Not profitability but market share is going to drive the stock prices in the IT space. Nomura, in its latest report has said that says the fact tha gaining market share has become a priority for investors and this comes across in the performance of TCS, Cognizant and HCL Tech and the under performance of Infosys and Wipro.

Nomura says market-share dynamics and expansion of the target market will be key to driving additional growth for industry players. And the key areas where there is still scope for offshoring are infrastructure management services, business process outsourcing and engineering services within service lines and Continental Europe among geographies. Here are five questions Nomura tries to answer in its latest reports:

What ails Infosys and should investors play the rebound here?

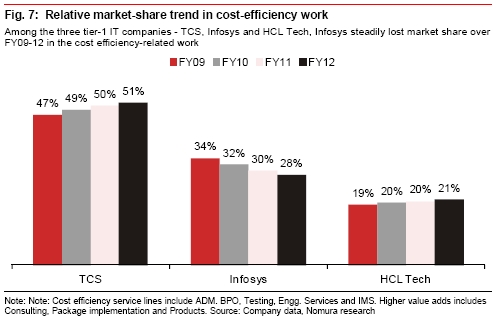

Nomura says Infosys denies its internal problems regarding hiring, business strategy or regulatory issues and keeps blaming its performance on the external environment which will not work. Infosys is losing out on commodity or cost efficiency business and is not getting enough cost efficient to lay the high volume market. It will turn around if discretionary spend on IT goes up, uses its cash better, sorts out the Visa issues and gets more competitive in the commodity segment.

Will Cognizant’s outperformance continue and will the stock recover?

Cognizant’s cutting of 2012 guidance has given rise to skepticism over if it can sustain its strong stock performance. Discretionary spend on IT has gone down and sure demand has fallen. But Nomura expects Cognizant to continue to gain market share, aided by an aggressive low margin requirement. Add to this a 20 percent revenue growth guidance which is achievable according to the research house, and Cognizant will maintain its outperformance over the peers.

Will Wipro be able to reduce lag with peers and at what cost?

Wipro has given a weak revenue guidance for the first quarter of 2013 as most its deals are finalised at the last moment. With decision making on deals are being delayed continuously Wipro is bound to suffer. This is in contrast with TCS or HCL Tech which have deals sealed already to give enough revenue growth over the next year. Nomura expects Wipro to lag the other market leaders and grow at 10 percent in 2013 which is lower than Nasscom’s guidance of 11-14 percent. It will also suffer in margins which even the management has warned investors about. Wipro will need to get its strategy right for Europe and US to over come the lag.

Impact Shorts

More ShortsIs HCLT’s outperformance sustainable and can the stock re-rate further?

HCL Tech has outperformed the Nifty by 16 percent over the past one year mainly due to high revenue growth. This is likely to continue as it has low margin thresholds and is strong in infrastructure management services where the order flow is heavy. But in the long term it will have to succeed in maintaining and growing clients beyond the size it has already reached (20 million dollars) which likes of Infosys and TCS have shown in the past.

Can the multiples in the sector correct on growth moderation and as core margins drop?

Multiple in the sector will mainly be determined by growth and core margins excluding the impact of currency fluctuations. Given that growth has slowed down and margins tend to shrink in a highly competitive market, rerating of stocks are unlikely to happen. IT companies have grown at 25 percent compound rate from 2006 to 2012 which is likel to slow down to 15 percent over the next two years. The outperformance will depend on how much market share each company can gain in this market.

Buy: HCL Tech, Cognizant

Neutral: Infosys, TCS, Wipro

)

)

)

)

)

)

)

)

)