The Indian and his/her love for gold will not change anytime soon. The FM in a misguided belief attributes India’s weak currency and rising current account deficit (CAD) to the Indian’s love for gold.

The FM believes that India’s foreign exchange reserves would have gone up by $10.5 billion if gold imports were to have halved. The FM also believes that India’s CAD and the rupee value will improve if gold imports were to be curbed. Unfortunately, even RBI wants gold imports curbed in order to manage the rupee (INR) better.

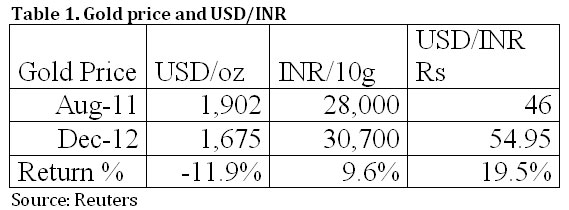

The FM and the RBI could never go more wrong in their understanding of gold. In fact the rise in the price of gold in India is more due to INR depreciation than demand. Table below gives the performance of gold in USD and INR terms from peaks seen in August 2011.

[caption id=“attachment_578789” align=“alignleft” width=“569”]  Gold prices in USD terms are down 11.9 percent since August 2011, reflecting the money moving away from gold[/caption]

Gold prices in USD terms are down 11.9 percent since August 2011, reflecting the money moving away from gold (seen as a safe have asset in times of crisis) to equities. US equities are up 18 percent since August 2011 as worries of market collapse on the eurozone debt crisis ebbed away. In the same period the INR has depreciated by 19.5 percent against the USD on the back of inflation in India that averaged over 9 percent in 2011.

[caption id=“attachment_578781” align=“alignleft” width=“380”]  The rise in the price of gold in India is more due to INR depreciation than demand. Reuters[/caption]

India’s fiscal deficit rose to 5.9 percent in the 2011-12 period from levels of 4.9 percent in 2010-11. The CAD rose from 2.7 percent in 2010-11 to 4.2 percent in 2011-12. Gold prices did not cause the fall in the value of the INR. The rise in inflation, fiscal deficit and current account deficit caused the INR to fall. Lack of governance of the economy caused the rise in inflation, fiscal deficit and current account deficit.

Impact Shorts

More ShortsThe average India’s demand for gold did not cause the rise in gold prices in INR terms. In a globalised world, assuming that the INR was steady against the USD, rising demand for gold in India would normally cause gold prices to rise globally as demand outstrips supply. If India’s demand for gold is met by increased production or by sales of central banks or other major holders of gold, gold prices will stay steady. However, the fact is that the INR was not steady and has depreciated sharply against the USD and this depreciation has led to import prices of gold becoming higher, leading to rising gold prices in INR terms.

The government imposing higher duties on gold imports is only making imports more expensive as the INR is showing no signs of strength against the USD. The government should focus its attention on strengthening the INR to lower domestic prices of gold. Gold demand in India will be met by market forces globally and if investors believe that gold will be a severe underperformer going forward they will sell gladly sell gold to Indians.

The INR is the problem, how to fix it?

The latest CAD data for the second quarter of fiscal 2012-13 is worrying the government and the RBI no end. CAD at 5.4 percent of GDP is highest on record and has forced the government to up its CAD forecast for 2012-13 from 3.5 percent of GDP to 4.2 percent of GDP, which is similar to levels seen in 2011-12. The INR is trading just 5 percent above the lows seen in June 2012, reflecting the high CAD.

The government has to focus on governance for sustained strength in the INR. Increasing debt limits for FIIs and encouraging capital flows is more short term in nature. Long term sustenance of the INR depends on government efforts to tackle inflation, subsidies, and deficits. Curbing gold imports will definitely not help tackle the weak INR in any way. It may only serve to increase speculative activity in gold leading to more headaches for policy makers.

Arjun Parthasarathy is the Editor of www.investorsareidiots.com, a web site for investors.

)

)

)

)

)

)

)

)

)