This week, investor attention will be focused on 12 January as Infosys announces its results for the quarter ended December and kicks off corporate India’s results season. Most brokerages expect margins at IT companies to surge on the back of the rupee’s sharp depreciation in the past few months.

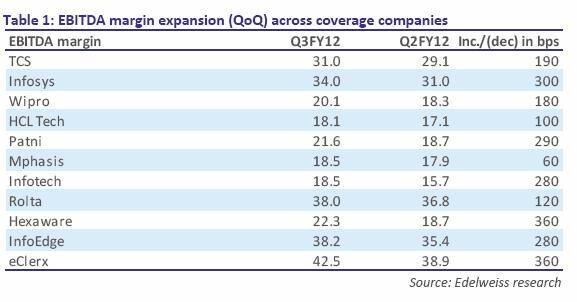

While Edelweiss expects revenue growth for the industry to moderate to 2-3 percent from earlier expectations of 4-5 percent in dollar terms, margins are expected to benefit from the sharp depreciation in the rupee last year.

[caption id=“attachment_177587” align=“alignleft” width=“380” caption=“Of course, the big question on everyone’s minds will be the guidance that companies, especially Infosys, provides for the next few quarters. Reuters”]

[/caption]

[/caption]

CLSA also expects currency movements to favor Indian technology companies and predicts strong margin improvements across the board in the past quarter.

Predictably, most brokerages expect Infosys to be the biggest beneficiary of the rupee’s fall as its EBDITA (operating profit) margin is expected to surge to a seven-quarter high of 34 percent. Indeed, Infosys remains the top IT pick for CLSA.

Margins at TCS are also expected to have received a boost, although to a lower extent since India-dependent revenues account for close to 10 percent of its consolidated revenues. Nonetheless, operating margins are expected to rise to 31 percent, the highest since financial year 2001.

Impact Shorts

More ShortsHowever, two companies that might make investors unhappy are HCL Technologies and Wipro. HCL Tech’s margins are expected to be negatively impacted due to incentives announced in the previous quarter and hikes in wages. Wipro, too, will see its margin constrained by salary hikes and forex losses on designated hedges appearing in the revenue line.

[caption id=“attachment_177544” align=“alignleft” width=“577” caption=“Source:Edelweiss Research”]

[/caption]

[/caption]

Among mid-caps, CLSA expects Hexaware to report the best results with a 4.5 percent quarter-on-quarter dollar revenue growth and an almost 300 basis point improvement in margins (100 basis points = 1 percentage point).

Of course, the big question on everyone’s minds will be the guidance that companies, especially Infosys, provides for the next few quarters. Hints of delays in decision making or budget cuts by clients could send investors running out of IT stocks and dampen sentiment for Corporate India. After all, not very many sectors are expected to post good results, barring IT and a few others.

)