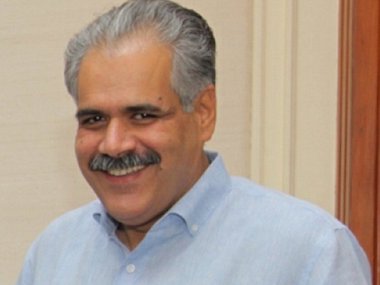

InterGlobe Enterprises, IndiGo’s biggest shareholder company, has now said it has signed an agreement to participate in sale of Virgin Australia. Billionaire Rahul Bhatia-owned InterGlobe owns 37.87 percent in IndiGo, while Rakesh Gangwal, his family members and his family trust own 36.64 percent in India’’s largest airline.

Rahul Bhatia-led InterGlobe Enterprises signs agreement to participate in sale process of Virgin Australia. InterGlobe is bound by confidentiality requirements of agreement pic.twitter.com/FVJiQgh193

— CNBC-TV18 (@CNBCTV18Live) May 15, 2020

Virgin Australia collapsed on 21 April, putting 16,000 jobs under threat. The cash-strapped carrier announced it had entered “voluntary administration” to recapitalise the business after being battered by the pandemic, which has crippled the global airline industry. “As regards Virgin Australia, InterGlobe Enterprises has signed an agreement to participate in the sale process and is bound by the confidentiality requirements of that agreement. We are unable to say anything further at this stage,” InterGlobe Enterprises said, according to a PTI report. Two days ago, there were reports that Indigo Airlines, is joining a list of bidders who have shown interest in Virgin Australia, Australia’s second-largest aviation company. However, the company denied it in a filing with the exchanges. Rahul Bhatia owns IndiGo, holding through InterGlobe Enterprises Ltd. The aviation firm has appointed an Australian consultant for the process. On 12 May, news reports said: “The entity has accessed data room and may take the process forward. However, no formal interest has been submitted yet,” said a person about InterGlobe’s plans. A spokeswoman for InterGlobe said the firm would not comment on market speculation, according to a report in _The Business Standa_rd. No bids have been put in yet. The first round of bids have have to be submitted by 15 May, according to a report in The Times of India. IndiGo is interested in taking Virgin back to its roots as a low-cost carrier. It would then look to return it to profitability by running a lean and mean operation, news reports said. Deloitte, the administrator for Virgin Australia, is seeking indicative bids by Friday T(today) and binding offers in June, targeting a deal by the end of that month, a report in Mint said. Virgin Australia, Australia’s second-largest airline, entered bankruptcy administration two weeks ago after the government refused the airline’s request for a 1.4 billion Australian dollar ($888 million) loan after a debt crisis worsened by the coronavirus shutdown pushed it into insolvency, The Associated Press said in a report. The airline’s major shareholders are Singapore Airlines and Etihad Airways as well as Chinese investment conglomerates Nanshan Group and HNA Group. British billionaire founder Richard Branson holds a 10 percent stake, the report said. Virgin said in a statement to the Australian Securities Exchange that it had appointed a team of Deloitte administrators to “recapitalize the business and help ensure it emerges in a stronger financial position on the other side of the COVID-19 crisis.” It is one of the first major airlines to seek bankruptcy protection in response to the pandemic. Virgin’s administrators have taken control of the company and will try to work out a way to save either the company or its business, The Associated Press said.

)

)

)

)

)

)

)

)

)