What happens if a bank goes bust in India? Logically, depositors will rush to the bank’s branches to get their money back. There will be panic and commotion. A blame game will follow. Will the depositors get their money back? If yes, how soon? When a bank fails, naturally the regulator will ask the bank’s promoters and board to repay the depositors using whatever means available, typically by selling the assets of the bank. This, however, isn’t an easy solution. [caption id=“attachment_7404161” align=“alignleft” width=“380”]

PMC Bank. PTI photo[/caption] It might take years before the bank manages to sell its assets and generate enough liquidity to pay back to the customers. The other escape route is deposit insurance scheme provided by Deposit Insurance and Credit Guarantee Corporation (DICGC), which will pay Rs one lakh per bank account in the event of a bank failure. That is where the problem lies. This is the lowest deposit cover among comparable countries. Rs one lakh is a pittance when it comes to a significant number of depositors in India, especially when it comes to senior citizens who typically choose to park their life savings in bank fixed deposits. Isn’t it time to overhaul this mechanism? The deposit insurance guarantee scheme was set up in 1961 to ensure depositors are guaranteed at least some amount in the event of a bank collapse. This amount was enhanced to Rs one lakh only in 1993 from Rs 30,000. According to an

SBI report , currently the DICGC provides for cover of Rs 1 lakh per depositor (since May 1993) for deposits of Commercial Banks, RRBs, Local Area Banks (LABs) and Co-operative Banks and rest of the deposit amount is forfeited in the rare event of a bank failure. At the end of FY19, the number of registered insured banks stood at 2098, comprising 157 commercial banks and 1941 cooperative banks. In 2017, the government has introduced “The Financial Resolution and Deposit Insurance (FRDI) Bill” in the Parliament but withdrew it in 2018 due to the bail-in clause and mass protest across the country. The FRDI bill contemplated a mechanism of deposit insurance up to a specified limit (at least Rs 1 lakh) for not only banks but also for the NBFCs, insurance companies, pension funds, stock exchanges, and depositories. The SBI report argues that in the backdrop of the

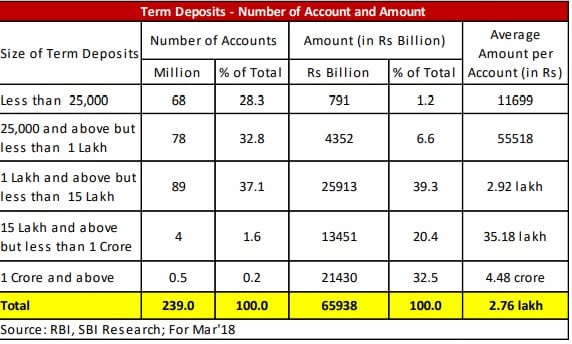

PMC Bank crisis , it is high time the DICGC needs to revisit the low cover under the insurance scheme. What should be the ideal threshold level for the deposit cover? As the SBI analysis shows, in terms of the number of accounts, 61 percent of the total accounts are less than Rs one lakh, around 70 percent are less than Rs 2 lakh, and 98.2 percent are less than Rs 15 lakh. This means small depositors are adequately covered in terms of insurance cover.

The problem, however, is that in terms of quantum of deposits, percentage of deposits less than Rs 1 lakh is only 7.8 percent of the deposit base. This means while majority in number may get their money back, the remaining is set to lose a big chunk of their savings. About 20.4 percent of the deposits are contributed by customers having deposits of more than Rs 15 lakh but less than Rs 1 crore with average deposits of Rs 35 lakh. In the event of a bank collapse, Rs 1 lakh will be painfully inadequate to compensate this segment. The SBI report calls for a minimum Rs 2 lakh deposit insurance cover for term depositors and Rs one lakh for savings bank depositors and a separate threshold for senior citizens. The SBI’s suggestions, if accepted , will be a progressive step in the evolution of deposit scheme in India. But for high value depositors and senior citizens, even a Rs 2 lakh cover won’t be enough. Eventually the government will have to look beyond these levels of deposit cover in the backdrop of gross uncertainty in the financial system, such as the recent PMC episode. Despite the RBI’s claims of being among the strictest banking regulators in the world, it has not inspired confidence among depositors of failing banks.

In this context, the depositors, mainly senior citizens or high value depositors, should be given an option—either through the bank or directly—to avail insurance cover for their entire deposit money parked in the bank wherein they get the full amount back in the event of bank collapse by paying a premium to the insurance company. This can be offered along with the regular DICGC scheme. Those who aren’t keen to join the scheme on account of a relatively high premium can continue with the existing deposit insurance scheme. In India, unlike the developed countries, there are no strong social security systems in place. A bank closure can terminate the whole savings of senior citizens or deny access to their hard-earned savings for a long period like it is happening in the PMC bank case. The PMC episode is a big eye-opener for the regulator and the government to radically rethink and innovate new ways for depositor protection.

The deposit insurance guarantee scheme was set up in 1961 to ensure depositors are guaranteed at least some amount in the event of a bank collapse

Advertisement

End of Article

)

)

)

)

)

)

)

)

)