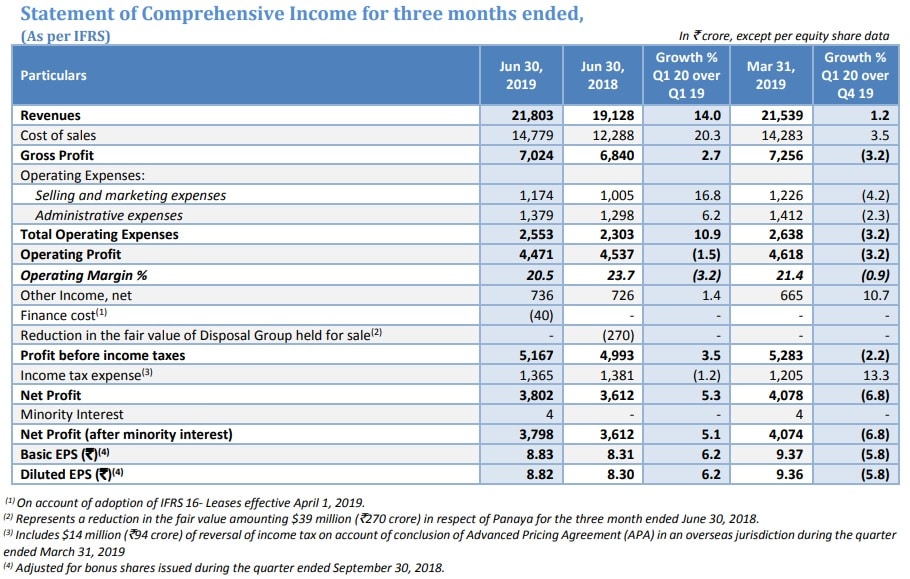

Infosys Ltd beat estimates for June-quarter profit and raised revenue forecast for the fiscal year, as India’s second largest IT services firm bagged more business from its dominant North American and European markets. Infosys on Friday reported 5.2 percent growth in consolidated net profit to Rs 3,802 crore for the quarter ended 30 June 2019, said a PTI report. [caption id=“attachment_4299991” align=“alignleft” width=“380”] Representational image. Reuters.[/caption] It had posted a net profit of Rs 3,612 crore in the April-June 2018 quarter, Infosys said in a BSE filing. The company and its rivals such as Tata Consultancy Services in the $150 billion Indian software services industry rely heavily on revenue from their clients in the West, reported Reuters. A slowdown in both the US and the European economies due to concerns over events such as Brexit and the trade tussle between Washington and China has hurt margins of Indian software services exporters. Revenue from operations of the Bengaluru-based firm grew 13.9 percent to Rs 21,803 crore in the June 2019 quarter, as compared to Rs 19,128 crore in the year-ago period, it added. Infosys has increased its revenue growth guidance for FY20 to 8.5-10 percent in constant currency. In April quarter, Infosys had said it expects revenue growth of 7.5-9.5 percent in FY 2019-20. “We had a strong start to FY'20 with constant currency growth accelerating to 12.4 percent on year over year basis and digital revenue growth of 41.9 percent. This was achieved through our consistent client focus and investments which have strengthened our client relationships,” Infosys CEO and Managing Director Salil Parekh said. He added that the company has consequently raised its revenue guidance for the year from 7.5-9.5 percent to 8.5-10 percent. [caption id=“attachment_6983351” align=“aligncenter” width=“910”]

Source: Infosys[/caption] In US dollars terms, Infosys net profit grew to $546 million in the June quarter from $534 million in the year-ago period, while revenues rose to $3.13 billion as against $2.83 billion. The company noted that its current policy entails paying up to 70 percent of the free cash flow annually by way of dividend and/or buyback. The board has reviewed and approved a revised capital allocation policy after taking into consideration the strategic and operational cash requirements, it said. “Effective from financial year 2020, the company expects to return approximately 85 percent of the free cash flow cumulatively over a five-year period through a combination of semi-annual dividends and/or share buyback and/or special dividends, subject to applicable laws and requisite approvals, if any,” it added. The results were announced after the market hours. Infosys shares closed marginally higher at Rs 727.10 apiece on BSE. — With agencies inputs

Source: Infosys[/caption] In US dollars terms, Infosys net profit grew to $546 million in the June quarter from $534 million in the year-ago period, while revenues rose to $3.13 billion as against $2.83 billion. The company noted that its current policy entails paying up to 70 percent of the free cash flow annually by way of dividend and/or buyback. The board has reviewed and approved a revised capital allocation policy after taking into consideration the strategic and operational cash requirements, it said. “Effective from financial year 2020, the company expects to return approximately 85 percent of the free cash flow cumulatively over a five-year period through a combination of semi-annual dividends and/or share buyback and/or special dividends, subject to applicable laws and requisite approvals, if any,” it added. The results were announced after the market hours. Infosys shares closed marginally higher at Rs 727.10 apiece on BSE. — With agencies inputs

Infosys has increased its revenue growth guidance for FY20 to 8.5-10 percent in constant currency.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)