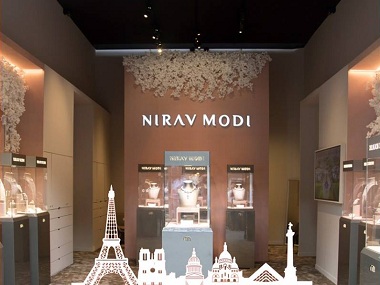

Potential buyers have expressed strong early interest in a bankrupt US firm of jeweler Nirav Modi, who has been accused of involvement in a $2-billion bank fraud in India, court filings in New York show. Firestar Diamond Inc filed for bankruptcy protection on 26 February in the United States, following accusations that other firms led by Modi and his uncle colluded with officials of state-run Punjab National Bank to secure unauthorised loans between 2011 and 2017. Modi and his uncle Mehul Choksi, owner of Gitanjali Gems Ltd, left India in January before the fraud came to light, but have said in letters and statements they are innocent. Indian investigators have, however, attached or seized assets belonging to Modi and his companies. Firestar is not named in the police complaint. “Early expressions of interest in purchasing some or all of the debtors’ business operations have been strong,” Firestar Diamond said in a court filing on Wednesday. It has also told secured lenders it was in discussions with lenders for debtor-in-possession financing as it weighed options. [caption id=“attachment_4360719” align=“alignleft” width=“380”] A Nirav Modi store. Facebook image.[/caption] Firestar Diamond and its affiliates had annual sales of around $90 million, with clients such as Costco Wholesale, Macy’s and JC Penney Co Inc, it said. The Central Bureau of Investigation has so far arrested at least 13 people, seven from the bank and six more from Modi and Choksi’s companies. Investigators have also seized a number of properties from the two, including jewellery and luxury vehicles. “Among the properties seized and businesses closed were factories in India which produced most of the fine jewelry merchandise sold by the debtors to their customers,” Firestar said in its filing. The Indian units had provided some back office and support functions, it said, adding, “The sudden loss of its supply chain and back office support has dramatically impacted the operations of the debtors in the short term. Firestar Diamond was formed as a Delaware corporation in 2004 under the name Jewelry Solutions International. Its name was changed to Next Diamond Inc in 2005 and again in 2007 to Firestone Inc, before taking its current name in 2011. The company is a wholly owned subsidiary of Firestar Group, which in turn is wholly owned by Synergies Corp. Both are Delaware incorporated. Synergies is then wholly owned by Firestar Holdings Ltd, a Hong Kong corporation, which is then wholly owned by Modi’s Indian company Firestar International Ltd, according to the filing made in the United States Bankruptcy Court Southern District of New York. Separately, the Enforcement Directorate, which targets offences involving foreign exchange and money laundering, said on Thursday it had seized 41 properties, worth about 12 billion rupees ($184.16 million) belonging to Choksi and companies he controls. Among the properties are apartments and office spaces in key Indian cities, the Enforcement Directorate, added.

Investigators have attached or seized assets belonging to Nirav Modi and his companies, Firestar is not named in police complaint.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)