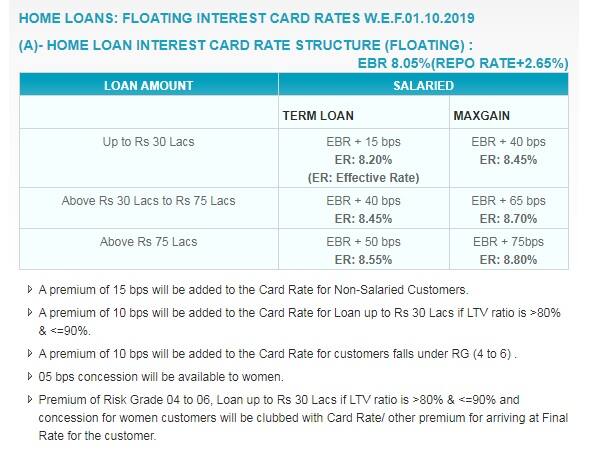

State Bank of India (SBI) has announced a few modifications to its floating rate home loans effective from 1 October 2019 to comply with the latest regulatory guidelines. The RBI has made it mandatory for banks to link all floating personal or retail loans to external benchmark. SBI, the first in India to launch a repo rate-linked home loan scheme in July, withdrew the earlier scheme a few days ago in order to launch a revamped scheme effective from 1 October. “We have decided to adopt repo rate as the external benchmark for all floating rate loans for MSME, housing and retail loans effective 1 October 2019”, SBI said in a release.  SBI has decided to adopt repo rate as the external benchmark for all floating rate loans for MSME, housing and retail loans effective 1 October 2019 as per RBI’s notification. A SBI press release said the bank voluntarily extends the external benchmark based lending to Medium Enterprises also, to boost lending to the MSME sector as a whole. The RBI has lowered the repo rate by 110 basis points so far this year. For all the details on SBI’s external benchmark-linked home loan, click

here

SBI has decided to adopt repo rate as the external benchmark for all floating rate loans for MSME, housing and retail loans effective 1 October 2019 as per RBI’s notification. A SBI press release said the bank voluntarily extends the external benchmark based lending to Medium Enterprises also, to boost lending to the MSME sector as a whole. The RBI has lowered the repo rate by 110 basis points so far this year. For all the details on SBI’s external benchmark-linked home loan, click

here

SBI announces linking of new floating rate housing loan scheme to repo rate; to be effective from 1 October

FP Staff

• September 26, 2019, 10:09:02 IST

SBI withdrew the earlier scheme a few days ago in order to launch a revamped scheme effective from 1 October

Advertisement

)

End of Article