If you were hoping that property prices will finally correct in 2014, think again. Despite the sluggishness in India’s residential markets for the last two years, the prices have remained high in most cities since builders are burdened with high costs such as a 40 percent hike in construction costs in the last two years while government taxes have also gone up substantially. Secondly, with banks not wanting to lend to realtors, cost of borrowing too has shot up, which means the overall cost of buying a house has gone up.

“Property prices remained high in most cities, largely because developers were hit hard by the vast increased costs of construction and debt. At the same time, potential for most salaried people in the country to more lucrative jobs took a nosedive because of the fallout of economic crisis in developed countries. These combined resulted in a stalemate between developers and property buyers in cities where inventory and property rates remained high, most notably Mumbai, NCR and Bangalore,” said Ashutosh Limaye, Head, Research andREIS, Jones Lang Laselle, in a report titledRowing The New Wave: Game-Changing Rules For Indian Real Estate

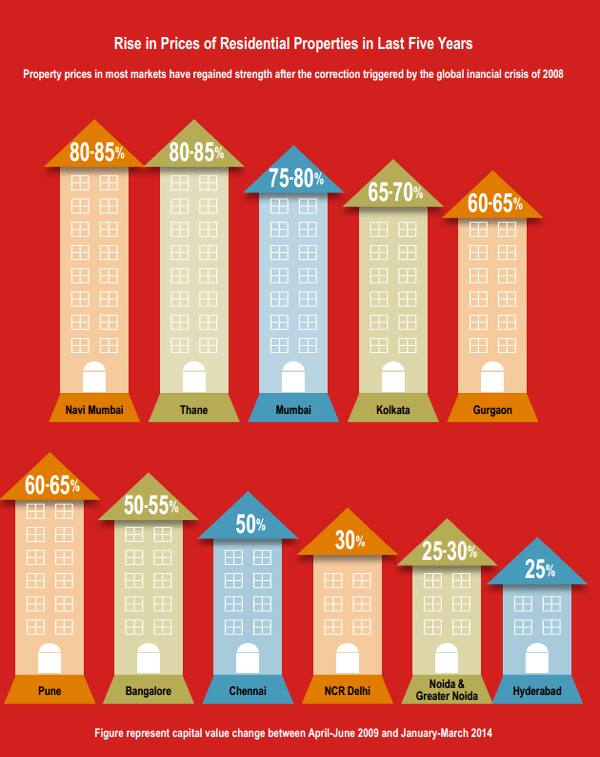

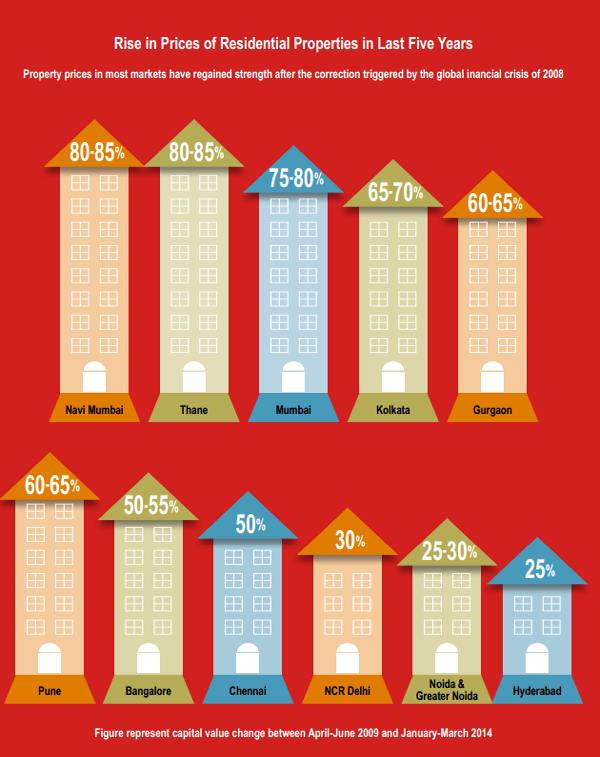

The chart below shows that property prices in most markets have shot up post the correction triggered by the 2008 global financial crisis. Surprisingly Mumbai’s Navi Mumbai and Thane have seen a whopping 80-85 percent increase in prices in the last five years as compared to investor-driven markets of Gurgaon and Noida where prices have gone up 65% and 30 percent, respectively. Clearly, Mumbai has reaped the maximum gains in the last five years when compared to other cities.

[caption id=“attachment_89113” align=“aligncenter” width=“600”]  Source: JLL[/caption]

The real estate consultancy firm expects residential absorption rate to pick up to 15% in 2014, though the sector continues to struggle with piling inventory and slow absorption rate in most cities.

)

)

)

)

)

)

)

)

)