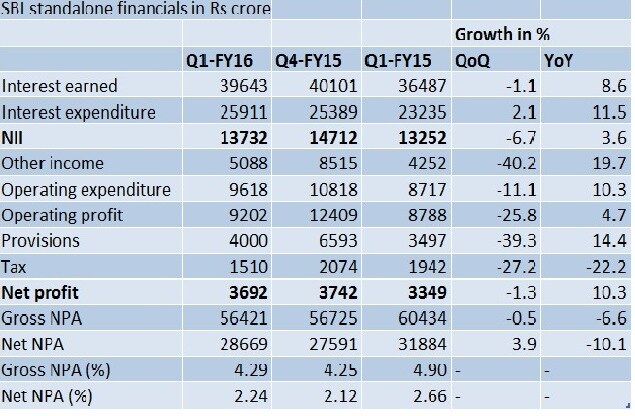

The April-June quarter numbers of State Bank of India (SBI) came broadly in line with market expectations, except on the quarter-on-quarter deterioration witnessed in the fresh slippage numbers. The bank has shown its gross non-performing assets (NPAs) at 4.29 percent of total loans, marginally up, compared with 4.25 percent in the preceding quarter, but fresh slippages in the June quarter stood high at Rs 7,318 crore compared with Rs 4,769 crore in the preceding quarter. This signals fresh cases of stress possibly on the corporate segment. SBI chairman Arundhati Bhattacharya, however, sought to play down the asset quality problem saying some part of this is due to seasonality factor. “As far as asset quality is concerned, we are in a much better position today, " said Bhattacharya. “In fact, after eight quarters, for the first time, we are seeing stress declining in the mid - corporate segment,” Bhattacharya said. Credit growth in the industry remains subdued, hence there is no scope as of now to cut lending rates, Bhattacharya said. The bank will look at further monetary transmission when credit growth picks up, she added. [caption id=“attachment_2387718” align=“alignleft” width=“380”]  Reuters[/caption] To be fair, among the state-run banks, SBI has managed its asset quality situation better compared with other large sized state-run banks. Typically, slippages in the fist quarter tends to be high, hence it is early to draw conclusions on the asset quality trend. One needs to wait and watch for a few more quarters to understand the trend. Though the exact numbers aren’t available yet, in the first quarter, SBI is estimated to have done close to Rs 4,000 crore fresh loan restructuring. While the gross NPA numbers came largely stable, what has disappointed investors is the fall in the net interest income (NII), the difference between interest earned and interest expended. On a year-on-year basis, bank’s advances grew 6.8 percent, much lower than the deposit growth of 13.7 percent. This hurt the NII, which fell to Rs 13,732 crore from Rs 14,712 crore in the preceding quarter, but higher than Rs 13,252 crore in the year-ago quarter. Despite lower NIIs, the bottomline grew 10 percent year-on-year on the back of a decline in provisions, which fell to Rs 3,358 crore from Rs 3,903 crore. Clearly, stress from defaulting companies continues to stay high. As Firstpost highlighted in a recent article , in the last two quarters the banking sector has seen a substantial rise in the number of firms which pay their dues after 60 days of the due date, indicating these can be potential NPAs in the approaching quarters unless the financial situation of these companies improve. The critical factor to watch out for is the recovery in economy, which will be a decisive factor on the stressed asset situation in the banking sector. Until now, there has not been much improvement in the cash flow situation of companies, which is directly reflected in the fresh slippage numbers of banks. Banks’ asset quality situation cannot be different from the real economy. With fresh investments not happening and projects yet to come back on track, companies are struggling to contain their cost over-runs. This is the reason they default on their payments to banks. Only a push to revive the infrastructure projects by the government, can improve the scenario. Even this will reflect on the books of banks only after a few quarters.  The persisting stress on the balance sheets of banks is visible in the rise in the SMA-2 category loans of banks. As Firstpost noted before, this chunk has gone up sharply in the recent quarters. Total gross gross NPAs of 35 listed banks stood at Rs 2.98 lakh crore as at end June, up 26.4 percent, from the year-ago period. About 90 percent of NPAs are on the books of state-run banks. The June quarter earnings announced by other state-run banks too indicate continuing stress on the asset quality front. The government’s recent announcement that it will infuse Rs 70,000 crore in state-run banks should give temporary relief to these NPA-ridden lenders. But, given the direct correlation the banking sector’s performance has with the economy, any sustainable improvement in the current asset quality trend can happen only with faster economic recovery. With inputs from Kishor Kadam

The June quarter earnings announced by other state-run banks too indicate continuing stress on the asset quality front

Advertisement

End of Article

)

)

)

)

)

)

)

)

)