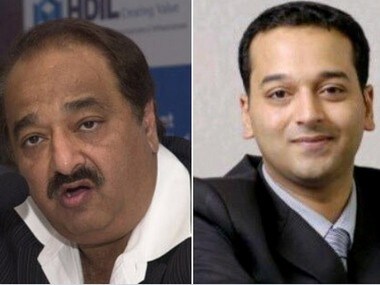

After the Enforcement Directorate (ED) filed a chargesheet on 16 December against Housing Development Infrastructure Ltd (HDIL) promoters Rakesh Wadhawan and Sarang Wadhawan in connection with the multi-crore Punjab and Maharashtra Cooperative (PMC) Bank scam last week, a newspaper report said the Economic Offences Wing (EOW) of the Mumbai Police may file its first chargesheet today (Friday) in the case. The police are set to also file in court formal charges against PMC Bank’s erstwhile chairman Waryam Singh, former managing director Joy Thomas and SS Arora who was a director at the bank, in the alleged over Rs 6,300 crore fraud, according to a report in The Times of India. The bank had sanctioned loans to 21 companies floated by HDIL without any requisite paperwork, the EOW probe revealed. These companies were allegedly formed to avail of loans as overdraft facilities, people in the know told The Times of India. [caption id=“attachment_7447931” align=“alignleft” width=“380”]  HDIL’s Rakesh Wadhawan and Sarang Wadhawan. Image courtesy - CNBC-TV18.[/caption] The EOW chargesheet runs into more than 32,000 pages. It lists charges under Indian Penal Code sections that deal with forgery, cheating, criminal conspiracy and destruction of evidence, the report said. Meanwhile, the ED’s chargesheet, running into around 7,000 pages, was presented before a special court set up under the Prevention of Money Laundering Act (PMLA) on 16 December. The Wadhawans have been booked under various provisions of the PMLA, according to a PTI report. The two were initially arrested by Mumbai Police’s Economic Offences Wing (EOW), which was probing the scam, and later taken into custody by the ED in October this year. The PMC Bank, which has around 16 lakh depositors, was placed under an RBI administrator on 23 September for six months due to massive under-reporting of dud loans. The bank, over a long period of time, had given more than Rs 6,700 crore in loans to HDIL, which is 73 percent of its total advances, and which turned sour with a shift in the fortunes of the now bankrupt company. Its total loans stand at around 9,000 crore and the deposits at over Rs 11,610 crore. There have been massive protests across city from the PMC Bank depositors following the RBI action. Twelve people, including top officials of the PMC Bank and HDIL, have so far been arrested by the EOW in connection with the scam.

The PMC Bank, which has around 16 lakh depositors, was placed under an RBI administrator on 23 September for six months due to massive under-reporting of dud loans

Advertisement

End of Article

)

)

)

)

)

)

)

)

)