The S&P BSE Sensex and CNX Nifty hit their respective all-time highs for a second straight day on Tuesday ( 19 August) but close to 90 percent of the actively traded stocks on the exchanges are still trading much lower (between 10 percent and 99.99 percent) below their peaks, with real estate stocks emerging as the worst performers.

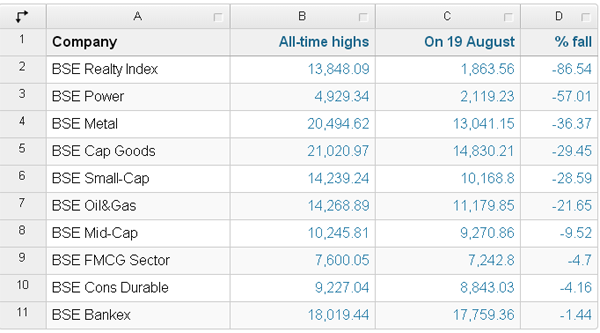

So out of the 3,600 stocks, 3,200 stocks are tradingbelow their all-time high levels .Most of these stocks arefrom the mid- and small-cap categories. The BSE Midcap Index is down by 9.52 percent and the BSE Small-cap by 28.59 percent from their respective record highs reported in January 2008.

[caption id=“attachment_93975” align=“aligncenter” width=“600”]

Source: CapitaLine[/caption]

Source: CapitaLine[/caption]

Among sectoral indices, the BSE Realty index is still lower by a whopping 86.54 percent from its all-time high of 13,848.09 recorded on 8 January 2008.It ended at 1,863.56 on Tuesday. Likewise, the BSE Power Index is 57 percent lower thanits lifetime high posted in January 2008. The other sectoral indices which aretrading well below their all-time highs are theMetal Index (down by 36.37 percent from its all-time high), Capital Goods (down 29.45 percent) and Oil & Gas (down 21.65 percent).

However, indices like, BSE Auto, BSE Healthcare, BSE IT and BSE Tech have hit new highs now.

Of the50 Nifty stocks, 40 are currently below their respective all-time highs recorded earlier.

Delhi based realty major DLF has been the biggest loser on the Nifty as its current share price of Rs 200.20 is a whopping 84 percent lower than itsall-time high of Rs 1,225 recorded on 8 January 2008.

NMDC was the second biggestloser in the Nifty pack . The stock is down69 percent from its record high of Rs 571.8 in January 2010. Third on the list is Bhel, which is down 62 percent from its life high.

The other major companies include Jindal Steel (share price down 62 percent from its peak price), NTPC (down 51 percent), Wipro (down 44 percent), Tata Steel (down 44 percent), Tata Power (down 42 percent), Sesa Sterlite (down 41 percent) and Reliance Industries (down 38 percent).

Meanwhile, the 10 stocks in the Nifty which have hit new life highs are Asian Paints, BPCL, Cipla, HDFC, Hindustan Unilever, Maruti Suzuki, M&M, Sun Pharmaceuticals, Tata Motors and Tech Mahindra.

)