Indian equity markets hit a record high on Monday with the Sensex touching 22,000 in early session and the Nifty holding above 6,500 levels on the back of continued strong foreign buying in blue chips.

Clearly the markets are in a pre-election mode,buoyant with hopes of a stable and reform-oriented government. After all, the beginning of India’s market outperformance coincided with the formalannouncement that Gujarat chief minister Narendra Modi would be the BJP’s prime ministerial candidate, andgathered steam when opinion polls predicted a significantly better showing for theBJP in the general elections.

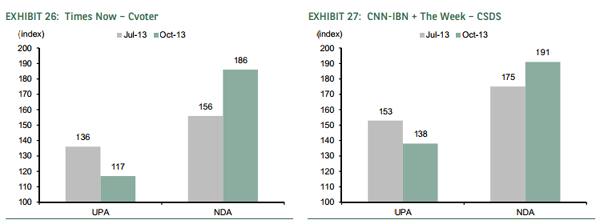

According to Manishi Raychaudhuri of BNP Paribas, part of the reason the Indian market is at all-time high is that opinion polls (most recently the CNN IBN CSDS poll) have forecast the BJP to get as many as 210 seats in the upcoming elections (with the NDA getting close to 230 seats).

[caption id=“attachment_78790” align=“aligncenter” width=“600”]  Chart: BNP[/caption]

Based on its discussions with investors, the brokerage says"the market believes that the more seats the BJP gets, the more able it will be to implement politically-difficult reforms".

However, the brokerage warns that its analysis of the Congress and BJP manifestos shows there is little difference between the parties’ poll promises.

“We find no rationale in the manifestos for assigning ‘pro-growth’ or ‘industry-friendly’ intentions to any one political group. It’s more important, then, to look at the various state governments’ achievements, rather than their stated missions. On that count, the BJP appears more industry friendly and hence the likely favourite of the equity markets,” saidRaychaudhuri.

“In our view, most measures needed to boost investments are ‘bureaucratic’ in nature, not ‘political’, so the number of seats won by the largest political party is less important - provided, of course, a threshold of 180 seats is crossed,” she added.

Such measures includeclearances for coal blocks already allocated,auctioning coal blocks for power projects; awarding portprojects to private developers through competitive bidding; and awarding airportprojects through competitive bidding. Other initiatives, such as awarding nationalhighway projects on an engineering-procurement-construction (EPC) basis or city metroprojects, may involve fiscal costs but are necessary to kick start the investment.

In case of a BJP government at the centre with either a comfortable formation or with a lower seat share and many regional parties, the brokerage is bullish onindustrialbecauseof potential return of corporate confidence in investment.

The brokerage is overweight on IRB Infrastructure and Crompton Greaves in industrials. “IRB’s recent three roadways order wins and clearance for premium rescheduling of new road projects have come as a shot in the arm for the company,” it said.Crompton Greaves, on the other hand, is set to be the biggest beneficiary of rising transmission capex.

The second sector to gain is PSU banks. If the investment cycle improves, asset quality concerns will diminish.

Third, is private banks,particularlythose focused in corporate and infra loans.

Among the financials, BNP has upgraded ICICI Bank and Bank of Baroda to overweight owing to better asset quality, a superior capital ratio and the possibility of much lower capital raising costs than peers.

Fourth is consumerdiscretionary- recovery in corporate confidence will lead to individuals’ confidence about incomes, the brokerage said.

And fifth is the oil and gas sector, due to expectations of a further decline in oil subsidies. BNP hasincreased weight on Reliance Industries and excluded Cairn and Petronet.

)

)

)

)

)

)

)

)

)