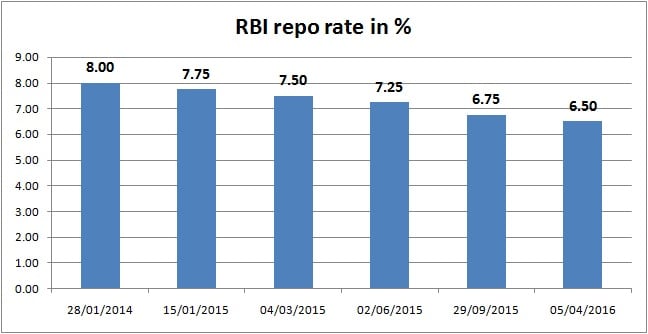

The Reserve Bank of India today cut the repo rate by a further 25 bps and also took measures to ease the liquidity constraints in the banking system, giving hopes for the industry and consumers that interest rates in the economy will fall faster than earlier. Here are the key points from the policy statement: [caption id=“attachment_2713182” align=“alignleft” width=“380”]  Raghuram Rajan. AFP[/caption] What are the actions taken by the central bank today? For one, it cut the policy repo rate by 25 basis points from 6.75 percent to 6.5 percent; Secondly, it reduced the minimum daily maintenance of banks’ cash reserve ratio (CRR) from 95 percent of the requirement to 90 percent with effect from the fortnight beginning 16 April. CRR is the proportion of deposits banks need to keep with the RBI. It has kept the CRR unchanged at 4 percent of net demand and time liabilities (NDTL). Thirdly, it narrowed the policy rate corridor from +/-100 basis points (bps) to +/- 50 bps by reducing the MSF rate by 75 basis points and increasing the reverse repo rate by 25 basis points, with a view to ensuring finer alignment of the weighted average call rate (WACR) with the repo rate; All the moves are intended to push banks to cut interest rates further. Despite the RBI cutting policy rate by 125 basis points since January 2015, banks have only cut interest rates by 50-60 bps. Two of the steps - on reverse repo and CRR - are aimed at increasing the liquidity with banks. With more cash in hand, banks should be able to cut rates at a faster clip. With the cut, the repo rate has hit the lowest in six years. However, the rate cut comes even as there have been calls for deeper cut in the repo rate from various quarters. Some even called for a 100 bps cut. So, why didn’t the central bank go for a deeper cut? The reason could be fears of inflation. It says inflation has evolved along the projected trajectory and also that CPI inflation is expected to decelerate modestly. It sees the rate around 5 percent during 2016-17. However, it has listed six uncertainties that are likely to throw the inflation scenario haywire. They are 1) recent unseasonal rains, 2) the likely spatial and temporal distribution of monsoon, 3) the low reservoir levels by historical averages, 4) the strength of the recent upturn in commodity prices, especially oil, 5) persistence of inflation in certain services, 6) the implementation of the 7th Central Pay Commission awards which will impart an upside to the baseline through direct and indirect effects.  Then why did the RBI cut the rate now? Mainly because the government has stuck to the fiscal consolidation path in the Budget for 2016-17. Another reason is the cut in the small savings rate affected by the government. The high interest rates offered on small savings has been forcing the banks to hold on to the rates for fear that savers may ditch them if they cut deposit rates. Moreover, the fears that inflation may spike has been offset by a few factors: 1) downside pressures stemming from tepid demand in the global economy, 2) the government’s effective supply side measures keeping a check on food prices, and 3) the Central government’s commendable commitment to fiscal consolidation. Another reason for the cut is the wobbly economic growth. Though it has maintained the gross value added at 7.6%, the RBI sees three downside risks to growth: 1) the fading impact of lower input costs on value addition in manufacturing, 2) persisting corporate sector stress and risk aversion in the banking system, 3) the weaker global growth and trade outlook. The uneven growth is likely to strengthen in the current financial year provided the monsoon is normal. “Given weak private investment in the face of low capacity utilisation, a reduction in the policy rate by 25 bps will help strengthen activity and aid the Government’s initiatives,” the RBI said. What does the RBI think of the Jaitley’s Budget? It has given a thumbs up to the Budget. For one the government sticking to fiscal consolidation path will help disinflation. Secondly, it has given a stamp of approval for the government’s rural thrust. “The Government has also set out a comprehensive strategy for reinvigorating demand in the rural economy, enhancing the economy’s social and physical infrastructure, and improving the environment for doing business and deepening institutional reform. The implementation of these measures should improve supply conditions and allow efficiency and productivity gains to accrue,” the RBI has said. This is very much needed given the stress experienced in the rural economy. “Consumer non-durables production has been shrinking, with a pronounced decline in Q4. This reflects the continuing slack in rural demand. On the other hand, consumer durables remained strong, even after abstracting from favourable base effects, which suggests that urban demand is holding up,” the RBI says in the statement. Clearly, rural and urban economies are on divergent paths.

RBI has given a thumbs up to Jaitley’s Budget

Advertisement

End of Article

)

)

)

)

)

)

)

)

)