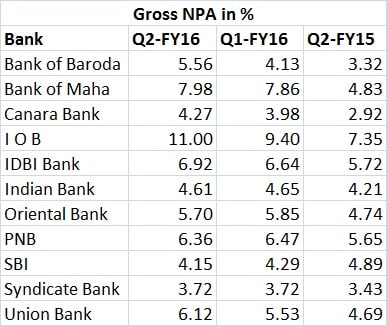

State Bank of India (SBI), the country’s largest lender by assets, continues to be an outlier among public sector banks, posting better-than-expected earnings in the September quarter of fiscal year 2016. The bank has managed to further reduce its non-performing assets (NPA) level and reported healthy growth in its fee-income. Its net profit rose to Rs 3,879 crore, up 25 percent, from Rs 3,100 crore in the year-ago period.[caption id=“attachment_2193965” align=“alignleft” width=“380”]  Reaping profits. Reuters[/caption] Gross NPAs of the lender fell to 4.15 percent of total loans compared with 4.29 percent in the preceding quarter and 4.89 percent in the year-ago quarter. Other income zoomed 35.6 percent in the quarter supporting the core profitability. In the quarter, SBI managed to recover Rs 892 crore and upgraded Rs 629 crore of loans. Overall, SBI has beaten analysts’ expectations in the second quarter, even though some of its peers continued to struggle to bring down their NPAs. “SBI has been reporting stable numbers with respect to slippages and NPA ratios over the past several quarters as compared to its peers. The bank’s core strength has been its high CASA (cheaper deposits) and fee income, which has supported its core profitability in challenging times,” said Vaibhav Agrawal, research analyst at Angel Broking Ltd. However, the banking industry still seems to be struggling with the NPA problem with many banks seeing a rise in bad loans in the second quarter. To be sure, analysts opine that the pace of rise in sticky assets have come down compared with the previous quarters. “While the stock of non-performing loans (NPLs) may continue to rise, the pace of new impaired loan formation in the current financial year ending 31 March 2016 will be lower than the levels seen in the past four years,” Moody’s Investors Service said in a recent note. “A meaningful proportion of stressed loans has already been recognised as impaired, while economic conditions are improving. However, the recovery in asset quality will be U-shaped rather than V-shaped, because corporate balance sheets remain highly leveraged,” the note said. The worst hit was Indian Overseas Bank (IOB), with its gross NPAs escalating to 11 percent from 9.4 percent in the preceding quarter and 7.35 percent in the year-ago quarter. The bank’s net losses doubled in the quarter after the provisions (the amount of money banks need to mandatorily set aside against impaired assets) rose by almost 74 percent. Similarly, Bank of Baroda has seen its GNPAs rising to 5.56 percent from 4.13 percent in the first quarter and 3.32 percent in the second quarter of the previous year.  Other lenders, which have seen an increase in their bad loan levels, include Canara Bank, Union Bank and Bank of Maharashtra. Many banks have also resorted to selling bad assets to asset reconstruction companies in a bid to clean-up their balance-sheets. Analysts expect the pace of rise in bad loans to subside but this will depend on the pace of the recovery in the economy. Total gross NPAs in the banking system stood at Rs 300,000 crore at the end of June. According to Moody’s the rise in bad loans on the books of Indian banks will continue at a slower pace on account of improving economic scenario. But the agency warned that there are no short cuts to the problem, unless the government forks out more money to strengthen them. NPAs from restructured loans Continuing slippages from the restructured loan portfolio is also a cause of concern for banks since many companies, whose loans are being recast, are unable to improve their performance despite relaxed repayment terms offered by banks. Not just public banks, but private sector lenders too have felt the heat of asset quality. In the September quarter, ICICI Bank reported fresh slippages of Rs 2,242 crore in the second quarter compared with Rs 1,672 crore in the June-quarter. Of this, about Rs 931 crore of fresh slippages emerged from restructured loans. Presently, a total of Rs 2,65,294 crores loans are being restructured under the corporate debt restructuring (CDR) mechanism, while the chunk of loans being recast under the bilateral channels would also work out to be somewhat equal to this. The fate of such loans will depend on how fast the situation on the ground improves and stalled projects come back on track, thus improving the repayment ability of corporate-borrowers. (Kishor Kadam contributed to this story)

According to Moody’s the rise in bad loans on the books of Indian banks will continue at a slower pace on account of improving economic scenario.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)