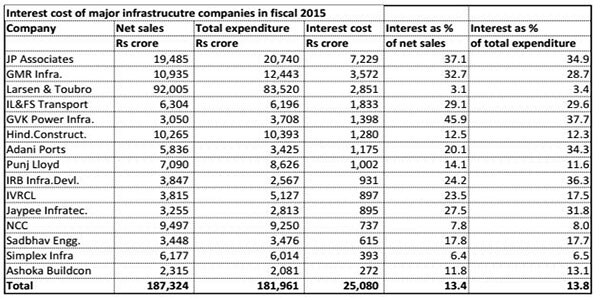

Reserve Bank of India (RBI) governor, Raghuram Rajan, has hit the nail on the head when he said in an interview to BBC on Tuesday (25 August) that central banks world over are constrained with limited tools in finding solutions to economic woes. Rajan said the real stimulus for economic revival should come from the governments through growth-oriented reform processes and not through monetary policy stimulus. The former International Monetary Fund economist stressed on the point that reforms are the only solutions to economic ailments. Over-intervention by central banks in the economy, he says, could contribute to ‘more bad than good’. [caption id=“attachment_2408524” align=“alignleft” width=“380”]  Raghuram Rajan[/caption] “I have been a little concerned about the immense burden for action that is falling on central banks and I think it is quite legitimate for central banks to say at some point we can’t carry the burden ourselves in fact we may not have the tools to do everything that is asked of us,” Rajan said. Rajan further makes it explicitly clear: “Don’t keep asking us (central banks) to do more because at some point we get into territory where the consequences may be more bad than good if we actually act.” To be sure, Rajan is speaking in the context of global economies and the central banks’ actions world over, not specifically India. But, the comments from the RBI governor are particularly relevant in the Indian context too. These comments are coming at a time when pressure is building up on Rajan, including from finance minister Arun Jaitley to go for further cut rates and thus support a struggling economy. Here, the central bank is burdened with the twin responsibility of fighting the inflation and supporting the economic growth and often takes blame if it goes wrong on any of these two fronts. Finance ministers openly criticising the central banks for lack of action (read rate cuts), even when growth-supportive fiscal measures and reform process are absent. The fact is that rate cuts are ineffective to revive growth in the current Indian context. The primary factor that has made rate cuts even more ineffective in the economy is the poor monetary transmission in the baking system on account of high amount of impaired assets. Secondly, there are multiple reasons that are troubling corporate balance sheets, other than interest cost. As Firstpost has noted several times before, the reason for why banks have not followed the rate signals from the central bank (RBI has cut key rates by 75 bps this year, but banks have done only by 30 bps) is the single reason that banks are burdened with huge bad debts and capital constrained (gross NPAs are Rs 3,00,000 crore on banks’ balance sheets). The fundamental problem that prevents banks from resuming credit expansion to industries is not a lack of RBI rate cut, but the huge bad loans on their books and scarcity of capital. Also, there is no genuine demand for loans from corporations yet as industries continue to struggle to gain the growth momentum back. In this scenario, an RBI rate cut can hardly help. On the contrary, large corporations with top credit ratings are moving more towards the money markets to raise funds from market, even as small firms are unable to do so. Project implementation is yet to pick up since companies are still struggling for fresh investments and various clearance hurdles still persist. Land acquisition continues to be a major problem for companies, which are planning new projects. If the government wants economic activities to pick up, there aren’t many options but to kick start reforms on land acquisition and taxation. Passage of GST alone can be a big booster dose to revive investor confidence.  There are no signs of fresh investments picking up from the private sector yet. In this scenario, the responsibility lies with the government to scale up public spending in infrastructure, which can then be followed by the private sector. To be sure, the government has begun spending, but it needs to spend more to reboot the economic engine. This is something, the government’s economic advisor, Arvind Subramanian, has pointed out in the previous round of economic survey . More over, as mentioned earlier, one must remember that the RBI rate cuts can ease the burden of companies only to the extent of reducing the interest burden. That is indeed a cost but it constitutes only part of the total cost of firms. Take for instance infrastructure companies. A Firstpost analysis of 15 infrastructure companies showed that interest cost, as a percentage of total cost, constitutes only about 13 percent on an average. The government can do better to help these firms by fast-tracking reforms and clearance processes aiding faster project execution. Interest cost constitutes only a part of the overall burden. An RBI rate can help only to the extent that supportive reform measures coming from the government to offer a conducive environment for industries to operate. But, it is unwise to expect that rate cut alone will offer any major relief to companies, especially smaller ones, which, unlike big companies, do not have the option to exploit cheaper money market. Repairing the banking system is equally critical to kick-start the economic engine and prepare banks to participate in the revival story. But, so far the Modi government has refused to initiate radical reforms in the banking sector. The central bank has its own reasons for not rushing with steeper rate cuts. One must note that even in the run-up to the August policy review too, majority of the external members of the RBI’s technical advisory committee wanted Rajan to cut rates for the sake of economy, but Rajan refused since the central bank wasn’t quite convinced yet on the reported death of inflation. It wanted to wait more. It is better to leave the bank to do its job on inflation since price stability is crucial for longer-term growth in the economy. The bottomline is: Rajan is absolutely right in observing that the central bank’s role is limited in solving economic problems. It’s a subtle message to the Modi government and Jaitley too that the government shouldn’t delay executing the reform process, before putting pressure on the RBI to cut rates further.

Rajan is absolutely right in observing that the central bank’s role is limited in solving economic problems. It’s a subtle message to the Modi government

Advertisement

End of Article

)

)

)

)

)

)

)

)

)