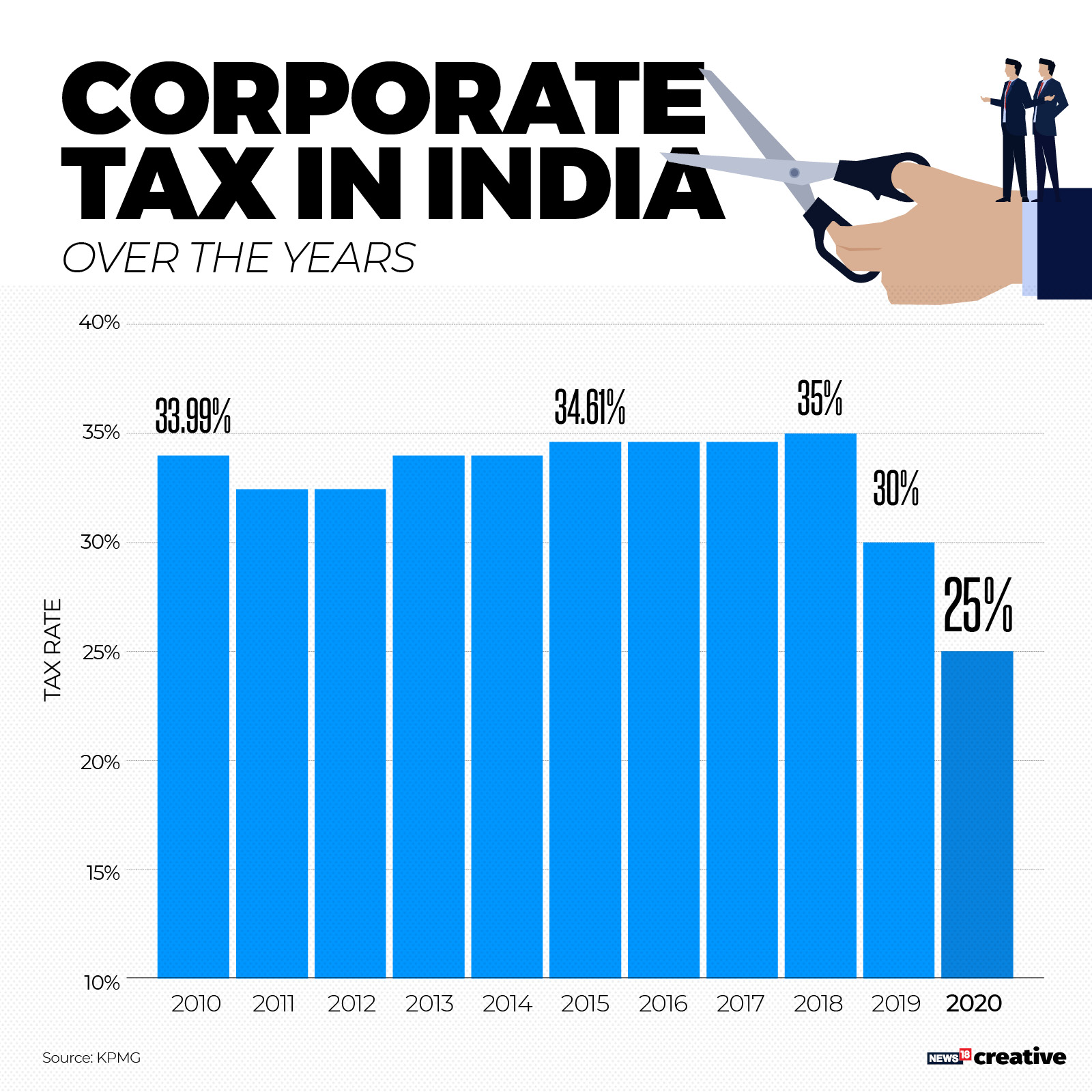

The economy desperately needed a growth boost, something that is powerful enough to rejuvenate the industries from the prolonged negativity all around; Union Finance Minister Nirmala Sitharaman has just delivered that. [caption id=“attachment_7340511” align=“alignleft” width=“380”]  File image of Finance Minister Nirmala Sitharaman. PTI[/caption] Of all the economic measures announced so far in Narendra Modi government’s second term to revive a slowing economy, Friday’s (20 September) corporate tax cut announcement stands out and easily ranks at the top. A tax cut from 30 percent to 22 percent for those companies who wouldn’t seek incentives and confessions is a smart step and nothing short of a major stimulus for the economy. If one considers the revenue forgone, it is a Rs 1.45 lakh crore stimulus package. The tax bonanza will work in favour of corporations fighting a severe demand slump in two ways, first as a much-needed sentiment booster and second, to free up some cash that can be diverted to reinvestments or debt burden as rating agency Moody’s Investors Service has noted. “The extent of final impact on credit profiles of Indian corporates will depend on whether they utilize the surplus earnings for reinvestment in business, debt reduction or high shareholder returns,” Moody’s said. Along with this, Sitharaman did a couple of major announcements some of which will bring joy to new entrepreneurs, especially manufacturing companies set up after 1 October which will get an option to pay 15 percent tax and effective tax rate. Also, the other steps such as no levy on listed companies that have announced buybacks before 5 July 2019; tax, no higher surcharge on capital gains on sale of security including derivatives held by FPIs, no enhanced surcharge on capital gains arising on equity sale or equity-oriented funds all are positive to pacify the investors.  The revenue foregone for this move will be Rs 1.45 lakh crore annually which shouldn’t be a big reason for worry because a widening tax base, cutting of losses on account of exemptions and incentives will eventually take care of this void. This, coupled with some of the measures announced in the recent days such as the creation of a distressed asset fund to extend funding to incomplete housing projects that are in good shape and measures to help budding MSMEs are steps that indicate the government is engaging with stakeholders to get the economy out of the slowdown course. The government provided window to provide last-mile funding for non-NPA, non-NCLT housing projects is net-worth positive. Also, the government relaxed External Commercial borrowings (ECB) guidelines to help real estate developers obtain overseas funds. This time, the smart move is that government is extending the benefit of lower tax rates only to those corporations which will do away with exemptions and incentives. This is essential to improve compliance and widen the honest tax base. Lower taxes will be a disincentive to tax evasion.  The decision to cut corporate tax to 25 percent was an agenda first moved by former finance minister Arun Jaitely, which has finally happened now. The step has been clearly welcomed by the markets with the Sensex soaring on Friday to about 1900 points in the intraday on BSE Sensex. With Friday’s announcement, it is fair to say that the government has finally moved from baby steps to radical reforms to help an ailing economy. Nirmala Sitharaman’s bold move on corporate tax cut signals shift from baby steps to radical reform, precisely what the economy needed.

Nirmala Sitharaman’s bold move on corporate tax cut signals shift from baby steps to radical reform, precisely what the economy needed

Advertisement

End of Article

)

)

)

)

)

)

)

)

)