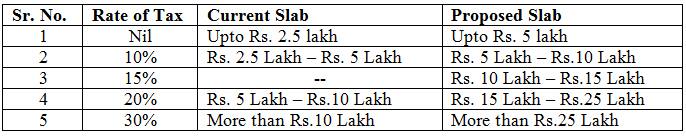

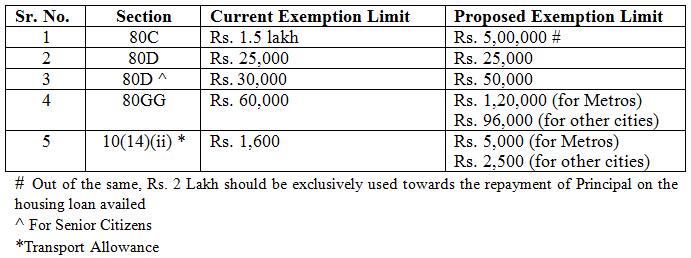

The Union Budget 2017 comes at a time when the economy is at the inflexion point. The Fiscal Deficit at 3.5% of Gross Domestic Product (GDP) is comfortable and the inflation rate is expectedly below 5%. The growth in the economy as well as in the industry however has not picked up to the expectations. Serious measures need to be undertaken, primarily as part of the Budget proposals, to move the economy over 7.5% of GDP for 2017-18 and beyond 8% p.a. in the following years. Additionally, the Goods and Services Tax (GST) may be finally a reality in 2017-18, and the tax measures especially indirect tax proposals therefore have to be in a rationalization mode with the GST in this Budget.  While ordinarily it may be difficult to evaluate, that out of every Rs. 100 earned by an individual in India, almost Rs. 55 to Rs. 60 is being paid to the exchequer as taxes, both direct and indirect, after the inclusion of all possible rebates, deductions, etc. depending on the income bracket and consumption pattern of the individual. In principle, it would not be wrong to say that one should adopt the One-Third (1/3) Rule in one’s personal finance, i.e. as a thumb rule, the proportion of net income utilization should be 1/3rd towards savings and investment, 1/3rd towards spending and no more than 1/3rd towards meeting the debt obligations (including housing loans). Such a balance will help to ensure that we have enough resources at all times to be in a financially sound condition to meet our life’s financial goals, timely repay our debts/Equated Monthly Installments (EMIs) and meet any contingency within the defined periphery of our Financial Plans. We understand that it may be difficult at the beginning of one’s career, however, during one’s career progression, one should aspire to achieve the above balance on a long term basis. The One-Third (1/3) Rule Model and process helps us to maintain the economic affairs of the household in order from the perspective of Financial Planning, which is aptly defined as “a convergent and holistic approach towards meeting one’s life goals through multiple array of products across different asset classes”. Accordingly, rather than offering individual benefits merely as reliefs, this Budget may seize the opportunity to help facilitate a consolidated and convergent approach for the benefit and Well Being of individual, household and families. Keeping the above aspects in perspective, the following Eleven (11) Point Agenda may be considered for the Budget: 1. The income-tax slabs may be revised as under for the taxable income:  2. Exemptions under various sections of the Income-tax Act, 1961 to be enhanced as given below:  # Out of the same, Rs. 2 Lakh should be exclusively used towards the repayment of Principal on the housing loan availed ^ For Senior Citizens *Transport Allowance 3. Under Section 80TTA, the deduction of Rs. 10,000 available on Savings Bank account interest should also be available on interest income from term deposits, viz. fixed deposits or recurring deposits of banks and on the interest income from corporate bonds. 4. Leave Travel Allowance (LTA) may be exempted for international travel also. 5. The limit of exemption from customs duty on the goods brought from abroad should be raised, viz. Rs. 35,000 exemption currently should be enhanced to Rs. 50,000. Additionally, there should not be any customs duty on smart phones which would help in promoting the environment for cash less transactions. 6. In cases where the Value Added Tax (VAT) is collected, especially in dining in Air Conditioned restaurants, the Service Tax should not be levied. 7. The limit for the payment of estimated tax (advance tax) during the year should be modified to Rs. 50,000 from Rs. 10,000. 8. The Business Income should be allowed to be adjusted against all income including salary income (except Other Income). 9. Income Tax exemption should be introduced on premiums paid for home insurance even for cases where home loan is not taken. Presently term plans of life insurance policies meant to cover the amount of home loan have deduction under Section 80C within the overall limit. 10. The duration considered for long term capital gains on the income schemes of mutual funds should be reverted to one year. 11. The tax parity should be considered amongst pension schemes such as National Pension System (NPS), Employees’ Provident Fund (EPF) and the Public Provident Fund (PPF). The above recommendations are proposed keeping in view personal finance perspective which would lead individuals to help plan their life goals accordingly. We expect such measures from the Budget would give money in the hands of the public in due course, both to save/invest as well as to cumulatively spend for the nation’s economic growth. It is expected that the trend in digital economy after the demonetization is expected to bring in more transparency and higher circulation of money in the formal system, including banking. It is opined that notwithstanding the reliefs and benefits being extended by virtue of the above said proposals, the tax to GDP ratio is expected to increase from the current 16.6%. It may be note that the average Tax/GDP ratio of the emerging markets is 21% and for the countries under the Organization of Economic Cooperation and Development (OECD), the same is 34% (source: The Economic Survey 2015-16). India may pursue the same as a milestone. It is expected that the above proposals may give a strong impetus to the industry and the economy to grow at higher rates not seen in the last one decade. Also, the rationalization of taxes at the level of personal finance would help in the households in saving a higher percentage of their income and investing the same suitably to achieve their financial goals. Lastly, an earnest attempt should be made so that we move to an era where the tax collection should be by virtue of indirect taxes only, thus progressively keeping the direct taxes to a minimum, preferably under a single slab. The writer is working with Financial Planning Standards Board India (FPSB India) in the capacity of Vice Chairman and Chief Executive Officer. The views expressed here are personal, and do not necessarily represent that of the organization. FPSB India is the sole marks licensing authority for the CFP marks in India, through agreement with US-based FPSB Ltd.

It is expected that the trend in digital economy after the demonetization is expected to bring in more transparency and higher circulation of money in the formal system, including banking.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)