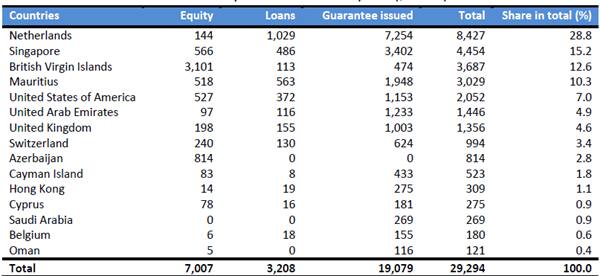

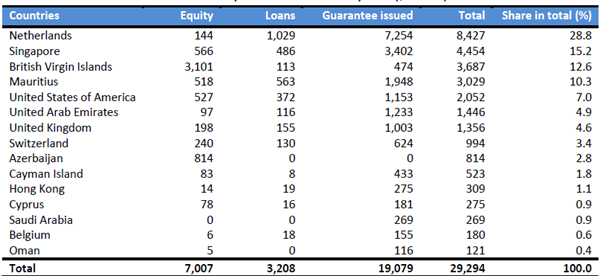

If you thought Indian corporates areincreasingly looking at expanding their global footprint by investing overseas rather than locally, think again. Because the top destinations for Indian overseas investments are not the UK or US, but tax havens such as the Netherlands and Singapore that have attracted most of the outward foreign direct investments from India, with a share of 28.8 percent and 15.2 percent in total investments, respectively, according to a report by Care Ratings.

Netherlands tops India’s outbound FDI list, but that seems like a no-brainer sincemany of the world’s largest multinational companies have been using the Netherlands as a tax haven. These companies ,which include Google, Microsoft, Gazprom and Wal-Mart, take advantage of a number of Dutch tax rules to reduce their tax burdens. What’s surprising, however, is that Singapore has pipped the Biritsh Virgin Islands andMauritius to become the second-most popular destination for Indian investments.

According to this Business Line article, personal income tax rates in Singapore are one of the lowest globally and the GST tax is applicable only when annual turnover exceeds S$1 million. Also, dividends and capital gains earned from foreign subsidiaries/branches aren’t liable for tax in Singapore. There is also no withholding tax on dividend distribution by Singapore companies. But here’s the real kicker: capital gains aren’t taxed, nor is there any inheritance tax. Setting up a business in Singapore is also fairly easy since businessmen just needa single shareholder, one resident director with a local address, and a minimum paid up capital of S$1 within a day or two.

Recently, a London research firm, WealthInsight, also pointed out that as regulations tighten in Europeand the world’s wealth moves to Asia, Singapore is tipped to overtake Switzerland to become the largest global offshore wealth center in terms of assets by 2020.

Followed by the British Virgin Islands and Mauritius, with a share of 10.3 percent and 7 percent respectively, Indian companies invested $3,687 million and $3,029 million, respectively, in these countries, the Care Ratings study showed.

What this essentially means is more than half of India’s foreign investment abroad have been in tax shelters- offshore locations wherecertain taxes are levied at a low rate or not at all. Such locations also providelittle or no financial information to foreign tax authorities.

The biggest advantage of a tax haven is that these countriesoffer a range of taxation levels from which to choose, allow for the creation of offshore entities to increase privacy, and have complex and detailed legislation to protect investors’ assets.

Andorra, the Bahamas, Belize, Bermuda, the British Virgin Islands, the Cayman Islands, the Channel Islands, the Cook Islands, Hong Kong, the Isle of Man, Mauritius, Lichtenstein, Monaco, Panama, Switzerland, St Kitts and Nevis are all considered to be tax havens.Many foreign institutional investors route their investments into India through one of these tax havens, so that the benefits of capital gains as well as dividend taxations are idealised.

[caption id=“attachment_79542” align=“aligncenter” width=“600”]  Country wise FDI Investment by India ($ million) Source: Care Rating[/caption]

The UAE (4.9%), United Kingdom (4.6%) and Switzerland (3.4%) account for less than 5% of investments made by Indians abroad.

India makes lower investments in countries such as Azerbaijan (2.8%), Cayman Islands (1.8%), Hong Kong (1.1%), Cyprus (0.9%), Saudi Arabia (0.9%), Belgium (0.6%) and Oman (0.4%)

The report has pointed out that total FDI investments made by India between April 2013 and January 2014 stood at $29,294 million. Out of the total investments, $19,079 million, or 65 percent, were guarantee issued, i.e. when the parent company guarantees to pay for the loan taken by a subsidiary in an offshore location.

“In terms of flow of dollars out of the country equity and debt would be relevant as a very small proportion of guarantees are invoked which necessitate the flow of dollars. Therefore, the outward investment would be around $ 10.2 bn so far,” clarified Madan Sabnavis, chief economist at Care Rating.

Equity investments and loans stood at $7,007 million and $3,208 million, garnering a share of 23.9 per cent and 11 percent, respectively.

)

)

)

)

)

)

)

)

)