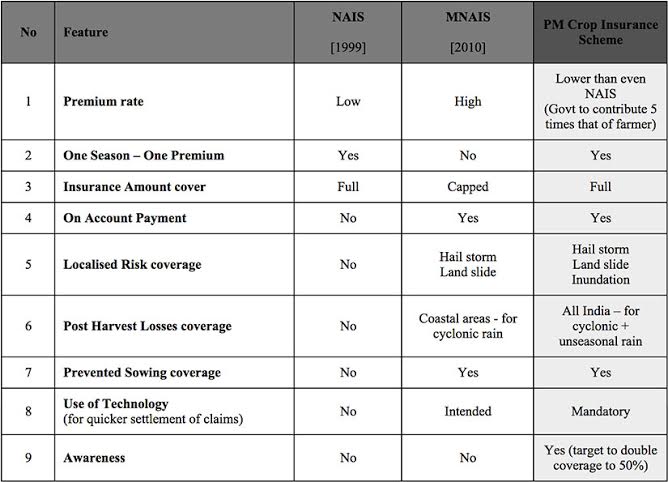

New Delhi - In a bid to address the rural distress that is driving farmers to suicide, the NDA government on Wednesday announced a new Rs 17,600-crore crop insurance scheme to cover loss of crops due to natural calamities like drought at a very low premium payout by farmers. The scheme will be rolled out from the coming kharif season starting June. The move is also to be seen in the backdrop of the drubbings the BJP suffered in the recent elections in Bihar and elsewhere, which clearly pointed to a growing disillusionment in the rural India about the central government. [caption id=“attachment_2539528” align=“alignleft” width=“380”]  Reuters[/caption] According to the government data, as many as 207 districts in nine states have been hit by drought. As much as 90 lakh hectare of land had been affected due to drought and the affected states had sought relief of over Rs 25,000 crore from the central government, a recent IANS report said. Also 302 districts in the country had received 20 percent less rain, which, though is not categorised as drought, will affect the farmers in these areas. Announcing the sop, prime minister Narendra Modi described the scheme wherein the Centre will provide Rs 8,800 crore annually to make up for almost all of the premium for the crop insured, as a move “that will transform the lives of the farmers in a big way”. Here are the key facts about the new scheme: Salient features: Under the scheme Pradhan Mantri Fasal Bima Yojana (PMFBY), the state will also provide a matching contribution while farmers will pay only only 2 per cent of the premium fixed by the insurance company for kharif foodgrains/ oilseeds crops and 1.5 per cent for rabi foodgrains/ oilseeds crops. The premium will be 5 per cent for horticultural and commercial crops for both seasons. “This new crop insurance scheme will have lowest premium for farmers in the history of Independent India,” said Home Minister Rajnath Singh. There will be no provision of capping the premium rate so as to ensure farmers get a higher claim against the full sum insured. At least 25 per cent of the likely claim will be settled directly on farmers’ bank account. According to the government, farmers will get a higher claim for the full sum insured unlike the existing schemes such as National Agricultural Insurance Scheme (NAIS) and Modified National Agricultural Insurance Scheme (MNAIS). The new scheme will cover yield loss of standing crops, prevented sowing/ planting risk, post harvest losses and localised risks, including inundation. At present, loanee farmers are mandated to take crop insurance cover. The new scheme is open to all farmers irrespective of whether they are loanees or not. There will be one insurance company for the entire state, farm-level assessment of loss for localised risks and post-harvest loss. And private insurance companies, along with the Agriculture Insurance Company of India Ltd, will implement the scheme. The government has also said the state governments have to make required changes in the law to bring in even the tenant farmers under the derisking fold. The difference from the earlier schemes: The government has elaborated how the new scheme is different in simple table:  “This is certainly the best for the farmer till date as it provides for localized events and removes the cap,” a report in the Mint newspaper quotes T. Haque, director, Council for Social Development, as saying. Apart from this, another major aspect of the scheme is the indented use of technology. The government will use remote sensing and smartphone and other modern technologies for accurate and quicker crop yield estimations. The challenges: As is evident from the government’s table above, this is not the first time the government has launched a scheme. Earlier in 1985 the government had launched a Comprehensive Crop Insurance Scheme (CCIS) 1985. It ran until 1999. In 1997-98, the government again launched Experimental Crop Insurance Scheme, which closed in one year. In 1999, the government launched National Agricultural Insurance Scheme (NAIS). However, the coverage of these schemes has been too low due to lack of awareness among the farmers. According to media reports, the coverage as of now stands at just 23 percent. The government is aiming at 50 percent coverage with the new scheme. This is going to be the biggest challenge for the government. Secondly, crop insurance sector is bogged down by frauds. According to an earlier report in The Economic Times, bank officials, insurance officials and farmers are hand in gloves to siphon off insurance money. How is the new scheme going to address this? With PTI

New Delhi - In a bid to address the rural distress that is driving farmers to suicide, the NDA government on Wednesday announced a new Rs 17,600-crore crop insurance scheme to cover loss of crops due to natural calamities like drought at a very low premium payout by farmers. The scheme will be rolled out from the coming kharif season starting June. The move is also to be seen in the backdrop of the drubbings the BJP suffered in the recent elections in Bihar and elsewhere, which clearly pointed to a growing disillusionment in the rural India about the central government.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)