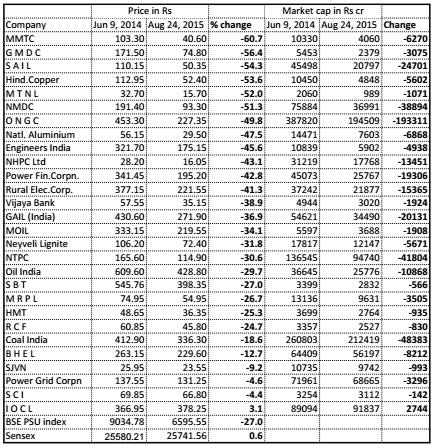

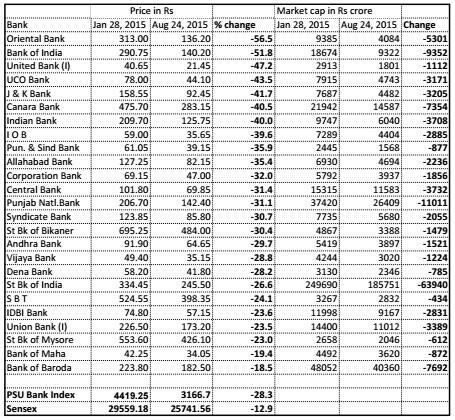

India’s public sector entities — mainly banks that have huge capital requirements over the next few years on account of Basel-III capital norms, provisioning burden on bad loans and funds required for credit expansion — should be the most worried lot about the uncertainty that has gripped the stock markets in a slowing world. A falling stock market and low investor appetite complicate the life for these weak entities since their valuations would remain under pressure. Many mid-sized and small state-run banks have witnessed a sharp drop in their valuations over the last one year. So are several other PSU undertakings (See the tables). This is no good news for these companies since the government wants them to go to the market and raise funds for themselves. [caption id=“attachment_2189989” align=“alignleft” width=“380”]  Reuters[/caption] Take the example of state-run banks. The government estimates a capital requirement of Rs 1.8 lakh crore for public sector banks (PSBs), of which it will infuse Rs 70,000 crore. For the remaining Rs 1.1 lakh crore, the banks have been asked to tap the market. But the question is who would want to invest in them? They as such are marred by poor governance, lack of professionalism and autonomy, high bad loans and poor capital strength. The valuations of almost all of these banks have plunged from their recent peak levels. In fact, the valuations are likely to take a further hit considering their weak asset quality position. Bad loan scenario, in these banks, has worsened in the backdrop of prolonged slowdown in the economy and absence of real recovery on the ground. As Firstpost has noted before , state-run banks haven’t seen the bottom of the bad loan addition, since a substantial chunk of stressed loans remain standard in the SMA-2 category. These accounts are loans, where repayment is overdue over 60 days and can turn bad if the economy doesn’t pick-up. The recently announced package by the government — Indradhanush — which indeed promises several incremental steps to improve the performance of state-run banks in the areas of HR, operations and ownership structure (transferring the stake holding to a separate holding company), doesn’t have a concrete roadmap for recovery of the existing stock of non-performing assets (NPAs).  When panic grips the stock markets, companies with weak fundamentals take the biggest hit. It is imprudent to experiment with the fate of banks since the banking system is the backbone of any economy. If the current situation continues, the failure of a few state-run banks in the next few years cannot be ruled out. If indeed that happens, that can push the panic button in India’s financial system and further erode investor confidence.  This is also true for other weak PSU undertakings such as Air India and several other, which are running huge losses. The government has a massive Rs 70,000 crore disinvestment programme for the current fiscal year, but there has been slow progress. So far, it has raise about Rs 12,500 crore, including yesterday’s IOC offer for sale. Moody’s warning On Tuesday, international rating agency Moody’s said a rating upgrade is possible for India if the government pushes ahead with reforms and strengthen its institutions. This means the world is still looking at India with the hope of emerging stronger through growth-oriented reform measures. As Firstpost noted in an article on Monday (24 August) , India has the fundamental strength to emerge stronger even though the rest of the world is slowing down, provided the government gets its act together. But, if the reform process doesn’t go ahead, this can also undo the progress made so far, which the country cannot clearly afford. Moody’s caution a reversal of perception on India ‘if there is a slowdown in or reversal of the policy reform process; if the banking system metrics continue to weaken, or, if there is a decline in foreign exchange reserves coverage of external debt and imports.’ The Modi government should wake up to face the tough questions on issues plaguing the banking sector and act fast. Incremental changes wouldn’t help much to get the state-run banks out of the current mess. So far, the government hasn’t shown the willingness to undertake radical reforms in the banking sector by bringing down the government’s stake in public banks, which control 70 percent of the industry, below 51 percent and open up these entities to private investments. Until the time it doesn’t happen, the whole idea of bringing in autonomy and professionalism in these banks are unconvincing promises. Typically, one shouldn’t get too worried about stock market fluctuations since the markets are often driven by sentiment and panic than fundamentals. But this time around, there is a genuine concern of a prolonged global slowdown mainly on account of signs of troubles brewing in China, which is the second biggest economy in the world. If the Chinese crisis sustains, one is looking at a longer period of uncertainty in the global stock markets. In that case, the prospects of weaker state-run banks, whose valuations have already dropped significantly, do not look good even with the additional capital infusion of the government. This is where the government should act even before it addresses other large-ticket reforms (GST, land and labour), since weak banks can have immediate impact on the whole economy. In that sense, the current stock market crisis and the prospects of prolonged slowdown in major world economies, should act as a wake–up call to the Modi government to speed up critical reforms. That’s the only way India can safeguard its position in an uncertain world economy. (Data support from Kishor Kadam)

The only way India can safeguard its position in an uncertain world economy is by bringing in meaningful reforms

Advertisement

End of Article

)

)

)

)

)

)

)

)

)