For the last five quarters, an unusual pattern has been seen in the results of HDFC Bank.

The bank, once seen as the best annuity scheme among listed stocks, thanks to the management’s ability to squeeze out consistent 30-31 percent net profit growth quarter after quarter, year after year, has seen a clear downward trajectory in the last 15 months.

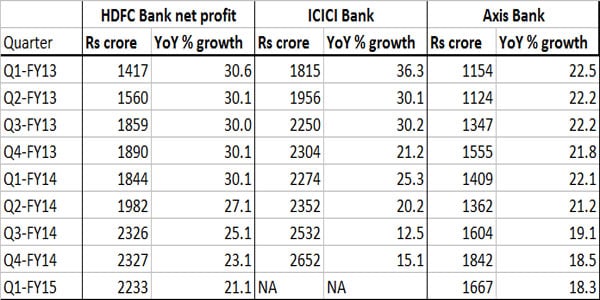

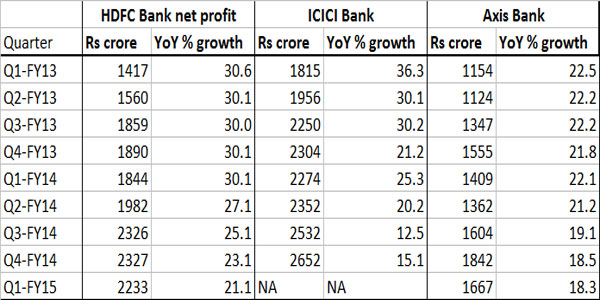

From a net profit growth of 30.1 percent in the first quarter of 2013-14 (April-June 2013), the figures have been heading south to 27.1 percent, 25.1 percent, 23.1 percent and to 21.1 percent in the latest quarter (April-June 2014).

For the last nine quarters, HDFC Bank’s average growth rate comes in at 27.48 percent, against Axis Bank’s 20.86 percent and ICICI Bank’s 23.96 percent (for eight quarters, the latest one being awaited).

Taking the last four rolling quarters, we get an average growth rate of 24 percent for HDFC Bank - about a third higher than Axis Bank’s and ICICI Bank’s 18-19 percent range.

This brings up the question: is HDFC Bank’s metronomic ability to churn out 30-31 percent earnings growth now a distant memory? Has it fallen from the sky to the treetop? And if the answer is yes, is the share overvalued?

Around lunch-time today (23 July), HDFC Bank’s share was quoting at Rs 842, against ICICI Bank’s 1,504 and Axis Bank’s 1997.

At these prices (or thereabouts), the market is valuing HDFC Bank at 4.65 times its book value - against ICICI Bank’s and Axis Bank’s 2.34 percent and 2.49 percent respectively (all figures from Capitaline).

What this means is that the market is valuing HDFC Bank at twice the level it is willing to give its two main private sector rivals with similar strengths. This, when HDFC Bank’s earnings are falling and its average is just about a third better than its rivals.

The reason why HDFC Bank may be getting such valuations could be one of the following:

One, as the first private bank to get its business model right, it has a perception advantage that the others didn’t. It’s like the kind of rating Infosys got before it went into a tailspin and yielded the ‘wow’ factor to TCS and Cognizant. Both ICICI Bank and Axis Bank went through hiccups in their initial phases - the former due to its merger with its long-term lending parent ICICI, and the latter due to an accumulation of bad loans when it was UTI Bank.

Two, punters may still be seeing huge value in a future merger with HDFC. This is now less unthinkable due to the Reserve Bank’s decision to allow long-term deposits to be raised without cash reserve and statutory ratios - something that will benefit HDFC. This was the single biggest deterrent to a merger.

Though both HDFC and HDFC Bank have downplayed the possibility of an early merger, the market clearly believes that this will happen sooner or later.

This is the only major logic for rating HDFC Bank at twice the rate of its two private sector rivals.

The market valuations of HDFC Bank are currently over Rs 2,01,000 crore while that of HDFC is Rs 1,62,000 crore. A big chunk of HDFC’s current value (over Rs 50,000 crore) comes from its 27.15 percent shareholding (excluding depository receipts held abroad) in the bank (22.56 percent including DRs).

A merged bank may unlock value as all the shares held by HDFC in HDFC Bank would by extinguished, or floated into a subsidiary for sale, improving earnings per share. Also, HDFC holds a lot of other investments which would have to be sold off if it were part of a bank. A reverse merger, with the housing company being merged in the bank is also possible.

Over the long term, a merged bank which includes a big housing financier would gain significant cost savings for combined operations.

It is the potential of a future merger with unstated benefits of size, scale, branding and market valuation that is keeping the current prices of both HDFC Bank and HDFC much, much higher than their intrinsic worth.

(Kishor Kadam contributed to this article)

)

)

)

)

)

)

)

)

)