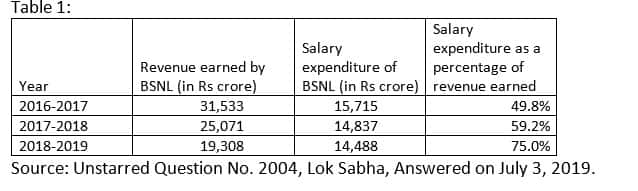

The government has announced the merger of BSNL and MTNL. The merger is being touted as a revival plan as well. Here is why it will not work. 1) Let’s take the case of Bharti Airtel. In 2018-2019, the total revenue from operations for the company stood at Rs 53,663 crore. Of this, the employee benefits expense or the money that the company spent on its employees stood at Rs 1,720 crore or 3.2 percent of the total revenue of the company. The employee cost is so low primarily because Airtel has over the years turned itself into a services company. The entire infrastructure that any telecom company requires to deliver its network has been outsourced to other companies. How does BSNL (the bigger of the two companies being merged) fair on this front? Let’s take a look at Table 1, which provides the details.  Table 1 makes for very interesting reading. The revenue earned by BSNL has collapsed over the years, whereas it’s salary bill has more or less remained the same. In 2018-2019, the salaries of its employees amounted to 75 percent of its revenue. The salary bill of Bharti Airtel during the same period was 3.2 percent. Even after this the company barely made a profit of Rs 792 crore on revenues of Rs 53,663 crore, meaning a profit margin of around 1.5 percent. 2) The question is how is the merged entity of BSNL going to compete? In the press release accompanying the decision of the merger, the government talks about offering a voluntary retirement scheme for employees over the age of 50.

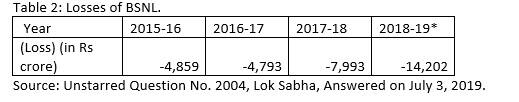

As of May 2019, BSNL had 1,63,902 employees. MTNL had around 22,000 people on its rolls. This puts the total number of employees in the new merged BSNL at 1.86 lakh. Now compare this with Bharti Airtel. As of March 2019, the company had 16,369 employees on its rolls in India and South Asia. This is around 9 percent of the employees that the merged BSNL will have. As we have seen earlier, the pre-merger BSNL earned a total revenue Rs 19,308 crore in 2018-2019. Bharti Airtel made Rs 53,663 crore, around 178 percent more, with one-tenth of the employees. Globally, any merger works only because employees get fired and the merged company is able to bring down their cost of operations. Will the merged BSNL be able to do something like this? The obvious answer is no. The number of employees that the merged entity will have to let go, is simply too large. Also, an outsourcing system will need to be built in order to keep the network going. 3) Now take a look at Table 2.  The accumulated financial losses of BSNL over the last four years stand at Rs 31,847 crore. An editorial in the Business Standard newspaper puts the overall accumulated losses of the company at over Rs 90,000 crore.

The fact of the matter remains that government companies in the services business do well up until they don’t have to face competition from private companies. This is true in sectors as diverse as banking, airlines, and telecom, showing that the private sector is more responsive to consumers than the public sector ever can be.

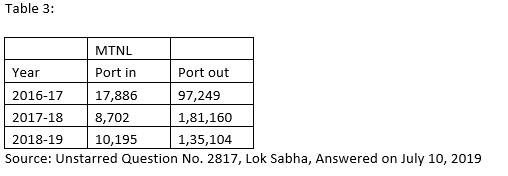

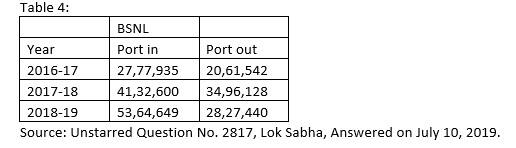

Taking this basic point into account, it only shows all over again that the ability of the government to throw good public money down the drain, is infinite. 4) One point that is getting made over and over again is that BSNL and MTNL are strategic assets, and hence, they can’t be sold to the private sector or be shutdown. Let’s first take the case of MTNL here. The company had a 6.95 percent share in Mumbai and Delhi, the two markets where it is licensed to operate. A strategic asset should be able to influence the overall market. At 6.95 percent market share that is simply not possible. Also, take a look at Table 3.  Table 3 clearly shows us that MTNL is a service that more and more people have abandoned, over the years. There is nothing strategic about it anymore. It’s a brand people associate with terrible service. As far as it being a strategic asset is concerned, it’s just something that those who benefit from the company not shutting down like to believe and would like us to believe as well. What about BSNL? BSNL had 10.72 percent all-India market share as of March 2019 and rather interestingly, its market share has gone up over the years. As of March 2017 it had a market share of 9.63 percent. Also, take a look at Table 4.  Table 4 clearly shows us that more people have come into BSNL over the years than left it. Over and above this, one argument that is constantly offered in favour of BSNL is that its network is available where no other network is available. This works in favour of the company even though it has made extensive losses over the years. The privatisation of BSNL will be seen as pandering to private players, something that the highly image-conscious Narendra Modi government (or for that matter no other government in its place) is unlikely to do. One way to go about it would be to breakdown BSNL into several parts and sell them through the auction route to different telecom companies. That way the government cannot be accused of favouring one private company.

Another way out is to shutdown MTNL and use its extensive real estate assets, along with that of BSNL as well, to finance the revival of BSNL, without the government having to throw more public money into these companies like it currently plans to do. But then these are just ideas. What the government is likely to do, as it has done with Air India, public sector banks and scores of other companies, is to continue throwing more public money down the drain.

Nevertheless, it is worth remembering here that just because you can throw money at a problem, doesn’t mean you can solve it. (The writer is the author of the Easy Money trilogy. He tweets @kaul_vivek)

)

)

)

)

)

)

)

)

)