In what could be another indication that the all round feel good feeling now visible in the economy is more sentimental than fundamental, an analysis of the earnings of 155 companies that announced results for April-June has shown that India Inc may not be witnessing any meaningful revival signs just yet.

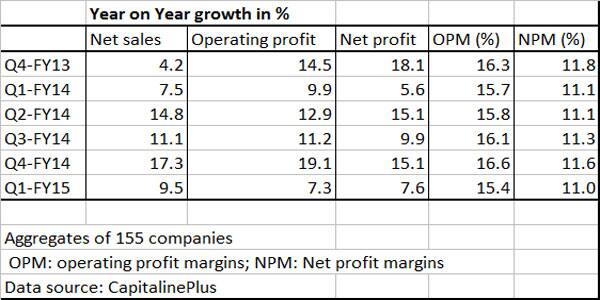

According to the analysis of quarterly results by Firstbiz, the net profit growth of the companies (manufacturing and services companies, excluding banks and NBFCs) has languished at a four-quarter low of 7.6 percent at Rs 23,843 crore during the quarter. This is despite the companies witnessing a lower interest cost and strong growth in the other income.

The interest cost of these firms has come down by 6.7 percent to Rs 2,679 crore in the quarter while their other income surged by 13.8 percent to Rs 6,928 crore.

Their aggregate net sales growth was also a four-quarter low of 9.5 percent at Rs 217,570 crore.

In line with the past five quarters, these companies reported 15 percent margins at operating level and 11 percent at net level.

However, this may not be a reflection of the earning trends of the overall industry since the sample size is too small. The combined market cap of these 155 companies accounted for just 20 percent of the total market cap on the BSE.

Moreover, Reliance Industries, which reported its earnings on 19 July, alone contributed 48 percent in the aggregate net sales and 25 percent in net profit.

The company had seen a 7.3 percent and 13.7 percent rise in net sales and net profit, respectively.

Among the 155 companies that came out with their financial results, information technology led the list with 20 firms, followed by capital goods (14), chemicals (13 firms), auto ancillaries (12), steel (7), pharmaceuticals (5) and consumer durables and entertainment sector four each.

On year-on-year basis, HFCL with a 139.55 percent rise in revenue, topped the list among corporates having net sales of Rs 100 crore and above. Its revenue more than doubled to Rs 619 crore during the period under review from Rs 258 crore in the corresponding quarter previous year.

HFCL is followed by Transcorp International (sales up 73 percent), Vakrangee (69 percent), Reliance Power (56 percent) and J Kumar Infra (51 percent).

The companies that have shown a fall in revenue includes NIIT (sales down 47 percent), NIIT Technologies (39 percent), Reliance Infrastructures (24 percent), Kirloskar Brothers (23 percent) and Oberoi Realty (18 percent).

On the net profit front also HFCL ranked first with a whopping 354 percent jump to Rs 69.47 crore. It was followed by Kokuyo Camlin (net profit up 353 percent), Hitachi Home (202 percent), HIL (184 percent, and Tata Sponge Iron (145 percent).

Cairn India, Indian Metals, Clariant Chemicals, Sasken Communications and Oberoi Realty were among the 41 entities which saw a decline in their net profit.

_Disclosure: Network 18, which publishes Firstpost and Firstbiz, is now part of the Reliance Group

_

)

)

)

)

)

)

)

)

)