Backed by demand from the IT/ITes sector, India’s Silicon Valley- Bangalore- has taken the lead in showing signs of a revival in the real estate market. But when it comes to artificial inflation of prices, Delhi shows all that is flawed in India’s real estate sector.

According to data provided by real estate consultancy firm Liases Foras, Bangalore witnessed 10 percent growth in sales for the first quarter of the current fiscal while all other major cities - Kolkata, Chennai, Mumbai, National Capital Region (NCR). Hyderabad, Pune- saw a decline in the same period.. This s because Bangalore’s real estate market caters to 80 percent end-users, many of them working professionals and NRI clients.

Ironically, when it comes to appreciation, prices remained stable in Bangalore while Chennai saw the highest appreciation of 4 percent quarter on quarter.

NCR (which includesNew Delhi as well as its suburbs Gurgaon and Faridabad in Haryana, and Noida, Greater Noida and Ghaziabad in Uttar Pradesh)led the laggards with a 20 percent decline in sales quarter on quarter, followed by Chennai and Hyderabad with 18 percent and 13 percent decline each. Mumbai Metropolitan Region, however, was almost stagnant with a meager 2 percent drop in sales.

But here’s why the NCR’s data shows what’s wrong with real estate: falling demand should mean prices should come under pressure. But despite a 22 percent drop in NCR sales, the average price of property in NCR has risen by 10 percent. This could mean black money is being pumped into the sector to keep prices artificially high.

“The price-supply situation in NCR clearly implies that home prices are being kept high artificially. The price depreciation is only being witnessed in the secondary market while builders are refusing to bring down prices in the primary market,” said Pankaj Kapoor, MD of Liases Foras, a real estate consultancy firm.

And here’s the real kick: The current level of unsold inventory in the NCR stands at 303.66 million square feet and is worth Rs8,402 crore,thus implying thatrealtors will take another 53 months (four-and-a-half years) to just sell all current listings at the current sales pace! Inventory of eight months shows a healthy real estate market.

With a weighted average cost of Rs 75 lakh for a 1,200 sq ft apartment in NCR, prices are still being kept high because investors are holding on to properties while end-users are still staying away. This also creates barriers for new launches/construction at lower prices in these areas.

According to an industry expert who did not want to be named,80 percent of the inventory in Delhi-NCR’s under-construction projects is bought by speculators. When units in new projects are sold to investors, these generally change hands multiple times during the construction period, which is generally three-four years.

Heavy churning implies faster price appreciation.

And while the level of monthly inventory has increased from 41 months in the second quarter of 2014 to 53 months in the first quarter of the current fiscal for NCR, the Mumbai market has somehow stabilised in the last few quarters. Monthly inventory is down from 58 months in Q2 of 2013 to 45 months in Q1 of 2014. Also prices and sales have more or less remained stagnant in the June quarter. While sales declined 2 percent quarter on quarter, prices only increased by 2 percent.

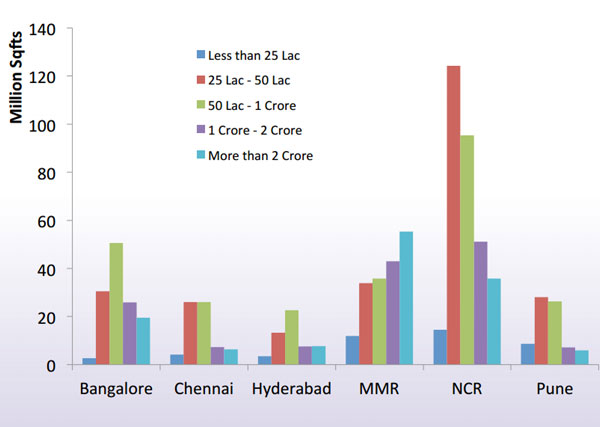

Thirdly, among all the six cities, NCR has the highest quantum of unsold inventory at 124 .21 million sq ft in the Rs 25-50 lakh range. ( See table below)

[caption id=“attachment_92415” align=“alignleft” width=“600”]  Source: Liases Foras[/caption]

)

)

)

)

)

)

)

)

)