Shareholders of Reliance Communication (RCom) must be sighing a heave of relief as the company is in the final steps of signing a deal with private equity investors- Blackstone and Carlyle Group.

According to Business Standard, RCom is looking at selling up to a 95 percent stake in Reliance Infratel, which owns nearly 50,000 towers. “Reliance communications, which controls Infratel, owns nearly 50,000 towers across the country and the valuation of the deal has been pegged at Rs 15,000 - Rs 20,000 crore” said the article .

Such an amount should help the company in repaying its king-size debt of around Rs 35,000 crore. “With the two deals, RCom should be able to wipe out Rs 22,500 - Rs 27,500 crore of leverage from its books” , it added.

While RCom is expected to get Rs31-41 lakh a tower, it is substantially lower than the Rs 1.2 crore the company got by selling a five percent stake to sundry investors in 2007. However, many experts consider this price to be reasonable due to the problems like overcapacity of towers plaguing the industry.

While RCom is expected to get Rs31-41 lakh a tower, it is substantially lower than the Rs 1.2 crore the company got by selling a five percent stake to sundry investors in 2007. However, many experts consider this price to be reasonable due to the problems like overcapacity of towers plaguing the industry.

In a bid to reduce its debt, the company is also exploring the possibilities of a Singapore listing for its company Flag Telecom, which owns 65,000 kms of submarine cable assets across the world. As per Reuters , RCom has roped in two more banks - Standard Chartered and DBS Group Holdings (Deutsche Banks was appointed earlier) for its upcoming $1 billion IPO, in what could be the biggest stock listing in Singapore this year.

Impact Shorts

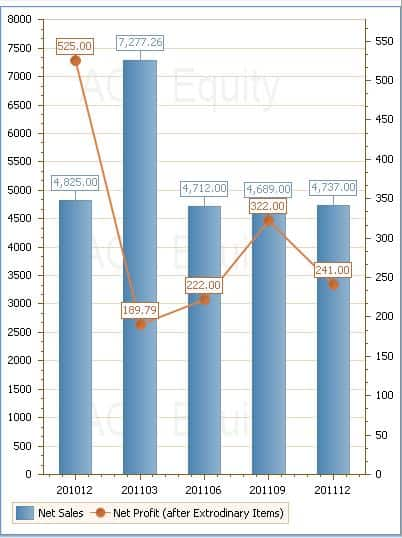

More ShortsFor the December 2011 quarter, it reported a 61 percent fall in net profit to Rs 186 crore compared to Rs 480 crore in the year-ago quarter. Citi has a buy rating on the company with a price target of Rs 117 per share compared to its current price of Rs106.

)