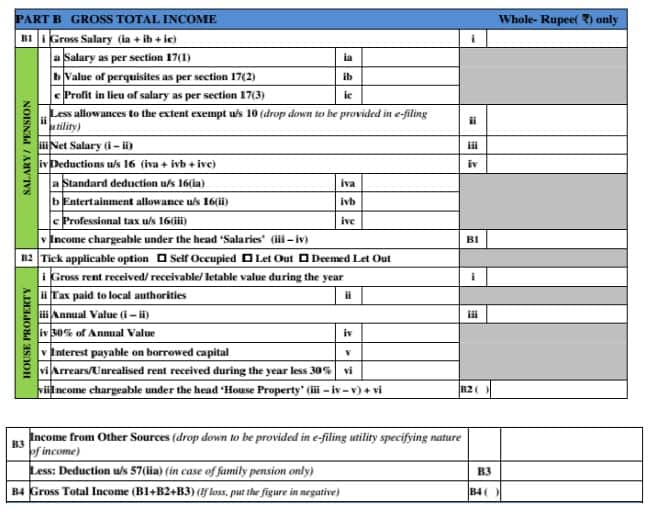

The government on Tuesday extended the due date for filing income tax returns by individuals for financial year 2018-19 by a month till 31 August. If you are a salaried employee, you will have to file your Income Tax Returns (ITR). The new last date for filing your ITR is 31 August, 2019. ITR 1 is filed by individuals having a total income of up to Rs 50 lakh, having income from salaries, one house property, other sources (like interest), and agricultural income up to Rs 5,000. This Return Form is applicable for the assessment year 2019-20 only, i.e., it relates to income earned during the Financial Year 2018-19. Aadhaar card mandatory for tax filing The Income Tax Department has made it mandatory for all taxpayers to link the Aadhaar card with PAN on the Income Tax Department website. Your employer would have issued the Form 16 (It is a certificate issued by an employer which has all the details of how much tax the employer has deducted from the salary of the employee and when it was submitted to the Income Tax Department) by 15 June. The ITR 1 form has been simplified this year, making it easier for salaried employees to e-File returns. Changes in ITR1 for the AY 2019-20 ITR 1 form for FY 2018-19 is not applicable to an individual who is either a director of a company or has invested in unlisted equity shares, said Archit Gupta, Founder and CEO, Cleartax. Under Part A, ‘Pensioners’ checkbox has been introduced under the ‘Nature of employment’ section. Return filed under section has been segregated between normal filing and filed in response to notices. Deductions under salary will be bifurcated into standard deduction, entertainment allowance and professional tax. [caption id=“attachment_7023271” align=“alignleft” width=“380”]  Representational image. Reuters.[/caption] The taxpayers will be required to provide income-wise detailed information under the ‘Income from other sources’. A separate column is introduced under ‘Income from other sources’ for deduction u/s 57(iia) – in case of family pension income. ‘Deemed to be let out property’ option now available under ‘Income from house property’. Section 80TTB column has been included for senior citizens. Who is eligible to file ITR-1 for AY 2019-20 ITR 1 Form is a simplified one-page form for individuals having income up to Rs 50 lakh from the following sources: (a) Income from Salary/ Pension; or (b) Income from One House Property (excluding cases where loss is brought forward from previous years); or (c) Income from Other Sources (excluding winning from Lottery and Income from Race Horses), In the case of clubbed Income Tax Returns, where a spouse or a minor is included, this can be done only if their income is limited to the above specifications.

| Income Tax slabs for FY 2018-19 |

|---|

| Men & women aged under 60 years |

| Rs 250000 |

| Rs 250001 to Rs 500000 |

| Rs 500001 to Rs 1000000 |

| Above Rs 1000001 |

| Senior citizens aged 60 years-79 years |

| Rs 300000 |

| Rs 300001 to Rs 500000 |

| Rs 500001 to Rs 1000000 |

| Above Rs 1000001 |

| Very senior citizens aged 80 years & above |

| Rs 500000 |

| Rs 500001 to Rs 1000000 |

| Above Rs 1000001 |

| Education and healthcare cess |

Who is not eligible to file ITR 1 for AY 2019-20 A. This Return Form should not be used by an individual who (a) is a Director in a company, (b) has held any unlisted equity shares at any time during the previous year, (c) has any asset (including financial interest in any entity) located outside India, (d) has signing authority in any account located outside India; or (e) has income from any source outside India. B. This return form also cannot be used by an individual who has any income of the following nature during the previous year: (a) Profits and gains from business and professions, (b) Capital gains, (c) Income from more than one house property; (d) Income under the head other sources which is of following nature:- (i) winnings from lottery; (ii) activity of owning and maintaining race horses; (iii) income taxable at special rates under section 115BBDA or section 115BBE; (e) income to be apportioned in accordance with provisions of section 5A; or (f) agricultural income in excess of ₹5,000. C. Further, this return form also cannot be used by an individual who has any claims of loss/deductions/relief/tax credit etc. of the following nature:- (a) any brought forward loss or loss to be carried forward under the head ‘Income from house property’; (b) loss under the head ‘Income from other sources‘; (c) any claim of relief under section 90 and/or section 91; (d) any claim of deduction under section 57, other than deduction under clause (iia) thereof (relating to family pension); or (e) any claim of credit of tax deducted at source in the hands of any other person What is the structure of ITR 1 Form? Part A: General Information Part B: Gross total Income

