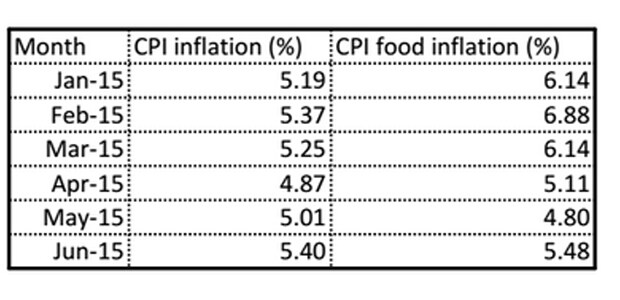

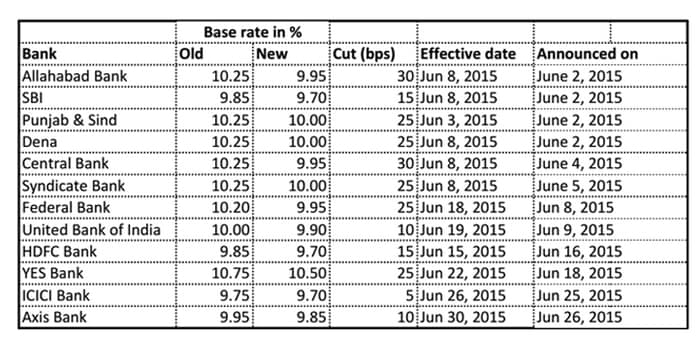

There was no surprise element when the Reserve Bank of India (RBI) retained its key lending rate at 7.25 percent on Tuesday since nothing much has changed between the last policy and this review in order to warrant a rate cut. On the contrary, price worries have inched up in the recent months, mainly on food items. The spike in retail inflation in May and June, especially in the price of essential food items, has clearly made the central bank more cautious. RBI governor Raghuram Rajan has made it amply clear that the central bank would watch the food prices closely in the next few months, before making up his mind on another rate move. “They (food prices) will have to be carefully monitored as they tend to be sticky and impart an upward bias to inflation and inflation expectations,” said Rajan. [caption id=“attachment_2378462” align=“alignright” width=“380”]  Raghuram Rajan. Reuters[/caption] Economists expect that if food prices do not go up further and overall retail inflation remains within the comfort zone of the central bank, one can expect further cut in key lending rates in the second half of the current year. The RBI has retained its 6 percent retail inflation target by January 2016, but has lowered inflation projection for the January-March period by about 0.2 percent. Consumer Price Index (CPI) rose to 5.01 percent in May and further to 5.4 percent in July, which is an eight-month high. CPI food inflation and vegetable inflation too rose in July from 4.8 percent and 4.64 percent, respectively, in the previous month.  Explaining the rationale for his status-quo on rates, Rajan, during the post policy presser, said there is uncertainty at this stage to make a policy move, which, he expects to be resolved in the approaching months. “Significant uncertainty will be resolved in the coming month, including the likely persistence of the recent inflationary pressures, the full monsoon outturn, as well as possible Federal Reserve actions,” Rajan said. Will banks follow cues? But, the biggest take away from the policy is that the RBI isn’t satisfied with the half-hearted response from the commercial banks with respect to passing the benefit of earlier rate cuts to the end-borrower. This part has found mention twice in the policy document.  For now, most banks’ base rates, or minimum lending rates, stand in the range of 9.7 percent to 10 percent. Early this year, the RBI had listed transmission of these rate cuts as a pre-requisite to for further monetary easing. Though some banks have begun cutting lending rates in the recent months, the rate actions have been limited to 25-30 basis points. “Since the first rate cut in January, the median base lending rates of banks has fallen by around 30 basis points, a fraction of the 75 basis points in rate cut so far,” the RBI has said. Further the RBI says it “awaits greater transmission of its front-loaded past actions, it will monitor developments for emerging room for more accommodation,” RBI said. Reading between the lines, the RBI wants more proactive response from commercial banks. Most of the banks, which cut rates in the last round, hadn’t done in the previous rounds and was merely aligning their base rates to the industry. The RBI might want to see some more transmission happening before it lowers rates further. Of course, banks have their own reasons—high bad loans on their books and capital shortage, for not cutting rates by a bigger margin. But, as the policy highlighted, state-run banks, which control 70 per cent of the banking sector, have been promised with a capital infusion of Rs 25,000 crore in the current yearas part of a Rs 70,000 crore injection over the next four years. The RBI expects additional capital to help banks lend more to productive sectors. The RBI’s point is simple: unless banks pass on the rate cuts, small borrowers will not benefit from the monetary easing by the central bank. Large, top-rated companies may not be too worried, since the previous RBI rate cuts have pushed down money market rates, lowering fund raising costs in the bond market. But, that isn’t the case with the individual borrowers and small firms, who still reel under the burden of high interest rates. The RBI clearly wants commercial banks to be more forthcoming in terms of monetary transmission. (Data support from Kishor Kadam)

Rajan’s message in RBI policy: For small borrowers to benefit, banks should cut rates deeper

Advertisement

End of Article

)

)

)

)

)

)

)

)

)