India has witnessed some major turbulence on the economic front in the past one year. Despite that, it seems the country continues to remain one of the top destinations for foreign investment. According to a recent Care Ratings report, foreign inflows could increase further after the new government is formed.

The report notes that the general expectation is that the economy will improve in FY15, albeit gradually on the premise that a strong government will be in place after the elections, which will reduce uncertainty in the business environment and focus on reviving growth.

Although foreign inflows have however been prone to fluctuations, the country remains a key destination for foreign investments,both foreign direct investments (FDI) and foreign institutional investments (FII).

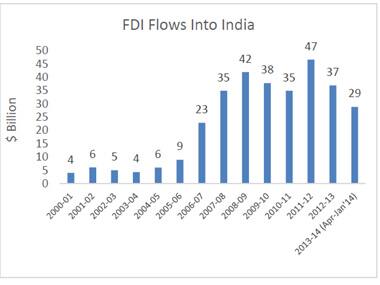

[caption id=“attachment_83812” align=“aligncenter” width=“380”]

Source: Department of Industrial Policy & Promotion (DIPP)[/caption]

Source: Department of Industrial Policy & Promotion (DIPP)[/caption]

The above table shows the level of FDI flows between 2000-2001 and 2013-2014.

The report notes that in terms of FDI, India has seen a steep jump in inflows in the past decade, growing at a compounded annual growth rate (CAGR) of 21 percent. Nevertheless, the year-on-year FDI inflows have been found to be susceptible to variations. After registering record inflows (34 percent growth) in FY12, FY13 saw a significant drop of 21 percent.

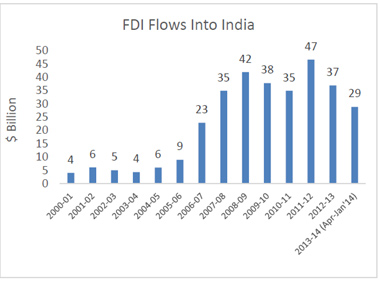

[caption id=“attachment_83813” align=“aligncenter” width=“450”]

Source: Sebi[/caption]

Source: Sebi[/caption]

FII investments, too, have witnessed a sizeable increase over the years. However, the report notes that this segment is prone to regular fluctuations.

FII inflows in emerging market economies, such as India, were severely hit in 2013 following the news of the winding down of the monetary stimulus of the US Federal Reserve and the stronger than expected growth in the US economy, which prompted investors to shift their asset holdings from emerging economies to the US market.

The report predicts moderate capital inflows into emerging economies with the tapering of the US stimulus and economic growth gaining momentum. However, it notes that inflows into India are likely to persist. Why? As per the economists of Care ratings,India, despite witnessing a marked slowdown in its economy is widely regarded as a stable economy among emerging markets with untapped potential. “The recent surge in FII inflows in the run up to the elections bears testimony to this,” it notes.

It also says that a pro-growth government in the centre would further aid the inflow of these funds.

The report expects FDI inflows to increase to around $40-45 billion in FY15 and FII inflows to be around $15-20 billion.

)