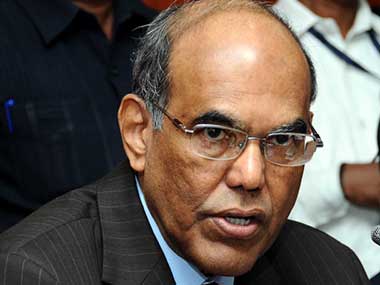

Finance minister Arun Jaitley has assured to clarify the confusions regarding the role of Reserve Bank of India (RBI) under the new monetary policy framework, amid concerns that the apex bank is set to lose some regulatory powers once the new system comes into existence. Interestingly, the debates on the new policy framework, under which the RBI and government will jointly set the inflation target, are not on the merits of adopting a globally accepted practice, but on whether the fresh changes will significantly curtail the powers of the RBI. Even as the new monetary policy committee (MPC) framework will, undoubtedly, be yet another key reform in Indian central banking in the Raghuram Rajan era, his own independence to set the monetary policy will heavily dependent on the constitution of the MPC. [caption id=“attachment_2142789” align=“alignleft” width=“380”]  Former governor Subbarao had strongly opposed adopting inflation targeting as a formal policy stance[/caption] If the government and its nominees have majority representation in the MPC and the governor isn’t given the power to veto the committee’s decisions, RBI governor will just be one among the many voices in the MPC. Clarity on this will emerge only when the structure of the new panel is clear. Some economists expect that the government, with its natural focus on economic growth and political interests, can alter the central bank’s policy focus to what is publicly more demanded at a given point of time if given an upper hand in the monetary policy committee. Questions have also been raised on the central bank’s very ability to achieve a pre-decided inflation target with its only available tool — interest rates — whereas reasons for inflationary worries in India are mostly supply-side constraints, upon which the RBI has little control. The debate on whether India should go for an inflation-targeting policy or refrain from officially committing inflation targeting as the central policy stance is old. Rajan’s predecessor, Subbarao had strongly opposed adopting inflation targeting as a formal policy stance, saying ‘inflation targeting is neither feasible nor advisable in India” for several reasons. Here are the points of arguments Subbarao highlighted in a 2011 speech, some of them are valid even in the current context. One: “In an emerging economy like ours, it is not practical for the central bank to focus exclusively on inflation oblivious of the larger development context. The Reserve Bank cannot escape from the difficult challenge of weighing the growth-inflation trade off in determining its monetary policy stance.” Two: “The drivers of inflation in India often emanate from the supply side, which are normally beyond the pale of monetary policy. In particular, given the low income levels, food items have a relatively larger weight in the consumption basket in India compared to advanced economies and even many emerging market economies. Monetary Policy, as is well known, is an ineffective instrument for reining in inflation emanating from supply pressures.” Three: “a necessary condition for inflation targeting to work is efficient monetary transmission. In India, monetary transmission has been improving but is still a fair bit away from best practice.” “There are several factors inhibiting the transmission process such as an asymmetric relationship between depositors and banks, administered interest rates on postal savings that are not adjusted in line with prevailing interest rate trends and rigidities in the financial markets. All these factors dampen the efficacy of monetary signals and complicate the adoption of an inflation targeting regime in India”. Four, even with regard to the new MPC framework, Subbarao had his own share of doubts, which he said in an interview to The Economic Times. “That (Government/RBI joint committee) is a good move, but what objective the Reserve Bank has been driving at has not been very clear. But having said I would also add that it will be difficult for the RBI to deliver on strict inflation target, partly because as much as 50 per cent of inflation is beyond the control of monetary policy,” Subbarao said. As Firstpost has noted earlier , all is well with regard to the fresh monetary policy framework as long as inflation remains low, supported by low crude oil prices and favourable domestic factors. But, the strength of the mechanism will be tested when inflation spikes as then the RBI will be forced to keep rates high, something the government may not take it in good humor. Also, an RBI, with little control on the monetary policy, may not be a favourite in the eyes of global investors and international rating agencies. Besides the new policy framework, the Budget 2015 also proposes to take away public debt management from the central bank to a separate agency. The role of Indian central bank in setting the monetary policy, as we know, has changed. The answer to what extent lies in the final structure of the MPC.

The role of Indian central bank in setting the monetary policy, as we know, has changed. The answer to what extent lies in the final structure of the MPC

Advertisement

End of Article

)

)

)

)

)

)

)

)

)