)

)

)

)

)

)

)