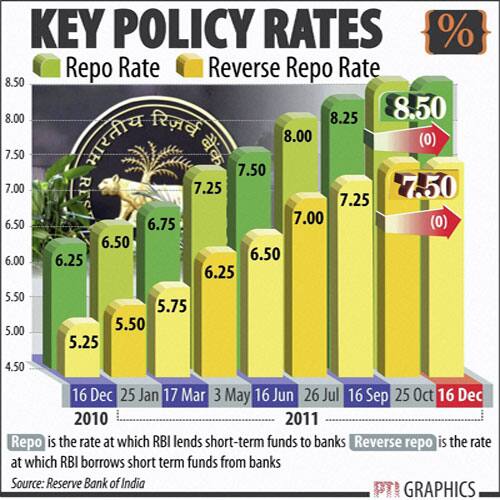

By keeping key rates unchanged the central bank has left the economy unchanged.

An economy that was looking at some respite from the central banker has been given nothing but lip service in the form ‘monetary policy actions are likely to reverse the cycle, responding to risks to the growth.’ The current policy has done little by way of actions.

[caption id=“attachment_158268” align=“alignleft” width=“380” caption=“With the government already in hibernation, the central bank’s stance,opting for a pause, has not gone down well with the market.PTI”]

[/caption]

[/caption]

By keeping the cash reserve ratio (CRR) and the repo rate unchanged, the cost of doing business in India continues to remain high. In fact, it has increased further as the rupee continues to depreciate. By removing speculation in the currency market through a move announced on Thursday, the central bank has made the currency market more illiquid and, in turn, more volatile.

In the policy statement, the RBI avoided spelling out any details of its plans to interfere in the currency market, something which corporates have been pleading with the central bank to do, especially after a nearly 20 percent depreciation in the currency in four months.

Corporate India is reeling under the pressure of high interest rates and non-availability of funds.With fewer companies committing to capacity addition - witnessed by a sharp drop in capital goods production- this policy will only help them delay their decision. This is exactly what the markets are saying. While the banking index is down 3.3 percent, capital goods index has fallen 4.9 percent.

[caption id=“attachment_158277” align=“alignleft” width=“500” caption=“PTI”]

[/caption]

[/caption]

Continuation of a high interest regime is only likely to increase the non-performing assets (NPA) of banks, further sucking away liquidity from the system. The NPAs of banks are at 4.19 percent compared with 3.35 percent a year ago.

Impact Shorts

More ShortsLack of liquidity has already resulted in Indian banks borrowing, on average, Rs 74,500 crore per day compared with Rs 43,800 crore in the September-ended quarter.Rates of overnight inter-bank loans climbed 315 basis points this year to 8.65 percent due to lack of liquidity. The overnight rate is the rate that large banks use to borrow and lend from one another on the overnight market, to meet short-term gaps.

What these numbers indicate is that cracks have started appearing in the economy. Rather than waiting for the cracks to expand, markets were looking at RBI to take steps to induce growth. But with rising inflation, there is little room for the central bank tomaneuver.Reducing interest rates or adding liquidity would have resulted in stoking the inflation fire, which is likely to increase further with a falling rupee.

With the government already in hibernation, the central bank’s stance,opting for a pause, has not gone down well with the market. Investors bet on growth or visibility of growth.

This credit policy does not give any such hope for reviving growth.

Naturally, investors are taking the only route available now - the route to the exits.

)