Business News - Page 10

Budget 2025: Taxpayers with income of up to Rs 13.25 lakh, not Rs 12 lakh, can pay nil taxes. Here’s how

By claiming two deductions, an individual with a gross salary of Rs 13,25,000 can bring their net taxable income down to Rs 12 lakh, making them eligible for the full tax rebate under Section 87A

Budget 2025: You will have to pay taxes despite income below Rs 12 lakh if...

Income taxed at special rates, such capital gains made through investments in stocks, including short-term and long term capital gains under Section 111A and Section 112, respectively, cannot be offset by the rebate

DeepSeek damage: On Jan 27, Nvidia lost combined networth of Starbucks, PepsiCo, McDonald's and Target

The steep drop followed a big development from a Chinese startup, DeepSeek. It announced it had created a large-language model capable of matching ChatGPT and other US rivals while using significantly less computing power

Modi govt sets 2026-deadline to end Maoist extremism, Budget 2025 allocates Rs 3,500 cr for security boost

The allocation for security-related expenditure is considered significant in the wake of Union Home Minister Amit Shah's repeated statements that the Narendra Modi government has resolved to end Naxalism in the country by March 2026.

Union Budget 2025-26: Sitharaman proposes Rs 300 cr to modernise Indian prisons

In May 2023, the Home Ministry had finalised a comprehensive ’Model Prisons Act’ with provisions regarding establishment and management of high security jails, open jails and ”protecting the society from the criminal activities of hardened criminals and habitual offenders” among others

After Budget 2025, should you opt for old or the new tax regime?

A comparison of the two regimes would clearly indicate that the intention of the Government is to streamline the process and ensuring a simpler tax environment to ensure compliance

Old vs new tax regime: How Budget 2025 alters your tax choices

Recognising the significant contributions of the middle class, the Government of India has consistently reduced their tax burden over the years

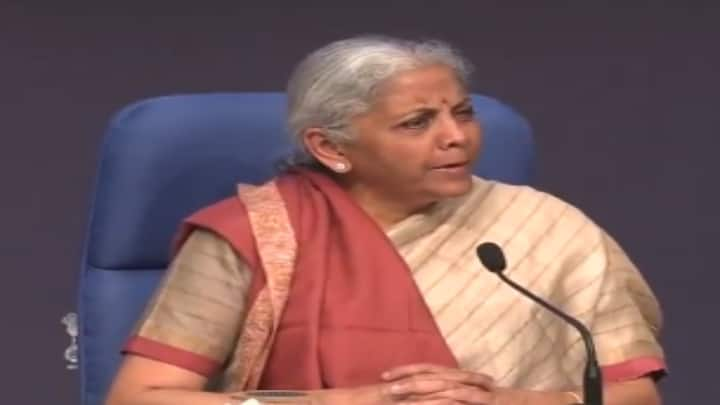

On Trump tariff pressure, Sitharaman says 'Income tax rebates not offered with that in mind'

When asked if the income tax rejig and changes in customs duty were proposed as a consequence of Trump's tariff threats, Sitharaman said, "We responded to the voice of the people and therefore we have given this (income tax relief)”

Budget 2025: Income tax gains depend on your investments too. 6 scenarios explained

Has Sitharaman’s tax reforms delivered on Modi’s 'Mahalaxmi' promise, easing burden on middle class?

One crore more people will pay no income tax due to hike in rebate to Rs 12 lakh: FM

The government has put "substantial amount of money" in hands of people through rejig of I-T slabs in the Budget and an additional 1 crore people will pay no tax due to hike in tax rebate to Rs 12 lakh per annum, Finance Minister Nirmala Sitharaman said on Saturday

Census to get delayed beyond 2025? What Sitharaman’s Union Budget 2025 hints at

If budgetary proposals are anything to go by, the decadal census is unlikely to be carried out in 2025 as well with a meagre Rs 574.80 crore allocated for the exercise in the Budget presented on Saturday

Where India earns its rupee from and what it spends on

Taxes and borrowings make up the majority of the revenue while a significant portion of the expenditure is allocated to mandatory obligations such as interest payments and state transfers. The Budget also offers insights into how the government generates revenue and allocates its funds. Let’s understand how this process works and its impact on the economy

Sensex and Nifty end flat on special trading day as Budget 2025 gets lukewarm response from investors

In a day market with heavy volatility, the 30-share BSE benchmark Sensex eked out a marginal gain of 5.39 points or 0.01 per cent to settle at 77,505.96. During the day, it hit a high of 77,899.05 and a low of 77,006.47, gyrating 892.58 points

Maldives, Afghanistan and Bhutan big gainers in India’s Union Budget 2025; Myanmar gets a cut

The budget has allocated a total of Rs 5,483 in funding to aid foreign governments in the financial year 2025-26. The amount is less than what was budgeted last year at Rs 5,806

Union Budget 2025: Did Sitharaman leave Indian Railways wanting for more to enhance its ‘gati’ and ‘shakti’?

