[caption id=“attachment_82058” align=“alignleft” width=“860”]

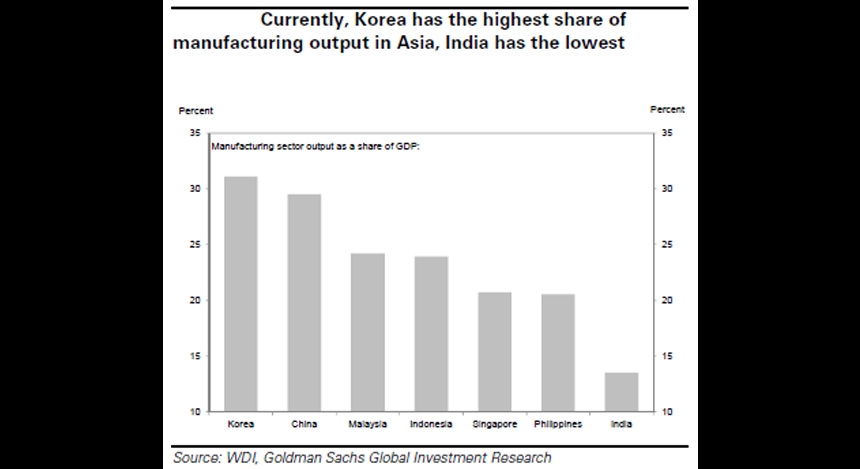

So, India wants to become a manufacturing giant. Given that it has the manpower, capital and other resources required to become one, what’s holding it back? Lots of things. As you can see from the chart below, India’s manufacturing output, as a share of GDP, is among the lowest in Asia. The next slides show what is going wrong with India’s manufacturing sector and are taken from the Goldman Sachs report titled “How India can become the next Korea”, which also contains recommendations on what India can learn from Korea, a manufacturing giant in Asia.[/caption]

So, India wants to become a manufacturing giant. Given that it has the manpower, capital and other resources required to become one, what’s holding it back? Lots of things. As you can see from the chart below, India’s manufacturing output, as a share of GDP, is among the lowest in Asia. The next slides show what is going wrong with India’s manufacturing sector and are taken from the Goldman Sachs report titled “How India can become the next Korea”, which also contains recommendations on what India can learn from Korea, a manufacturing giant in Asia.[/caption]

[caption id=“attachment_82060” align=“alignleft” width=“860”]

It’s high time India stepped up its game in manufacturing. To do that it needs to undertake comprehensive reforms. In terms of mistakes, the #1 mistake is that government has never focused on manufacturing as a primary objective. In India, so far, agriculture and the services sector have been relatively lightly taxed and preferred over industry. In addition, Indian manufacturing has not been export-led or labour-intensive. The focus in manufacturing has typically been heavy and capital intensive industry, according to Goldman Sachs.[/caption]

It’s high time India stepped up its game in manufacturing. To do that it needs to undertake comprehensive reforms. In terms of mistakes, the #1 mistake is that government has never focused on manufacturing as a primary objective. In India, so far, agriculture and the services sector have been relatively lightly taxed and preferred over industry. In addition, Indian manufacturing has not been export-led or labour-intensive. The focus in manufacturing has typically been heavy and capital intensive industry, according to Goldman Sachs.[/caption]

[caption id=“attachment_82061” align=“alignleft” width=“860”]

#2. High fiscal deficits have reduced funds available for infrastructure. A lower fiscal deficit will reduce “crowding out” the private sector – a phenomenon whereby high government borrowings reduce the quantity of funds available for the private sector and raise interest rates. Lower fiscal deficits also permit the government to spend more on infrastructure.[/caption]

#2. High fiscal deficits have reduced funds available for infrastructure. A lower fiscal deficit will reduce “crowding out” the private sector – a phenomenon whereby high government borrowings reduce the quantity of funds available for the private sector and raise interest rates. Lower fiscal deficits also permit the government to spend more on infrastructure.[/caption]

[caption id=“attachment_82062” align=“alignleft” width=“860”]

#3 Industrial parks have been ineffective so far. Special Economic Zones (SEZs) have been around since 2000, but plagued by land issues, lack of infrastructure and ownership problems. As much as 75 percent of SEZ land can be used for private profit, including real estate and other businesses that are not required to export, notes Goldman Sachs. In contrast, China mandates 80 percent of land in SEZs must be used for production. Infrastructure in Indian SEZs have also not improved vastly.[/caption]

#3 Industrial parks have been ineffective so far. Special Economic Zones (SEZs) have been around since 2000, but plagued by land issues, lack of infrastructure and ownership problems. As much as 75 percent of SEZ land can be used for private profit, including real estate and other businesses that are not required to export, notes Goldman Sachs. In contrast, China mandates 80 percent of land in SEZs must be used for production. Infrastructure in Indian SEZs have also not improved vastly.[/caption]

[caption id=“attachment_82063” align=“alignleft” width=“860”]

#4 The costs of doing business in India remains high.The IFC’s Doing Business Report 2014 ranks India at a low 134 out of 189 countries, one of the lowest in Asia. Starting a business takes 27 days, and costs 47 percent of per capita income, compared with six days for Korea, notes Goldman Sachs.[/caption]

#4 The costs of doing business in India remains high.The IFC’s Doing Business Report 2014 ranks India at a low 134 out of 189 countries, one of the lowest in Asia. Starting a business takes 27 days, and costs 47 percent of per capita income, compared with six days for Korea, notes Goldman Sachs.[/caption]

[caption id=“attachment_82064” align=“alignleft” width=“860”]

#5. Labour laws remain restrictive. India’s labor laws prevent firms from achieving economies of scale and encourage ‘informal’ and contractual employment. Legislation is aimed at protecting workers rather than creating jobs, adds Goldman Sachs.[/caption]

#5. Labour laws remain restrictive. India’s labor laws prevent firms from achieving economies of scale and encourage ‘informal’ and contractual employment. Legislation is aimed at protecting workers rather than creating jobs, adds Goldman Sachs.[/caption]

[caption id=“attachment_82065” align=“alignleft” width=“860”]

#6. Tax policies are discouraging industry. Corporate tax rate on profits in India is the highest in the region, at 34 percent, according to Goldman Sachs. With such a high incidence of taxation, firms have an incentive to stay small or remain in the informal sector. Goldman Sachs believe a goods and services tax (GST) would eliminate distortions between the taxes on manufacturing and services.[/caption]

#6. Tax policies are discouraging industry. Corporate tax rate on profits in India is the highest in the region, at 34 percent, according to Goldman Sachs. With such a high incidence of taxation, firms have an incentive to stay small or remain in the informal sector. Goldman Sachs believe a goods and services tax (GST) would eliminate distortions between the taxes on manufacturing and services.[/caption]

[caption id=“attachment_82066” align=“alignleft” width=“860”]

#7. Industry is susidising power for retail consumers. In India, industrial tariffs are higher than residential tariffs, notes Goldman Sachs. In addition, a peak power deficit of about 10 percent means factories endure repeated power cuts. To ensure constant power supply, companies install expensive diesel generators, which raise input costs.The tariff structure needs to change for industrial users, says Goldman Sachs.[/caption]

#7. Industry is susidising power for retail consumers. In India, industrial tariffs are higher than residential tariffs, notes Goldman Sachs. In addition, a peak power deficit of about 10 percent means factories endure repeated power cuts. To ensure constant power supply, companies install expensive diesel generators, which raise input costs.The tariff structure needs to change for industrial users, says Goldman Sachs.[/caption]

)