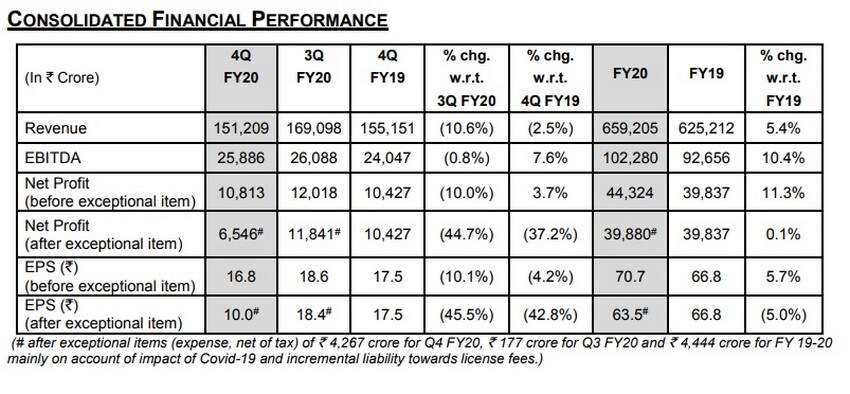

Reliance Industries Ltd (RIL) announced its fourth-quarter results today. The country’s largest listed company by market capitalisation on 30 April reported a consolidated profit of Rs 6,546 crore during January-March quarter 2020 with a one-time loss of Rs 4,267 crore. The consolidated profit in the previous quarter was Rs 11,841 crore and in the corresponding quarter last year, it was Rs 10,427 crore. The revenue has come in at Rs 1.51 lakh crore in Q4 as against Rs 1.55 lakh crore in year-ago quarter. [caption id=“attachment_4818281” align=“alignleft” width=“380”]  RIL logo. Reuters[/caption] RIL declared a dividend of Rs 6.50 per equity share of Rs 10 each for the financial year ended 31 March, 2020. The board has announced India’s biggest rights issue of Rs 53,125 crore at a ratio of 1:15 at a price of Rs 1,257 per share. The board approved the issue of equity shares of Rs 10 each at an issue size of Rs 53,125 crore by way of ‘Rights Issue’ to eligible equity shareholders of the company as on the record date, the company said. The terms and conditions of the Rights Issue will be decided by the Board or a duly constituted Committee of the Board and will be subject to applicable laws and regulatory/statutory approvals as may be required, it said.  The proposed rights issue will be the first by RIL in three decades, the company said in a statement. The issue will be structured as partly paid shares and will enable shareholders to phase out the outlay on their investment over a period of time, it said. Annual revenue up, EBITDA crosses Rs 1 lakh cr RIL achieved a consolidated revenue of Rs 659,205 crore ($ 87.1 billion), an increase of 5.4 percent as compared to Rs 625,212 crore in the previous year. Increase in revenue is primarily on account of higher revenues from the Consumer businesses. Digital Services business and Retail business recorded an increase of 40.7 percent and 24.8 percent, respectively, in revenue as compared to previous year. Revenues for the Refining and Petrochemicals business declined in line with fall in average oil and product prices for the year. Average Brent oil price declined 13 percent Y-o-Y, while the realisations for key petrochemical products declined by 15-32 percent Y-o-Y. This was partially offset by higher crude throughput and petrochemicals production during the year. The company’s annual EBITDA crossed Rs 1 lakh crore-mark (Rs 1,02,280 crore) for the first time, the company said. Profit after tax (including exceptional item) was higher by 0.1 percent at Rs 39,880 crore ($5.3 billion) in FY20 as against Rs 39,837 crore in the previous year.

Commenting on the results, Mukesh Ambani, Chairman and Managing Director, Reliance Industries Limited said, “Despite the daunting challenges arising from the fallout of the global pandemic, our company has once again delivered a resilient performance for FY 2019-20. Our O2C (Oil to Chemicals) businesses delivered sustained earnings due to its integrated portfolio, cost-competitiveness, feedstock flexibility and product placement capabilities. We continue to operate all our major facilities at near normal utilisation levels.

“Our consumer businesses further strengthened their leadership positions and recorded robust growth on all operating and financial parameters during the year,” Ambani said. Earlier on Thursday, the company said its entire board and senior leaders will take pay cuts ranging between 30 to 50 percent as a proactive measure to counter the cost pressures from the unprecedented challenges posed by the coronavirus outbreak. Ambani said he would forego his entire compensation for the year 2020-21. Reliance Industries share price fell 26.4 percent in the quarter ended March 2020 and 5.8 percent year-to-date, but registered a massive 63 percent rally from 23 March’s low amid expectations of rising ARPU, growth in Reliance Jio and consistent progress in deleveraging balance sheet plan. Last week, Facebook Inc signed a binding agreement with Reliance Industries to invest Rs 43,574 crore into Jio Platforms. Its investment will translate into a 9.99 percent equity stake in Jio Platforms on a fully diluted basis, the company had said in its BSE filing on 22 April. (Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Firstpost)

)

)

)

)

)

)

)

)

)