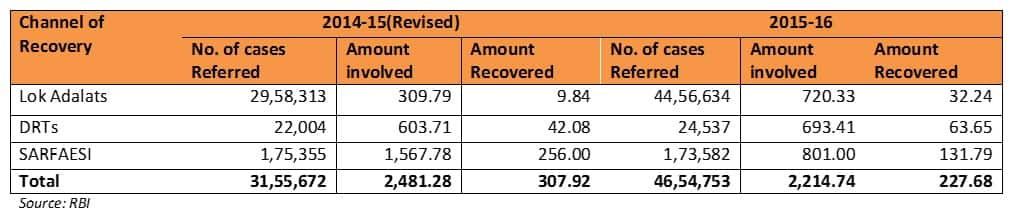

In a way, 12 February, 2018 marked the end of an era best characterised by the late J Paul Getty, oil billionaire, who said, “When you owe the bank $100, it’s your problem; when you owe the bank $100 million, it’s the bank‘s problem”. The institution of the Insolvency and Bankruptcy Code (IBC) in 2016 and the Reserve Bank of India (RBI) circular on 12 February, 2018 effectively changed all that. The owners of many of our companies, who individually owe the banking system that kind of money, face the risk of losing their businesses they or their families built or owned. The circular also buried all the various debt restructuring schemes that companies had gamed. Let’s take a trip down memory lane tracing the evolution of our debt resolution system to understand the true extent of the change; remember, the idea of business bankruptcy didn’t exist in the lexicon of Indian industry before the IBC came into existence. [caption id=“attachment_5129811” align=“alignleft” width=“380”] Representational image. Reuters.[/caption] Before 1991, the institutional mechanism for bad loan recoveries was made up of the Sick Industrial Companies Act (SICA), 1985 (to identify sick companies), Board for Industrial and Financial Reconstruction (BIFR) set up in January 1987, the Appellate Authority for Industrial and Financial Reconstruction (AAIRFR) in April 1987. The success of these institutions was negligible. Also in 1987, Lok Adalats were established, followed by the Debt Recovery Tribunals (DRTs) in 1993. In 2001, the first formal Corporate Debt Restructuring (CDR) mechanism was announced. In 2002, The Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest (SARFAESI) Act came into being. What do the numbers tell us about their success? Look at the table below. As a report by CARE Ratings suggested, these mechanisms were clearly ineffective. Out of a total of more than 4.65 million cases, over a period of nearly two decades, and out of a total of over Rs 2.21 lakh crore dues, recoveries amounted to just Rs 22,800 crore, or roughly 11 percent. The cases took years to be heard, with defaulting borrowers facing no penalties for bad behaviour.

(Amount in Rs billion) Take note that 96 percent of all the cases in the above table went to the Lok Adalats; recovery rates, measured as the amount recovered as a percentage of the amount of the debt, were 4 percent. In the DRT cases, the recovery rate was 9 percent. Not exactly a shining record of success. The SARFAESI Act helped set up asset reconstruction companies (ARCs) that would buy distressed debt, and restructure or recover them. At the end of March 2016, there were 16 ARCs that acquired a little over Rs 72,600 crore from banks. A number of impediments hampered their effectiveness; in most part, banks were unwilling to part with the assets because pricing was a problem. The CDR mechanism didn’t fare much better. Created mainly to address large borrowers, in its 18-year existence—the lower limit for cases was Rs 10 crore— the CDR Committee accepted 530 out of the 655 cases that were referred to it for restructuring; 94 cases (involving Rs 68,900 crore) exited successfully.

(Amount in Rs billion) Take note that 96 percent of all the cases in the above table went to the Lok Adalats; recovery rates, measured as the amount recovered as a percentage of the amount of the debt, were 4 percent. In the DRT cases, the recovery rate was 9 percent. Not exactly a shining record of success. The SARFAESI Act helped set up asset reconstruction companies (ARCs) that would buy distressed debt, and restructure or recover them. At the end of March 2016, there were 16 ARCs that acquired a little over Rs 72,600 crore from banks. A number of impediments hampered their effectiveness; in most part, banks were unwilling to part with the assets because pricing was a problem. The CDR mechanism didn’t fare much better. Created mainly to address large borrowers, in its 18-year existence—the lower limit for cases was Rs 10 crore— the CDR Committee accepted 530 out of the 655 cases that were referred to it for restructuring; 94 cases (involving Rs 68,900 crore) exited successfully.

In 228 cases, the restructuring package failed (Rs 97, 750 crore), leaving 205 ‘live’ cases (roughly Rs 2.37 lakh crore) before the repository. The 12 February circular wound up the scheme. Analysts and experts have commented on how companies gamed the CDR system by ’evergreen’ loans. There is a lot of evidence to support that conclusion.

Other mechanisms were introduced: a Joint Lenders Forum (JLF) based on a central repository of information on large credits or CRILC. The repository solved the problem of different lenders having different information about a borrower and a JLF could get banks to act in a coordinated fashion. But here again, information is sketchy, and suggests that it was ineffective. Announced in January 2014, 355 JLFs were set up between April 2014 and February 2015. As many as 44 cases were referred to the CDR mechanism. The flurry of restructuring schemes increased as the NPA problem showed signs of getting bigger. In July 2015, a the 5/25 scheme for the flexible structuring of long-term project loans was announced (focused on infrastructure-related loans where interest rates were adjusted every 5 years over a 25-year repayment period), followed by the Strategic Debt Restructuring (SDR) scheme in June 2015 (where loans could be converted into equity up to 51 percent, and then sold after the company became viable again; just two sales occurred) and the Scheme for Sustainable Structuring of Stressed Assets or S4A (where the total exposure loan could be divided into unsustainable and sustainable parts; the former would be converted into equity and preference shares). This smorgasbord of schemes didn’t even dent the NPA problem. The mountain just kept piling up until it reached 11 percent of total bank assets. The RBI also introduced an Asset Quality Review (AQR) of loan classification norms which didn’t affect bank behaviour either. They just continued to hide the problem or lie about it and evidence is now emerging as to how big the lies were. On 16 January 2019, an ICRA ratings report said that 23 banks had under-reported NPAs in 2015-16, and 30 banks did that in the following year based on the divergence reported by the banks and assessed by the RBI in its AQR. The extent of under-reporting was over Rs 83,000 crore in FY17 and over Rs 43,000 crore in FY16. The variation in profit was Rs 10,500 crore in FY16 and about Rs 20,000 crore in FY17. One more set of numbers will complete this tour: Loan write-offs. An ICRA report says that in a 10-year period—2009-2018, banks have written off over Rs 4.8 lakh crore. In FY18, the write-offs amounted to more than Rs 1.44 lakh crore; over the last four financial years, banks have written off more than Rs 3.57 lakh crore. That’s the size of a mid-size bank. All of which we now know because of exposure to the bright glare of scrutiny.

The 12 February 2018 circular goes to the next step. Consider that in this financial year alone—FY19—banks expect to recover Rs 1.8 lakh crore from borrowers. That’s more than 35 percent of the amount written off in the last decade. So the IBC and National Company Law Tribunal (NCLT) must be doing something right, as is and will the 12 February RBI circular.

Yes, it has been reviled by both bankers and businessmen who were borrowers. But also remember this, the next time you read their criticisms about it: They hid the extent of the problem for years, and lied about it. (The writer is a former journalist and a communications consultant)

)

)

)

)

)

)

)

)

)