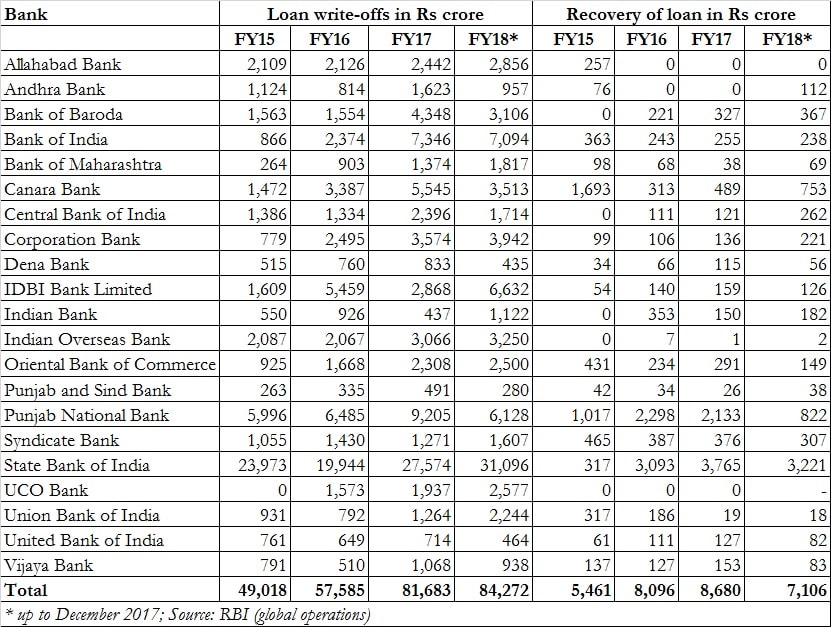

Over a roughly three-and-a-half year period, from when Narendra Modi took charge as Prime Minister in mid-2014, to the end of December 2017, India’s public sector banks (PSBs) have written-off loans worth Rs 2,72,558 crore. Of the amount, a meagre Rs 29,343 crore has been recovered, according to data available with the Reserve Bank of India (RBI). Of the write-offs, the biggest in a year happened at the Mumbai-traded State Bank of India (SBI), which wrote off Rs 31,096 crore in the nine months to 31 December, 2017. PSBs recovered a total of Rs 15,786 crore over a twenty-one month period ended 31 December 2017 (the first nine months of FY18 and all of FY17 put together). This data was submitted by the Minister of State, Finance, Shiv Pratap Shukla, on 27 March, 2018, in Parliament. There have been tall claims by the ruling BJP, possibly by mistake, about the recovery of a much larger amount. Just last week, the BJP’s official twitter handle pushed out a tweet saying that the ‘Insolvency and Bankruptcy Code (IBC), 2016, has resulted in recovery of Rs. 4 lakh crore out of staggering Rs. 9 lakh crore of NPAs or bad loans given to the corporates under UPA government”. The BJP’s official twitter handle deleted that tweet subsequently but the party’s Odisha unit still carries the tweet attributing the same to the Ministry of Corporate Affairs.

A BJP spokesperson, Ashok Goel, too has tweeted the same.

Insolvency and Bankruptcy Code (IBC), 2016 has resulted in recovery of Rs. 4 lakh crore out of staggering Rs. 9 lakh crore of NPAs or bad loans given to the corporates under UPA government. pic.twitter.com/UZXcyD5ysk

— Ashok Goel (मोदी का परिवार) (@AshokGoelBJP) April 14, 2018

There is no public data available on the total value of cases referred to the IBC. But, on 4 April, the IANS

quoted Corporate Affairs Secretary Injeti Srinivas as saying that Rs 4 lakh crore NPAs have been recovered due to the insolvency system. This is probably the total value of cases referred to the IBC so far and that could have confused the BJP’s IT cell and some leaders, who tweeted the figure as the total value of loans recovered. According to the Insolvency and Bankruptcy Board of India’s (IBBI) website, a total of 669 cases have been referred to the IBC thus far. The amount involved is not given. The value of all cases is estimated at around Rs 4 lakh crore, according to banking industry sources. [caption id=“attachment_4370853” align=“alignleft” width=“380”] Representational image. Reuters.[/caption] At present, Indian banks’ total gross non-performing assets (NPAs) stand at Rs 9 lakh crore. Of this, over 90 percent is with state-run banks. According to a PTI report, bank NPAs will swell by another 8,000 crore as advances to the scam-hit Gitanjali Gems Group have turned bad during the quarter ended 31 March. Banking scams involving fraudsters like Nirav Modi have wrecked havoc. But the bad loans pile was built over a period of years with banks competing to lend to firms riding the economic boom. Very little was done to monitor the quality of lending. The corporate political nexus too took the banking system for a ride. Case in point being the Rs 9,000 crore Kingfisher loan. In the first round, in June last year, the Reserve Bank of India (RBI) referred 12 cases to the IBC totaling about 25 percent of the gross NPAs in the banking system. According to banking industry sources, 28 more accounts were referred to IBC. In most of these cases, the process is underway. The RBI’s all-out war against NPAs began in January 2015 when the central bank put out rules for the early recognition of stressed assets in the banking system and their punitive provisioning. Till then, PSBs, which account for 70 percent of the banking system and almost 90 percent of bank NPAs, were happily ever-greening bad loans of influential, politically connected promoters via technical adjustments. The infamous corporate-political nexus worked in full swing. Banks’ recovery record from NPAs has been extremely poor. To understand the gravity of the matter, just look at SBI’s track record. In fiscal year 2015 alone, SBI wrote-off loans worth Rs 23,973 crore while it recovered just Rs 317 crore. In the next fiscal year fiscal year, it wrote off Rs 19,944 crore, whereas it recovered Rs 3093 crore from loans that were written off. In FY17, SBI wrote off loans worth Rs 27,574 crore, it recovered Rs 3,765 crore. In the subsequent fiscal year till December 2017, it wrote off Rs 31, 096 crore, recovered mere Rs 3,221 crore.

India’s state-run banks have been one of the biggest recipients of taxpayers money. Just recently, the government announced a Rs 2.11 lakh crore capital infusion in state-run banks. Now, will the transfer of assets worth Rs 4 lakh crore offer hope to India’s baking system? It is naïve to expect a significant outcome since admitting to bankruptcy proceedings only ensures speedy resolution of the case. If a bankrupt company fails to turn around, lenders will have to sell its assets to recover money. The problem is that there aren’t enough buyers for such stressed assets in India at prices the banks want, to compensate for their losses. (With data inputs from Kishor Kadam)

)

)

)

)

)

)

)

)

)