If you leave out the foreign institutional investors (FIIs), the Life Insurance Corporation and a few domestic mutual funds, there is practically no equity market in India. The retail investor has, in fact, been exiting equity at the end of every boom and bust cycle.

There are several reasons why retail investors are missing in equity action. Physical assets have been more reliable, with gold and real estate giving superlative returns with much lower volatility over the last one decade. Moreover, retail investors have to rely on the benevolence of strangers (brokers, advisors) to scan for profitable investment opportunities, unlike in gold or realty.

Thirdly, there are serious governance issues in corporate India and retail investors do not know which management to trust beyond the big index companies. This is what has led to a huge misallocation of capital in the economy towards unproductive sectors like gold and real estate. The repeated attempts by policy makers to channelise savings into equity markets have cut no ice with retail investors.

One of the main issues in corporate governance has been the possibility of overstatement and understatement of profits, depending on what the promoter wants or what suits the current ownership structure. Minority investors have to steer through layers of financial statements to obtain kernels of information on the companies they want to invest in, or to figure out why a stock may be outperforming or underperforming.

Last but not the least, in the absence of a compulsory dividend payout policy, the investor has to depend on the vagaries of the capital market and price trends to make a capital gain - a vital incentive for investment in stocks.

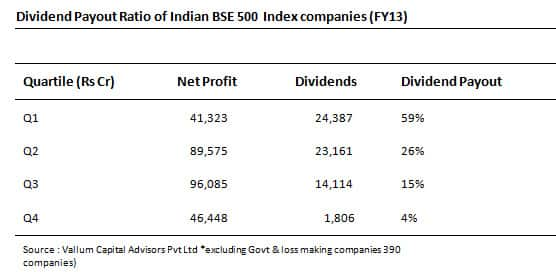

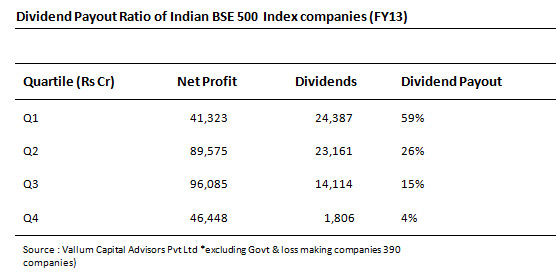

A close look at the constituents of the BSE 500 Index over the past fiscal year (excluding 110 government and loss-making companies), throws up an interesting fact about the dividend policies pursued by India Inc. We have not included government-owned companies as government is a policy maker on taxation related to dividends as well as majority shareholder - which gives us a conflict of interest, but that is another story.

[caption id=“attachment_75148” align=“aligncenter” width=“556”]

Table 1[/caption]

Table 1[/caption]

The study throws up the interesting fact that the average payout is around 23 percent of net profits but this data is skewed by a few companies with very high dividend payouts. On an aggregate, companies accounting for 50 percent of the total profits of the abovementioned universe pay just around 10 percent of profits as dividends while keeping the balance 90 percent at the disposal of the controlling shareholders.

Policymakers in search of a radical outcome in the equity markets need a radical solution to the problem of retail investors staying away. A simple first step would be to make a 25 percent dividend payout ratio compulsory, and this can reinvigorate the equity boom in the country. The compulsory dividend payout is a strong self-fulfilling mechanism which ensures strong enforcement (of accounting standards) and incentivises the promoter to stick to the straight and narrow. It also eliminates India Inc’s preference for debt financing, thereby making it even safer for banks to lend money to companies.

Dividends are also a definitive statement about the ability of managements to achieve profit growth on a sustainable basis.

Brazil has successfully implemented a compulsory dividend policy since 1996, a model that should inspire India. Each country has drawn its inspiration from the uniqueness of the problem it has faced and adopted a system that has suited it best. Recently, the Chinese Security Regulatory Commission (CSRC) has expressed strong opinions about low dividend payouts by listed entities and framed rules for ensuring payouts by both listed companies as well as those making IPOs.

In one of its working papers, the International Monetary Fund has indicated that various governments across the Europe are discussing some form of Allowance for Corporate Equity (a variant of dividend payout) in order to reduce the debt bias in companies - an important cause of the 2008 meltdown in the global financial markets. Our policymakers need to take radical steps to arrest this sustained exit of the Indian retail investor from the markets and make equity attractive to a larger segment of the population to enable sustained wealth creation.

Manish Bhandari is Managing Partner and CEO of Vallum Capital Advisors, a fund management and advisory firm based out of Mumbai. He is reachable at manish.bhandari@vallum.in)

)