When Indians think of beauty it is not only the fairness cream or the traditional coconut oil with some extra Amla that they are looking for. A growing middle class with rising aspirations surely is changing the consumption basket for the Indians.

[caption id=“attachment_329379” align=“alignleft” width=“380” caption=“Agencies”]

[/caption]

[/caption]

A latest report by Macquarie Research says the consumption pattern in household and personal care products (HPC) is changing. Soon one could see more categories like hair conditioner, fabric conditioner, anti ageing cream, deodorants, face wash, sun care, body lotions and male care products gaining popularity.

The report says penetration of many of the traditional categories like detergents, soaps and hair oils has little room for expansion, forcing companies to innovate. Even more consumers are looking for convenience and are ready to experiment.

[caption id=“attachment_329195” align=“aligncenter” width=“367” caption=“Source: Macquarie”]

[/caption]

[/caption]

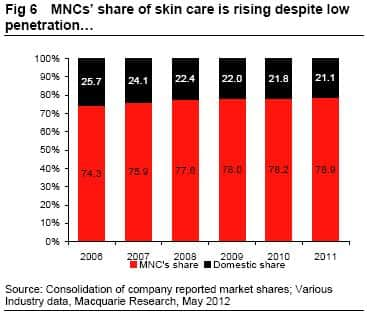

And this is where more global HPC players are looking at India with a positive view as the developed markets are already saturated and they have entrenched their foothold in China. And their penetration into India is still very low though increasing over time. The chart above shows the MNC penetration in the skin care category in India.

Who wants to come into India?

L’Oreal aims for sales of 1billion by 2020 in India which is a growth of 19 percent per year over 2010-20.

Impact Shorts

More ShortsReckitt aims to make India its largest global sales contributor by 2016.

P&G plans to increase its number of product categories in India to 25 by 2016 from 15 in 2011.

Colgate has stepped up its product offerings in the recent past from pure oral care through product launches into personal, hair and home care.

Beiersdorf plans to enter emerging categories like deodorants and also

plans to launch small pack sizes (sachets) to improve its product affordability and contemplating manufacturing facilities in India.

Avon cosmetics plans to increase its pan-India footprint by 2013 after witnessing a growth of 35 percent per year over the last five years.

So why is premiumisation so alluring in India?

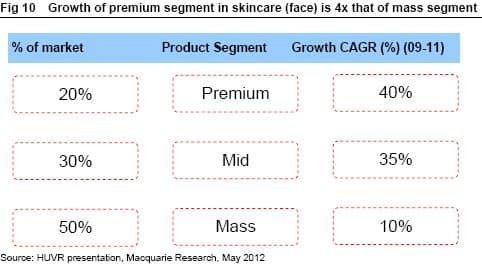

Indian consumers’ spending in premium HPC categories is the lowest among the BRIC nations and can be partly explained by the low per capita and disposable income. And that gives the confidence! The chart below and Macquarie estimates show that if 10 percent of consumers shift from mid to premium segment of consumption, that could double the size of premium segment for detergents and soaps.

Is India ready for premiumisation?

Yes, says Macquarie. As penetration of key categories with significant market sizes like soaps, detergents, oral care, hair oil and shampoo has either reached maturity or is fast approaching it. So the companies with significant exposure to these segments are bound to innovate and create space for more premium products.

How big is the threat for domestic players?

As long as the domestic players can also innovate and cater to the increasing aspirations of the Indian middle class, they will not suffer. Of course, companies with the right entry strategy in categories like skin care, deodorants, cosmetics and home care, where the penetration still has room to grow, will perform better.

)