The equity markets are flying and it is time to take stock. Which are the companies that returned the most in the last 14 months (from April 1 2013)?

At Firstbiz, we did a little bit of number crunching and the resutls were surprising. Aurobindo Pharma is the stock that rose the most among A-group on the BSE – 292 percent as of 8 May. In the last three trading sessions, the stock has added another 4.22 percent.

The other major stocks are Eicher Motor, which rose about 150 percent, United Phosphorus about 126 percent, Adani Enterprises 120 percent and Bharat Forge about 107 percent.

It is to be noted that among the top five, two are Gujarat-based companies.

Among the B-group stocks, PFL Infotech was the top gainer - about 1529 percent. Swadeshi Industries follows closely with 1155 percent. Vimta Labs comes next with about 680 percent rise, followed by Marksans Pharma and Vaibhav Global, both about 500 percent.

The enthusiasm in the stock market continued and both indices ended on a high note again. The Sensex closed at 23871.23, up 320.23 points or 1.36 percent, and the Nifty at 7,108.75, up 94.50 points or 1.35 percent.

1:20 pm: Dalal Street may be celebrating, but this chart shows who’s feeling left out

Stock markets may be surging, but not everyone is celebrating. Exactly how muchdo ordinary Indians invest in the stock market? The answer: Not much at all.

According to a recent Morgan Stanley report titled “The Next India” dated 12 May, domestic households are significantly “underweight equities”.

In other words, they own very few stocks, directly and indirectly.“They own, directly and via mutual funds and institutions, about $330 billion of stock,” the report notes. In comparison, they have about $1,290 billion in bank fixed deposits and a staggering trillion dollars plus estimated in gold, it adds.

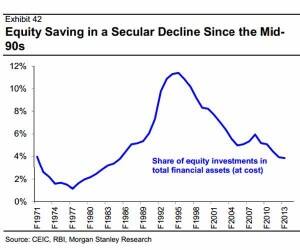

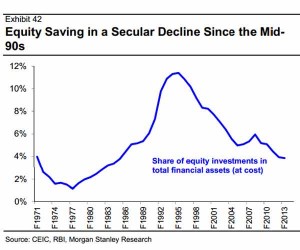

Look at the chart:

[caption id=“attachment_84614” align=“aligncenter” width=“300”]  Morgan Stanley[/caption]

Equities account for less than 6 percent of total financial assets. Assets can be divided into financial assets (stocks, bonds, bank deposits, etc) and physical assets (real estate and gold).

According to Morgan Stanley, there has been a secular decline in equity savings since the early 1990s. That’s a problem for the economy because it limits domestic risk capital formation and increases dependence on global sources of global risk capital.

Indeed, much of the buying in the recent stock market surge is accounted for by foreign investors, who have poured more than $5 billion this year alone. The overwhelming hope is that a BJP-led government will draw up a comprehensive action plan to combat sluggish economic growth.

So, while the Sensex and Nifty may be hitting new highs, the benefits are only felt slightly by households, who have invested minimally in stocks.Modi mania may have gripped the nation, but very few Indians are gaining from the benchmark indices hitting daily life-time highs.

12:18 pm: Nomura sees Sensex hitting 27,200 by year end on hopes of strong govt

The Sensex pierced the 24,000 market to hit a high of 24,067, while the Nifty rose to 7171. There seems to be no stopping this bull run if the exit poll results turn out to be true. Global brokerage Nomura has said that the markets may see a 10 percent up move if the election results come in line with expectation. It has set an year-end target of 27,200 for the index.

Its top picks include Axis Bank, ICICI Bank, SBI, YES Bank, RIL, BPCL, GAIL, Coal India and Adani Port & SEZ.

Of its favourites, Adani Port & SEZ, a Gujarat-based company, has run up on expectations that the company will benefit if Narendra Modi indeed becomes the prime minister.

Investors have remained bullish about other Gujarat companies too. Read a story on this here.

11:20 am: Will BJP form the next government? Here’s what the planets foretell

Investors are feeling incredibly upbeat, even to the point of completely ignoring economic fundamentals, which range from poor economic growth, creaking factory output and elevated inflation.

As Religare notes in a research note, “the Modi wave seems to be for real, with the BJP making inroads across hitherto uncharted areas like Odisha and West Bengal.”

Oh well. Today, it seems is a day of cheering the exit poll results, although most experts speaking on CNBC TV18 seem to turning more circumspect about the prospects of reforms and the list of things the new government will have to do to revive the economy.

The Sensex is currently trading at 23,969, pushing 400 points higher, while the Nifty is about 130 points higher at 7,145. Both indices are creating lifetime highs every minute as they trade, since we are now in totally uncharted territory.

Astrologically speaking as well, it looks like the stars are in favour of the BJP and its allies coming to power. According to a report by Ganeshaspeaks.com, run by Bejan Daruwalla, the “Modi factor” is expected to help the BJP, which is likely to win between 200 and 225 seats. It also notes that Narendra Modi’s chart indicates great possibilities of coming intopower," the report by the astrological company notes.

For more of the predictions, click on this link.

10:30 am: All eyes on 16 May as experts see Modi delivering on economic policies

Political observers seem to be mostly agreeing to the market sentiment that a Narendra Modi-led government will form the next government at the Centre.

“It is quite apparent that NDA is heading for majority,” Shobhna Bhartia, Editorial Director, Hindustan Times, told CNBC-TV18 in an interview. She does not expect any instability even if NDA falls short of 272.

“I see no problem in Modi delivering on economic policies. The first important task for the Modi government will be the budget. The budget will reveal a lot about the new government’s policies,” she said.

She expects the NDA government to appoint sector-specific regulators.

A Motilal Oswal report said decisive mandate would obviate the need for hunt for allies providing much needed stability to the government. This would also pave the way for ushering in enduring reforms a significant positive for the market.

Read more expert views here.

9:45 am:Sensex gallops as Modi wave real; Adani Ports among top gainers

The Indian equity markets opened at life highs riding high as investors pumped in more money after exit poll results pointed to an NDA government formation at the Centre. The benchmark indices hit another record high at the open but retreated later as mild profit booking set in.

At 9:37 am, the Sensex was at 23,819.97, up 268.97 points or 1.14% and the Nifty at 7,082.25, up 68 points or (0.97 percent.

Macquarie Securities told CNBC-TV18 that the BJP-led NDA has very high margin for safety to form the government. the brokerage said the market will now closely monitor cabinet portfolio allocation. It advised investors to look at investing in cyclicals, such as SBI, Axis Bank and L&T, as they are trading at around 50% discount to defensives. It doesn’t see much profit taking in the near term.

The rupee also held the ground as it opened at 59.7 against the dollar.

“The Modi wave seems to be real after all, vote share for the Congress might just be the weakest since 1977, and regional parties do have a role to play, albeit marginal,” Religare Institutional Research said in a report today.

Global cues also helped the Indian equities in their upmove as Asian equities resumed their uptrend. Nikkei was higher on weaker yen South Korean shares also jumped to two-week highs.

Shares of Gujarat-based companies were in focus with Adani Enterprises, Adani Power and Torrent Power rose 2-5 percent.

)

)

)

)

)

)

)

)

)