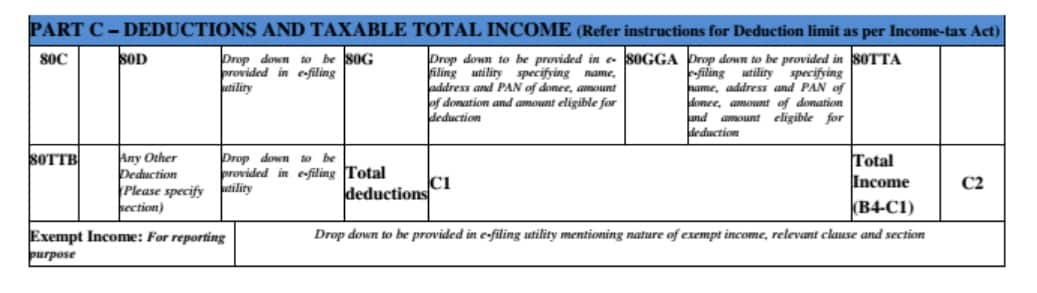

Part C : Deductions and taxable total income

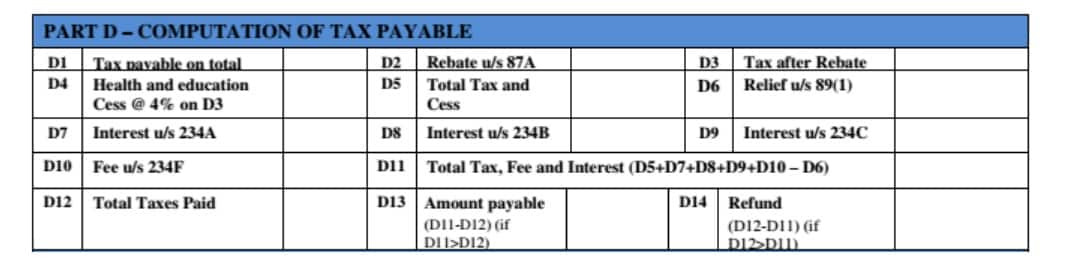

Part C : Deductions and taxable total income  Part D: Computation of Tax Payable

Part D: Computation of Tax Payable  Part E : Other Information

Schedule IT : Detail of Advance Tax and Self Assessment Tax payments

Part E : Other Information

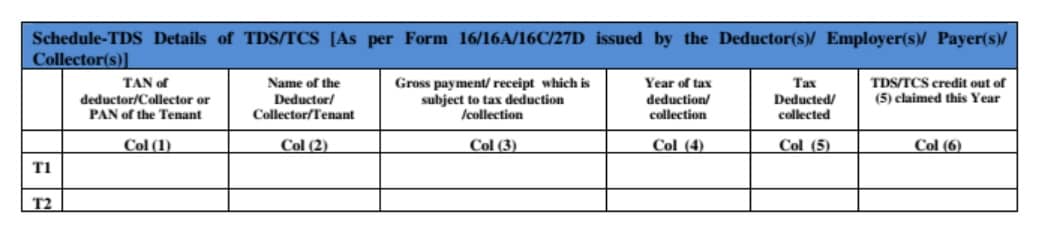

Schedule IT : Detail of Advance Tax and Self Assessment Tax payments Schedule TDS: Detail of TDS/TCS

Verification

Documents required for filing ITR a) PAN b) Aadhaar c) Bank account details d) Form 16 (It is a certificate issued by an employer which has all the details of how much tax the employer deducted from the salary of the employee and when it was submitted to the Income Tax Department) e) Investments details How to file ITR 1) Login with all the documents required for ITR in the Income Tax Department

website 2) Enter your personal information 3) Enter your salary details 4) Enter details for claiming deduction 5) Enter details of taxes paid 6) e-File your ITR 7) E-Verify FAQs I earn income over Rs 50 lakhs. Which ITR form should I file this year? If you have income above Rs 50 lakhs, you can file ITR 2, ITR 3 or ITR 4 (Sugam) depending upon your source of income. If you are a salaried individual having income above Rs 50 lakhs, you should file ITR 2. And if you are having income from business or profession, then you should file ITR 3. In case you are following presumptive income u/s 44AD /44AE, then you should file ITR 4 (Sugam). Do I need to report exempt LTCG in ITR-1? You need to report exempt LTCG in ITR 1 provided it is exempt under Section 10(38). If you have taxable LTCG, you may use the other forms as applicable. Also it is mandatory to e file tax returns for those whose LTCG exceeds Rs 2.5 lakhs even if your income is below taxable limit. Can I file ITR-1 with exempt agricultural income? Yes, you can if the agricultural income does not exceed Rs 5000.And If the agricultural income is more than Rs 5000, then you should file ITR 2. How to report bank accounts in ITR-1? The details of all the savings and current accounts held at any time during the previous year must be provided. However, it is not mandatory to provide details of dormant accounts which are not operational for more than 3 years. The account number should be as per Core Banking Solution (CBS) system of the bank. It is to be provided in the Part E – other information of the ITR form. Do I need to include dividend income from mutual funds? Yes. Dividend income from mutual funds is exempt under sec 10(35). It is to shown in Part D under the head Exempt Income (others)

)

)

)

)

)

)

)

)

)