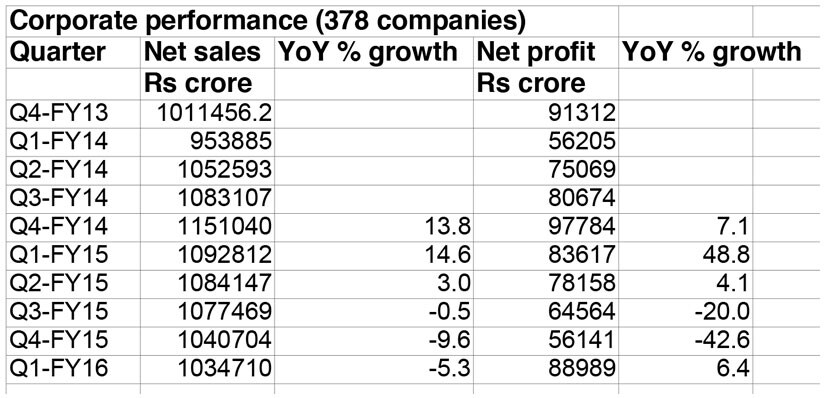

If the NDA government wants to win some brownie points by accelerating India’s economic growth, it needs to work hard on regaining the lost investor confidence. The Narendra Modi government, which has positioned itself as the agent of change, has so far failed to make any meaningful progress in pulling off large-ticket reforms. The Monsoon Session washout in Parliament proves that Congress’ political ploy has worked well to stall the function of the house and let the government progress with its reform-agenda. The challenge lies with Modi to find a way around. For now, the uncertainty over the fate of key reform legislations (pertaining to land, labor and tax) and the absence radical reforms in the country’s banking sector have acted as a major turn off to investors looking at India as an opportunity.[caption id=“attachment_2345602” align=“alignleft” width=“380”]  Prime Minister Narendra Modi. Reuters[/caption] On Friday, the finance ministry announced a slew of measures to revive the public sector banks (PSBs), which included creation of a Bank Board Bureau (BBB), linking compensation of top management to performance, improving governance standards, focus on quality of business than quantity of business and fresh additional capital infusion within one month. These announcements are welcome but incremental steps of what has been announced in the past, not big bang reforms that can transform the state-run banks. The government clearly doesn’t want to cut the majority stake in state-run banks and let them operate as independent entities in true sense. It wants consolidation among state-run banks, but does not have a roadmap. Waning confidence Stock markets, which were riding on the Modi-wave last year when BJP came to power with clear majority, has somewhat lost momentum. Sensex has fallen about 8 percent from its peak of 30,024.74 registered in March, 2015. Corporate earnings continue to be muted, fresh investments are yet to happen and government has failed to steer the banking sector out of the current, deep mess. Business confidence in the government has clearly faded. “We had an emperor on 27th of May 2014. Very few places in the world in the last 20-30 years (have) a success like that in the history of a nation. I am not anti this government. But the fact does remain, the shine seems to be wearing off,” said industrialist and Rajya Sabha MP, Rahul Bajaj in an interview to NDTV a week back. Bajaj, who used to be a Modi admirer in the beginning, isn’t the only one who has raised criticism on the government for not walking the talk. In February this year, HDFC chairman, Deepak Parekh too had mounted criticism on Modi saying nothing has changed on the ground after the new government has taken over. “After nine months, there is a little bit of impatience creeping in as to why no changes are happening and why this is taking so long having effect on the ground,” Parekh said in an interview to PTI. The ease of doing business—something Modi has highlighted as a major priority in his agenda—is still eludes, thanks to the bureaucratic maze. International observers have begun turning impatient. In July, Moody’s Investors services warned of disappointment creeping in on the slow-paced reforms undertaken by the Modi government. After the initial progress made on small reform steps (insurance and coal bills), high-priority items such as land acquisition reforms and bringing clarity on tax-front still remain in the to-do list. The government should have gone ahead with the disinvestment plan quite early, when the markets were ripe and investor appetite was adequate. But, the government waited till December to go for the fist issue of SAIL (Rs 1,700 crore) and followed up this year with more including Coal India (Rs 22,600), Power Finance Corporation (Rs 1,600 crore) and Rural Electrification Corporation (Rs 1,555 crore). It plans to sell 10 per cent stake again in Coal India to raise about Rs 23,000 crore. One has to wait and see whether the market will have appetite for the remaining issues. The bitter fact is that Modi government at the Centre hasn’t changed the life of industries in India so far. A Firstpost analysis of the performance of 378 companies (excluding banking and finance companies) in the April-June quarter shows continuation of dismal performance.  The net profit of these firms grew by 6.4 percent in the June quarter as compared with 48.8 percent in the year-ago quarter. The net sales of these firms contracted by 5.3 percent as compared with a growth of 14.6 percent in the corresponding quarter last year. The performance of infrastructure firms has not been encouraging as well.  Though, there are some indications of total number of stalled projects declining. But, as _Firstpost_ explained in an earlier article , the decline in the number of stalled projects has to be seen in proportion to the total scrapped projects. The more worrying part is that fresh investments haven’t picked up yet from private sector. Inability of the companies to pay back loans has spiked the bad loans and restructured loans on banks’ books, which together constitute over 11 percent of the total bank loans. This, in turn, adds to the capital requirement of banks. Unless the corporate performance improves, slippages would continue on banks’ balance sheets. There aren’t many admirers for Modi government’s economic policies. The majority at the Centre and the Modi-brand image have taken a beating due to its economic policies, contributing to the slow economic progress despite favorable global (low oil and commodity prices and China’s slowdown) and domestic factors (low inflation, falling interest rate regime and booming stock markets). The NDA government has constantly shied away from radical reforms in the banking sector. The onus of promoting financial inclusion and social welfare lie with these banks, while private sector banks largely stay away. At the same time, the government insists on better business performance from PSBs. The government should understand that unless the rules applied are same to all, there won’t be any level-playing field. Secondly, the BJP government’s confrontations with the RBI in the areas of monetary policy and debt management didn’t go down well with the international investors. When the revised draft of the Indian Financial Code proposed to undermine RBI’s power in monetary policy, government received criticism from all quarters. Moody’s cautioned that tampering with the RBI’s independence would hurt India’s economic prospects since an MPC controlled by the government will have lower credibility and politics would drive decisions. Third, the government hasn’t shown the courage to initiate radical reforms in the financial sector, especially on the privatization of government-controlled entities. Modi’s own earlier stance that government shouldn’t be in the business of running business wasn’t practiced in reality. The government continues be in business. The big example is the banking sector, where it controls 70 percent of the market. This hardly indicates a progressive reform step. Even on Friday’s package, the reluctance of the government to bring down its stake below 52 percent was evident. The bottomline is this: The BJP government has to acknowledge that investors are skeptical today about the ability of government to pull off large ticket reforms. Rahul Bajaj is just one among the many who feel so. Modi’s biggest challenge today is to revive that lost investor confidence. This can be achieved only by radical reforms in sectors such as banking, not through baby steps. (Kishor Kadam contributed to this story)

The bitter fact is that Modi government at the Centre hasn’t changed the life of industries in India so far.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)