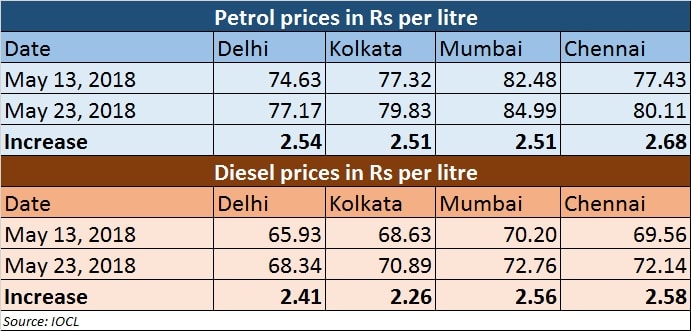

Rising crude oil prices, expected to increase further over the next six months, and their cascading effect on domestic petrol and diesel prices will make the going harder for the common man, analysts told Firstpost. Fuel costs the most in financial capital Mumbai. Petrol retails at Rs 84.99 and diesel sells at Rs 72.76, according to Indian Oil data. Petrol sold at Rs 84.99 on 23 May, or Rs 2.51 more than 13 May’s price. Diesel retailed at Rs 72.76 on Wednesday, or Rs 2.56 more than 13 May’s price. Petrol is costlier by some Rs 7.12 since the beginning of the year, while diesel is costlier by some Rs 9.49.Things could get worse, because sector analysts expect global crude oil prices to rise further over the next six months. Global oil prices this month hit their highest in more than three years on record Asian demand and after the United States said it would re-impose sanctions on major oil exporter Iran, which ships a lot of crude oil to India, Reuters reported. New Delhi, earlier this week, said it is trying to find a ‘solution’ to the ongoing fuel crisis. Oil minister Dharmendra Pradhan said the regime will work out a solution, expected this week. Domestic fuel prices track global oil rates, which have risen on expectations of lower supplies from Iran, from major exporter Venezuela and from top exporter Organisation of Petroleum Exporting Countries (OPEC) that has enforced production cuts. [caption id=“attachment_2173479” align=“alignleft” width=“380”]  Petrol station. Representational image. Reuters[/caption] But, there is nothing much our government can do in the given situation because it cannot cap the prices of petrol and diesel, revised daily amid rising crude prices, said analysts. Sachin Pilot, the Congress chief for Rajasthan, on Monday, demanded that the Centre and state governments reduce the excise duty and VAT on petrol and diesel respectively. Reducing the excise duty and VAT on petrol and diesel is not the way out, said Dibyanshu Sinha, Partner, Khaitan and Co. That would be a ‘knee-jerk’ reaction to the situation, he said. “The rise in prices is completely outside the government’s [control]. Taxation is a good revenue source for the government. It would not be prudent to do away with taxes as the revenue from taxes benefit the people,” Sinha said. The abolishing of VAT and excise duties on fuel will only provide a temporary solution, said Kavan Mukhtyar, Partner and Leader, Automotive at PwC. “Remember, we do have a fiscal deficit and allocating money for subsidising fuel is not asset creation. Fuel is an expense and any government will be very, very caution before deciding to give any subsidy today,” he said.  Instead, Mukhtyar suggested that the focus should be on efficiency. Just as the Goods and Services Tax (GST) has improved the efficiency of the transport sector, similarly such a measure would help fuel, he added. Rupee weakens More than the rise in crude prices that hit $80 on 22 May, the highest in four years, it is the weakening rupee that is of concern. The rupee declined 25 paise to hit a fresh 16-month low of 68.29 per dollar in early trade today after it had gained 8 paise to close at 68.04 against the US dollar on fresh selling of the American currency by banks and exporters. On 21 May, the rupee lost 12 paise to close at a fresh 16-month low of Rs 68.12 against the US dollar on sustained dollar demand from importers and corporates amid weak global cues. The rise in crude prices can be contained, said Kaushik Madhavan, Director - Automotive & Transportation, MENASA at Frost & Sullivan. “Unless the weakening rupee recovers in the next few days and weeks, the price of fuel will go up even if crude stays at the same price,” he added. Inflationary pressures Consumers need not look for any respite in fuel prices, cautioned Mukhtyar. Prices have gone up to a point where there is an inflationary pressure and therefore the prices of goods will go up. Across the board, there will be an increase in the prices of vegetables and food grains. Prices of FMCG may also go up, he added. The Narendra Modi-led government cut the excise duty on fuels by Rs 2 a litre last October. But that move followed nine hikes to the tax between November 2014 and January 2016, to shore up finances as global oil prices fell, reported the PTI. The central government cut the excise duty by Rs 2 per litre in October 2017, when petrol reached Rs 70.88 per litre in Delhi and diesel Rs 59.14. Because of the reduction in excise duty, petrol had, on 4 October, 2017, come down to Rs 68.38 per litre, while diesel decreased to 56.89 per litre. The government had between November 2014 and January 2016 raised the excise duty on petrol by Rs 11.77 a litre and on diesel by Rs 13.47 per litre to take away gains arising from plummeting global crude prices. This led to its excise mop up more than doubling to Rs 2,42,000 crore in financial year 2016-17 from Rs 99,000 crore in fiscal 2014-15. (Data inputs by Kishor Kadam)

Fuel costs the most in financial capital Mumbai. Petrol retails at Rs 84.99 and diesel sells at Rs 72.76, according to Indian Oil data.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)