“Sex sells,” is an old adage in show business and advertising. If I were to come up with a similar sort of statement when it comes to writing on business and economics it would have to be “real estate sells.” An article on the real estate scenario in India has more chances of being read than anything else.

People who make a living from the real estate industry, be it brokers, real estate consultants or builders, like to tell us time and again that real estate prices are only going to go up. So, it’s time that we forgot about all other ways of spending money and bought a house.

Various reasons are offered, right from shortage of land(they are not making any more of it) to now that Narendra Modi has become the prime minister, everything is going to be fine. In my previous pieces on real estate (you can read a few of them

here and

here ) I have tried to expose several myths that over the years have come to be associated with the sector.

In this piece we will just look at one data point that tells us loud and clear that real estate prices should not be going up, as has been justified by those make a living from real estate, time and again.

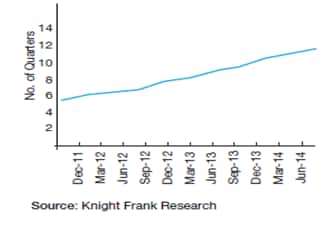

Look at the following chart:

“Quarters-to-sell(QTS) can be explained as the number of quarters required to exhaust the existing unsold inventory in the market. The existing unsold inventory is divided by the average sales velocity of the preceding eight quarters in order to arrive at the QTS number for that particular quarter,” the India Real Estate Outlook Report brought out by Knight Frank points out.

What this shows us clearly is that there is a huge amount unsold inventory when it comes to residential apartments across metropolitan India. In fact, what is worse is that this number has been going up over the last few years.

[caption id=“attachment_96827” align=“alignleft” width=“333”]  Data for Mumbai[/caption]

The table on the left shows us the quarters-to-sell unsold inventory in Mumbai. This stands at 12 in June 2014. What this means is that it will take close to three years to sell the current accumulated inventory of unsold homes in Mumbai. This number was at 5 in December 2011. Hence, Mumbaikars are going slow when it comes to buying homes is a conclusion that can be easily drawn. And that is not surprising given the astronomical prices that builders want for a home in the maximum city.

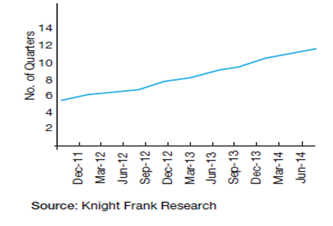

Here is a similar table for the National Capital Territory (i.e. Delhi and its adjoining areas).

[caption id=“attachment_96829” align=“alignright” width=“331”]  Source: Knight Frank[/caption]

The quarters-to-sell unsold inventory in the NCR in June 2014 stood at a little over nine. This means that it will take a little over two years to sell all the unsold residential apartments in NCR. The number had stood at around 6 in June 2012.

If we look at this graph for other cities like Bangalore, Hyderabad, Pune etc, it is along similar lines, though the curve may not be as upward sloping as it is in the case of Mumbai and NCR.

Take thecase of Bangalore where the curve is kind of flat. This tells you that people in Bangalore haven’t slowed down on buying residential homes at the same rate as people in Mumbai and NCR have. Hence, the quarters-to-sell unsold inventory has more or less hovered around 6.

Indeed, what these graphs clearly tell us is that the supply of residential apartments in India’s biggest cities has clearly been more than their demand. And given this Mumbai has 2,13,742 residential apartments which have been built but not sold. The same number in NCR stands at 1,67,000.

Hence, between two of India’s biggest residential markets, the total number of unsold homes stands a little over 3.8 lakhs. In total, the sales fell by 27% during the first six months of 2014, in comparison to the same period last year. Nevertheless, those associated with real estate expect prices to continue to go up. The Knight Frank report forecasts that the real estate prices in Mumbai will " increase for the entire year (2014) [by] 10.1%." An increase in prices is forecast for NCR and other cities as well.

The point here is that with so many unsold homes, how can housing prices continue to go up, unless they are rigged? Further real estate developers are sitting on a huge amount of debt. As a recent report in the Business Standard pointed out “At end of March 2014, the country’s top listed developers were sitting on Rs 39,772 crore of debts.”

As we know most real estate developers in India are not listed on the stock market. Hence, the total amount of their debt must be considerably higher than Rs 39,772 crore. So how are real estate developers going to repay this debt unless they get around to selling the homes they have built? One answer is that they keep launching newer projects, raise money and use that money to repay their previous debt. ( I discuss this in detail here) . And then launch newer projects to collect money to build their previous projects. So the cycle works.

But in the recent past the number of new launches has been falling. During the first six months of 2014, the number of new launches fell by 32% in comparison to the same period last year, the Knight Frank report points out. Hence, new launches as a source of funds seems to have slowed down, but they do bring in some money nonetheless.

Another possible explanation is lending by banks. Bank lending to the commercial real estate sector has been growing at a much faster rate than overall lending. Between July 26, 2013 and July 25, 2014, lending by banks to commercial real estate grew by 18.2%. In comparison, the overall lending grew by just 11.3%.

With newer launches slowing down, the only possible explanation for this lending is that banks are essentially giving fresh loans to real estate companies so that the companies can repay their old loans. This has allowed real estate companies to not cut prices on their unsold inventory. If bank loans had not been so forthcoming, the real estate companies would have to sell off their existing inventory to repay their bank loans. And in order to do that they would have to cut prices.

Further, most real estate companies as we know are a front for politicians. During the Congress led United Progressive Alliance, a huge number of scams and a lot of corruption happened. Hence, the conspiracy theory I would like to offer here is that the money that politicians got through various rounds of corruption during the UPA rule has also found its way into the real estate market. This has allowed real estate companies to continue holding prices at high levels, despite supply far outstripping demand.

As I mentioned in the previous piece I wrote on real estate , real estate consultants make money from real estate companies and hence, it is but natural for them to keep telling us that prices will continue to go up. Nevertheless, data from the International Monetary Fund shows that real estate prices in India between the period January to March 2014, fell by 9%. This was the most in a sample of 52 countries. ( Click here for table) The IMF of course does not have an incentive to ensure that real estate prices in India continue to remain high.

To conclude dear reader, if you still have the money to buy a house, this is the time to drive a hard bargain.

(Vivek Kaul is the author of the Easy Money trilogy. He tweets @kaul_vivek)

)

)

)

)

)

)

)

)

)