Does theModi era mean that India is at the cusp of a turnaround in financial savings?

According to a report by Deutsche Bank, domestic institutional investors (DIIs) who were record sellers in 2013 are likely to become net buyers in the second half of this year.

Currently equity shareholding of retail investors in BSE 500 companies is at 11 percent, the lowest since March 2001. However, this is likely to reserve as real interest revives. For the past two years, as the Nifty has made higher tops, domestic funds have been on a selling spree while FIIs have been net buyers. The retail investor has largely remained on the fence. But recent data shows a trend reversal is in place.

May 2014 witnessed the first signs of revival in equity allocation with equity MFs receiving Rs 2000 crore - the highest in the past 33 months. Anecdotally, this trend has likely extended into June too. While this has not yet translated into strong MF investment in equities, Deutsche believes it should begin to incrementally fructify, particularly if the budget is pragmatic.

A sharp decline in both domestic and global gold prices, a government committed to inflation control and vibrant equity markets should seed the transition from physicalto financial savings, the brokerage believes.

Here are two reasons why investors are likely to return to the stock markets this year.

1 Gold prices are declining

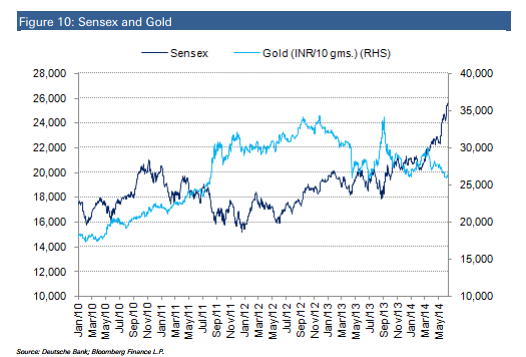

Gold prices in India have declined by 17% from peak, while globally gold prices have declined by 32% since late 2011 peak, implying that domestic prices could fall furthers as the government potentially rolls back gold import restrictions following current account deficit normalisation.

“As the government walks the path of fiscal discipline and redirects expenditure from consumption to investments, we see increasing credibility in market expectations of real interest rates staying positive, galvanizing the shift from physical to financial assets,” Deutsche Bank said in a note.

[caption id=“attachment_88977” align=“aligncenter” width=“526”]  Source: Deutsche Bank[/caption]

The graph above shows that Sensex has performed better than gold in the last three months and the graph below shows that Sensex has given a positive return of 15 percent but the three month return on gold has been a negative 10 percent.

[caption id=“attachment_88979” align=“aligncenter” width=“483”]  Source: Deutsche Bank[/caption]

2. Sensex has performed better than real estate too

[caption id=“attachment_88980” align=“aligncenter” width=“548”]  Source: Deutsche Bank[/caption]

Even the three month return on real estate is negative 2 percent against 9 percent for Sensex.

“We believe that the skew in India’s household savings to physical assets has bottomed and we may see a transition towards more productive financial assets. The latest available data shows some uptick in financial savings rising to 32.4% vs. 31% in FY12,” noted Deutsche.

Recent bold measures by the government on food inflation and railway tariff hikes illustrate its resolve to address the country’s macroeconomic imbalances and make economic recovery the cornerstone of its political strategy, Deutsche Bank said.

)

)

)

)

)

)

)

)

)