As the markets opened in New York on Thursday (7 November) morning something very strange happened.

Amidst the dripping anticipation of Twitter’s stock offering the American markets opened with a noticeably downward pace. The tech-heavy Nasdaq Composite dropped by 1.2%, rumours flew of the Fed toning down the bond-buying program, the Dow Jones Industrial Average dipped by 34.61 points and the S&P 500 fell to 1,761.11; all of this within the first few hours.

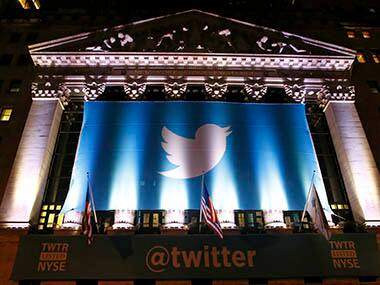

As the markets prepared for “TWTR” to scroll across the trading floor screens this erratic readjustment of the market didn’t seem like an auspicious sign for a tech stock. But since Twitter had raised the requisite $1.8 billion in an IPO there was no stopping the train. And to everyone’s relief as Twitter stock made its debut on the trading floor of the New York Stock Exchange the markets started to normalise.

[caption id=“attachment_1217907” align=“alignright” width=“380”]  Twitter and America surprising everyone. Was it too good to be true? AP[/caption]

A bonus surprise for many (except Twitter management probably) was the near doubling of the opening price to $45.

For days analysts and gurus had been progressively inching the predictions higher and higher with the general consensus arriving at the $24-$26 range.

To make it a near national victory for the American economy - a report surfaced that pegged growth in the United States economy at 2.8% for the third quarter, far exceeding analyst predictions. Twitter and America surprising everyone. Was it too good to be true?

Impact Shorts

More ShortsThe sudden and unexpected rise in market prices has made many analysts scratch their heads; this could after all be a recurrence of the 90s tech bubble culture. How does a stock predicted at $26 during the previous night’s dessert open at $45.10 after breakfast the next day and just as quickly reach $50 before finding a satisfying siesta of $47.40 after lunch. That is a 92% boost from its prediction with a relatively modest stabilization of a 72.69% hike. The Twitter IPO has effectively made a meal of analysts’ predictions.

Twitter has proven itself to be unlike any other social media related IPOs such as Facebook, at least as far as investor behaviour is concerned. Facebook was plagued with valuation issues from its very first day on the market with major fluctuations and controversies souring the good cheer of everyone’s favourite tech darling in 2012. Even the relatively professional and firmer brand of LinkedIn has faced troubles but not Twitter.

Could it just be that a company with no declared profits and no tangible product be traded with such blind optimism? Or is Twitter on the path of other market darlings like Groupon and Zynga that were soon dumped unceremoniously after their tryst with investors? Or worse, forgotten like the MySpace of old. Obviously, it’s too early to say for certain but reasonable speculation would lead us to some well-informed conclusions.

Is the Thursday closing of $44.90 an over valuation? Yes.

Is that necessarily a bad thing? NO.

Here’s why - the reasons behind the pop in Twitters stock price was the result of a precarious balance between the supply and demand of available shares where demand won. The demand for the 70 million Twitter shares resulted in the offering being oversubscribed 30 times. This overwhelming demand from the market was instrumental in driving up the price. It’s important to remember that fundamentally, price rise is a result of increasing supply in the face of limited demand.

The other not-so-fundamental contributor to pricing is the rationale behind the demand itself. Even though market critics remain doubtful about Twitter’s undeclared business model, they all agree that the current valuation would demand Twitter to grow exceptionally fast to justify its current price.

The resulting price of an IPO for any company indicates the future anticipated value of the enterprise, and in the case of Twitter, a $45 share price ($31 billion worth) would demand a growth rate of 3200% by 2018 i.e. a $6 billion in revenue. However, the current predictions are closer to $1.8 billion revenue by 2015, according to Brian Wieser at Pivotal Research.This seems highly unlikely, especially since the track record of the company doesn’t show any profits (losses actually, $65 million in the last quarter, 300% greater losses year over year).

So why the demand?

It’s important to understand that Twitter is a brand that has become an ubiquitous part of daily life for over 230 million users in the world and known to the entire world. And even as Facebook lays claim to 1 billion users, Twitter users live lives of constant engagement, both in their personal networks as well as in their public networks.

Many analysts don’t appreciate the culture value of Twitter’s brand and think of it like the many earlier flash-in-a-pan type social media businesses. But for the individual customers and clients of traders, funds and investing organisations, Twitter is a life reality for most and has become a natural part of the global lexicon for all; whether it is the Arab Spring or thanking Sachin Tendulkar, the idea of what Twitter is and can be is ingrained in its ever increasing user base. And it is this personal relationship that people enjoy with Twitter that makes it as iconic as Google and Facebook.

The original culture of Twitter and it’s users is a very personal and integral component of their broader relationship with society, which further enhances their attraction to the brand. Twitter makes everyone a someone, the centre of their own universe, and that is an appeal that isn’t going to change any time soon.

Does that mean Twitter will certainly be a profitable $6 billion company by 2018? No.

But can it? Well the buying public seems to think so.

)

)

)

)

)

)

)

)

)