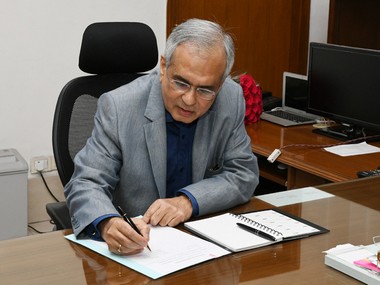

New Delhi: NITI Aayog Vice Chairman Rajiv Kumar on Wednesday said the middle class is “trained enough” to decide which personal income tax option is good for them and exuded confidence that their propensity to save will not come down. Kumar was commenting on the Budget proposal of finance minister Nirmala Sitharaman to give option to personal income tax payers to remain in existing tax scheme with exemptions and deductions or opt for new simplified tax regime with lower tax rates but without exemptions and deductions. “This is a recognition that the middle class especially the taxpayers are now trained enough to know what is good for them. “You give her additional income in her pocket and let her decide, how much they want to save rather than link savings and make it in some sense compulsory,” he told PTI. Industry experts, however, said that two tax regimes with optionality for personal tax, as in the case of corporate taxes, only make the structure more complicated. [caption id=“attachment_4447733” align=“alignleft” width=“380”] File image of Rajiv Kumar, Vice-Chairman of NITI Aayog. PIB image[/caption] “Let them decide according to their situation… My view is that middle class’ saving propensity won’t come down,” Kumar asserted. As an economist, Kumar said he was thrilled about this simplification of the process. However, eminent economist and National Institute of Public Finance and Policy (NIPFP) professor Ila Patnaik believes that households are generally short sighted and do not save adequately for old age. “This is one reason for governments to be paternalistic and nudge people towards saving for pension and old age. This was one rationale for tax exemption like 80C. The new system reduces these incentives,” she opined. Patnaik said for infrastructure investment, India needs long term savings, not just from abroad, but also domestic savings. “These were also linked to tax exemptions. In a study on the subject my colleagues and I found that households respond to tax incentives and save in instruments that give them benefits. These will also be impacted,” she noted. According to latest data, over the past six years, India’s savings rate has been considerably declining. At the height of India’s growth phase in 2012, the overall saving rate was around 36 per cent but it is now down to 30 per cent. Talking about the ‘Vivad Se Vishwas Scheme’, Kumar said the aim of the latest measure is to reduce litigation and see finalisation of 4.83 lakh stuck cases in appellate forums under the direct taxes category. Under the scheme, a taxpayer would be required to pay only the amount of the disputed tax and will get complete waiver of interest and penalty provided they pay by March 31, 2020. A similar scheme, ‘Sabka Vishwas’, for cases stuck in litigation under the indirect taxes category, was brought by the government in the last Budget. Asked whether government’s record Rs 2.10 lakh crore disinvestment target for the next fiscal is too ambitious, Kumar said this (2020-21) disinvestment target is not an unachievable target at all. “But this ambitious target also reflects the Prime Minister’s view that we are going to create more space for the private sector… he asserted.

NITI Aayog Vice Chairman Rajiv Kumar on Wednesday said the middle class is “trained enough” to decide which personal income tax option is good for them and exuded confidence that their propensity to save will not come down

Advertisement

End of Article

)

)

)

)

)

)

)

)

)