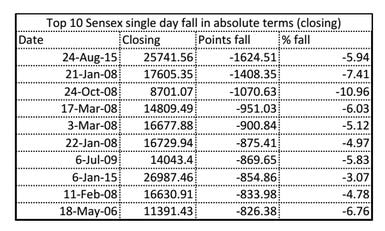

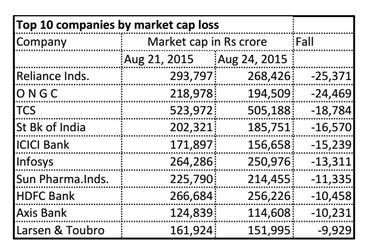

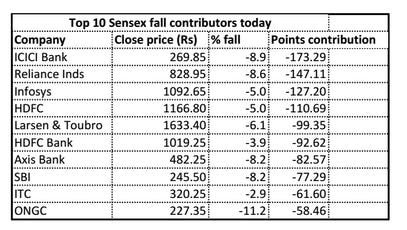

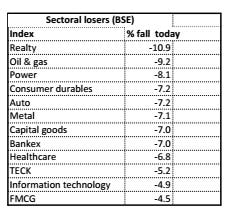

By Rajesh Pandathil and Kishor Kadam The much-feared China is happening and Indian markets felt the pinch today. The Sensex crashed 1,624 points to end at 25,741.56 and the Nifty 490.95 points to 7,809. The rupee, meanwhile, tumbled 1.2 percent from the previous close to 66.65 against the dollar. [caption id=“attachment_2401846” align=“alignleft” width=“380”]  Bombay Stock Exchange. Reuters[/caption] A key reason for the fall is the global slowdown fears led by the Chinese economy. The Chinese stock market too fell about 8.5 percent. The slowdown of the Chinese economy and the consequent devaluation of its currency has had a ripple effect on emerging market currencies. “Notably, China’s economic slowdown is worrisome for a swift global economic recovery to come through. This has led to a markets globally getting into the risk-off mode for now, having an impact on India as well,” said Hitesh Agrawal - head research, Reliance Securities, Explaining the market fall today. But that is not the only reason. As Agrawal says, there are domestic reasons too. “On the domestic front, another quarter of disappointing earnings season for 1Q, coupled with the somber management commentaries, had cast a shadow over the extent of recovery possible in the current fiscal. Add to this the sub-par monsoon this year, which will make India’s economic recovery challenging,” he said. Foreign institutional investors (FIIs/FPIs) today net sold shares worth Rs 5,275 crore while domestic institutions net bought equities worth Rs 4,098 crore, as per provisional data available on exchanges. Check out the following factoids about today’s market fall:  Is this really the biggest single-day market fall? The answer is no. It becomes the biggest only when you consider the absolute points. Percentage-wise, it is the 29th biggest. The biggest fall - 12.77 percent - was on 28 April 1992, when Harshad Mehta scam broke. However, when it comes to wealth erosion, this is the steepest fall. Overall, Rs 704,256 crore (Rs 7 lakh crore) of investor wealth eroded in today’s market fall. The earlier record was on 21 January 2008, when the investors sold on fears of a recession in the US, after the Global Financial Crisis broke out. A large section of market observers has said India is better placed. Is it?  It is. That is what a comparison with the peers shows. In the last 10 sessions, after China started devaluing the yuan on 11 August kicking off worries across the markets, Indian markets have fallen 8.4 percent, making it the second best performer after New Zealand, which has fallen 4.39 percent. The worst performer was China - the markets there fell 18.29 percent during the period. However, today India is the worst performer after China, which fell 8.49 percent. Which stocks witnessed the most market cap erosion today?  Energy majors Reliance Industries and ONGC saw a market cap erosion of Rs 25,371 crore and Rs 24,469 crore, respectively. TCS, State Bank of India, ICICI Bank, Infosys, Sun Pharma, HDFC Bank, Axis Bank and Larsen & Toubro were the others. While TCS, Infosys and Sun Pharma were pummelled due to the US slowdown fears, banks come under pressure due to the domestic economic worries.  The top Sensex loser by points was ICICI Bank, followed by Reliance Industries, Infosys and HDFC.  On the sectoral front, the top loser was the BSE Realty Index, which fell 11 percent. Oil & gas followed with a 9.2 percent fall. The Bankex was down 7 percent.

The top Sensex loser by points was ICICI Bank, followed by Reliance Industries, Infosys and HDFC.

Advertisement

End of Article

Written by FP Archives

see more

)

)

)

)

)

)

)

)

)