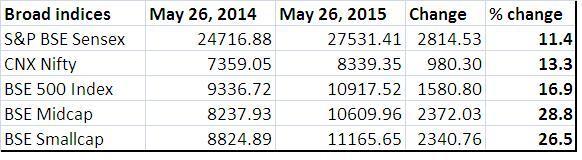

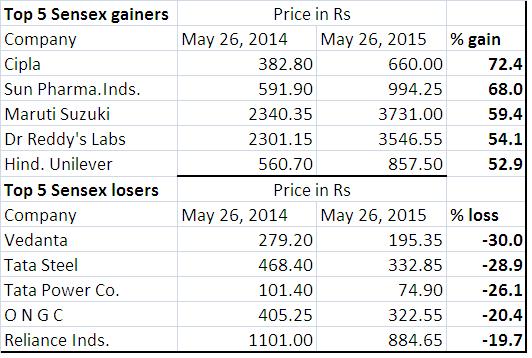

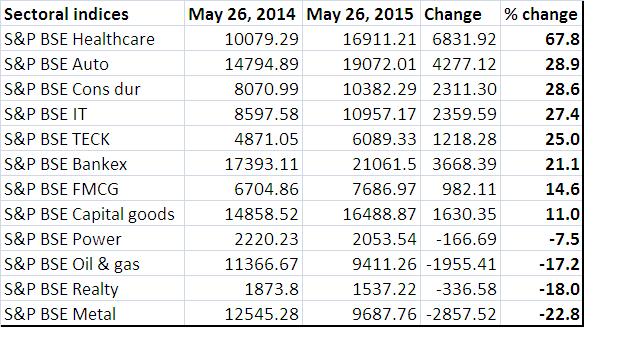

Critics may be baying for his blood but the stock market has kept its faith in prime minister Narendra Modi. At least that is what one would infer from the returns data analysis over the last one year. [caption id=“attachment_2263764” align=“alignleft” width=“380”]  Reuters[/caption] When Modi stormed to power last May, expectations of a revival in the economy boosted the markets. Investors hoped the new dispensation would revive the stalled projects, rein in headline inflation and boost business sentiment. Though a section of the investors have expressed their disillusionment, largely they have kept their faith in the government. A look at how various segments of stock market fared in the past one year shows the 30-share benchmark Sensex rose 11 percent during the period. However, the index is currently trailing after scaling all-time high of 30,024.74 in early March this year. During the period under review, the 50-share S&P CNX Nifty gained 13 percent buoyed by a sharp rally in several frontline stocks. Strong buoyancy in the broad market also resulted in the BSE’s market cap growing by 20 percent to Rs 102 lakh crore from Rs 85.21 lakh crore in last May.  Foreign institutional investors once again entrusted lot of faith in Indian equities and bond market, pumping in a robust $41 billion or Rs 2.52 lakh crore during the period, up about 7 percent from the year-ago period. FIIs infused $15.4 billion or Rs 93,636 crore in equities, while net investment in debt market stood at $26.1 billion or Rs 1.58 lakh crore.  Amid hopes the economic revival going ahead will perk up the performance of smaller companies, the rub-off effect was also seen in other key indices, with BSE mid-cap index surging 29 percent and small-cap index soaring 27 percent. The broader BSE 500 index, too, was up 17%. On the sectoral front, S&P BSE Healthcare index was the biggest gainer in the pack, jumping nearly 68 percent during the period as pick up in domestic merger activities and strong demand in the overseas markets triggered massive rally in most of the pharma stocks. Pharma major Cipla’s share clocked in robust gains, rallying 72 percent to trade at Rs 660 as on date. Another major player Sun Pharmaceutical’s shares soared 68 percent as investors cheered its merger with Ranbaxy Lab. Dr Reddy’s also attracted significant buying interest and shot up 54 percent. Automobile sector also showed a lot of promise in the last one year after reporting de-growth in the last two financial years. However, with demand for four wheelers getting back on the road and interest rates heading southwards, investors lapped up automobile shares with the BSE Auto index rising 29 percent. The sector heavyweight Maruti Suzuki was the star performer with the company’s share surging 59% on the back of improving month-on-month sales.  Consumer durables’ category, too, remained in the thick of action amid improving consumer sentiment with the BSE Consumer Durables’ index rising 29 percent, while the BSE IT index gained 27 percent due to the revenue buoyancy from a weak rupee. Hopes of a revival in the US economy also boosted the sentiment for these shares. However, the last one year failed to generate investor optimism in key sectors such as power, oil & gas, realty and metal. Amid correction in global commodity prices and slackening demand from China, the BSE Metal index was the biggest underperformer, tumbling 23 percent. The BSE Realty index followed with losses of 18 percent amid huge debt, rising inventory and lack of demand in the sector. Similarly, a sharp fall in global crude oil prices weighed on domestic oil & gas index, which fell 17 percent during the period. Data inputs from Kishor Kadam

Foreign institutional investors once again entrusted lot of faith in Indian equities and bond market

Advertisement

End of Article

)

)

)

)

)

)

)

)

)