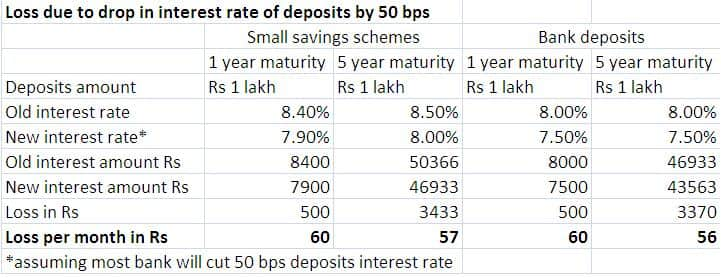

It’s a different issue altogether how much a few basis points (bps) reduction in the base rates or minimum lending rates of banks would actually benefit the individual home, auto loan borrowers. One bps is one hundredth of a percentage point. The resultant decline in the EMI burden of the borrower would ultimately amount to a small amount (let’s say for Rs 20 lakh loan, a few hundred rupees less), which shouldn’t be the deciding factor for someone to go for a fresh loan typically.  Nevertheless, it’s certainly an incentive to average Indian consumer, for whom, even a minor decline in their interest cost burden is a boon. But the catch here is that if banks are pushed to the corner to lower their lending rates by a big margin that would eventually hurt the depositors as well. Here is why: One of the main reasons, why lending rates aren’t coming down drastically in the banking industry is the relative high deposit rates most banks offer to savers, which have to come down first before lending rates come down, since banks wouldn’t be willing to compromise on their margins. But, the issue is banks cannot suddenly lower their deposit rates, lower than the small savings schemes, since this will result in many customers can shift to such schemes, which offer equally good or even better returns. That is the reason why banking industry is lobbying for a reduction in the small savings rates whenever they are asked to cut lending rates. Interest rates on various small savings schemes of the government such as Kisan Vikas Patra, public provident fund and National Savings Certificate are currently some where close to 8.5-8.7 percent. Presently a five-year bank fixed deposit offers a rate of return of about 7-8 percent to the customer.  Nevertheless, there is a pressing need for steeper lending rate cuts to boost the demand. Despite the Reserve Bank of India (RBI) slashing its key lending rate, repo, at which banks borrow from the RBI, by 125 bps, most banks had limited their base rate cuts to a small quantum (30-50 bps) to protect their profit margins, partly due their bad loan problems and low demand. But banks need to cut rates to help an improvement in economic activity. Traditionally Indian banks have been enjoying higher Net Interest Margin (NIMs) than their counterparts in other part of the world. NIM is the difference between interest earned on loans and expended on deposits. For instance, the average NIMs of US banks stand around 2.95 percent. The average NIMs of Indian banks had fallen from 3 percent in 1999-2000 to 2.5 percent in 2009-10 but the bigger banks grew their NIMs aggressively thereafter. Presently, if one takes an average, Indian banks’ NIM would stand well above 3 percent. For some private banks, it can go well above 4 percent. Following the latest rate cut from the RBI by a higher-than-expected 50 bps, banks have begun cutting their base rates in the last two days. The biggest cut came from the country’s largest lender, State Bank of India (SBI), which slashed its base rate by 40 bps to 9.3 percent. Others too have followed but with smaller cuts. At least eight other banks have reduced their base rates by 25 bps to 9.7- 9.75 percent. While the RBI has cut its key rate by a cumulative 125 bps so far this year, most banks have cut rates by 30-50 bps. Announcing the monetary policy early this week, RBI Governor Raghuram Rajan said the central bank would work with the government to ensure proper transmission of policy actions in the banking system. What this effectively means is that RBI will suggest the government to bring down the interest rates offered on small savings so to let banks also lower their deposit and lending rates. It’s not clear at this stage as to what extent the government would adjust the small savings rate to enable monetary policy transmission. The interest rates on such schemes are revised once in a year and are linked to the G-Sec yields. But, the short point is those who keep their retirement funds or other savings in bank deposits or small savings schemes are set to take a hit, even though, on the other side, the borrower may have some relief on the interest burden. (Kishor Kadam contributed data to this story.)

Following the latest rate cut from the RBI by a higher-than-expected 50 bps, banks have begun cutting their base rates in the last two days.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)