Despite hopes for more funding, the Union Budget 2025 keeps Indian Railways' allocation the same, missing a chance to boost its growth and development

Healthcare experts hail Budget 2025’s push for daycare cancer centers, drug cost relief

Healthcare experts lauded the announcement by Finance Minister Nirmala Sitharaman to setting up daycare cancer centres, terming the step a paradigm shift in cancer treatment for rural patients.

Budget 2025: One reason Sitharaman can afford to give income tax benefits

Finance Minister Nirmala Sitharaman on Saturday announced major tax benefits for the middle class, with positive tax collections likely being one reason for her to arrive at such a decision

‘A force multiplier’: Modi praises Union Budget 2025, says this is the budget for all Indians

PM Modi said that this year's budget has prioritised employees from all sectors. He highlighted that tourism will get a major boost within the next few years as the government will bring it under the ambit of infrastructure

Union Budget 2025 has good news on income tax for NRIs too

Under the revised New Income Tax Regime for 2025, the tax-free income threshold, including the standard deduction, has been raised to Rs 12.7 lakh. Additionally, individuals earning up to Rs 25 lakh will benefit from a tax reduction of up to Rs 1.1 lakh

Union Budget 2025: Flying to and from small-town India to get easier with air connectivity to 120 new destinations

The modified scheme will support the creation of both big and small airports in hilly regions in the northeast. Meanwhile, Bihar will get new greenfield airports to meet the needs of the state

Union Budget 2025: Bihar takes centre stage, which state got what?

Bihar receives significant attention in Nirmala Sitharaman’s 8th Union Budget, the second in Prime Minister Narendra Modi’s third term, with substantial investments in agriculture, infrastructure, education, and regional connectivity

Union Budget 2025: Tax deduction on interest for senior citizens doubled from Rs 50,000 to Rs 1 lakh

Finance Minister Nirmala Sitharaman on Saturday said tax deductions at source (TDS) will be rationalised for senior citizens and doubled from Rs 50,000 to Rs 1 lakh

Union Budget 2025: New income tax bill to be half the current one and simpler, says Sitharaman

The new income tax bill - a direct tax code meant to simplify compliance for individual taxpayers - will be introduced next week, said Sitharaman as she presented the Union Budget 2025

Union Budget 2025: After Eco Survey flags high cost of medical education, India plans 75,000 more college seats

Finance Minister Nirmala Sitharaman on Saturday announced that 10,000 seats will be added in medical colleges and hospitals by next year and 75,000 seats will be increased over the next 5 years

Union Budget 2025: Sitharaman announces Rs 500 cr plan for 3 Centres of Excellence on AI

Finance Minister Nirmala Sitharam on Saturdsy said that the government will set up Centre of Excellence in Artificial Intelligence for education with an outlay of Rs 500 crore.

Budget 2025: World's biggest postal network India Post to turn into 'public logistics organisation'

Finance Minister Nirmala Sitharam said that India Post will be transformed into large public logistic organisation with 1.5 lakh rural post offices to become catalyst for rural economy

Union Budget 2025: FM unveils Dhan Dhanya Krishi Yojna to boost rural prosperity

Union Budget 2025: Finance Minister Nirmala Sitharaman launches the Dhan Dhanya Krishi Yojna to enhance productivity in 100 districts

Gold prices jump to all-time high at Rs 84,900 per 10g

Gold prices surged to a record high of Rs 84,900 per 10 grams in the national capital on eve of Union Budget 2025, fueled by strong domestic demand and global market trends

PM Modi's Goddess Lakshmi remark sparks hopes for income tax relief for middle class

The clamour for liberalising tax slabs, reducing tax rates and hiking standard deduction, among other measures, is growing and remains to be seen if Finance Minister Sitharaman’s Bahikhata unveils tax sops for the middle-class taxpayers

Union Budget 2025: Sensex surge reflects budget optimism, but economic struggles loom large

Despite the surge, the Sensex remains 2,900 points, or 3.6 per cent, lower than its level after the last Budget in July 2024, pointing to the deeper struggles in the market