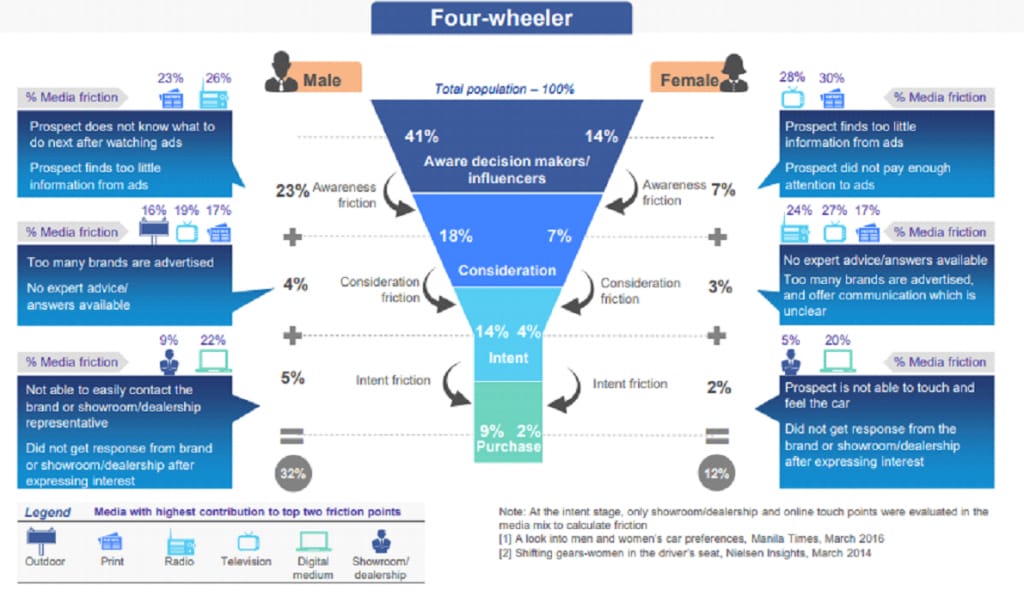

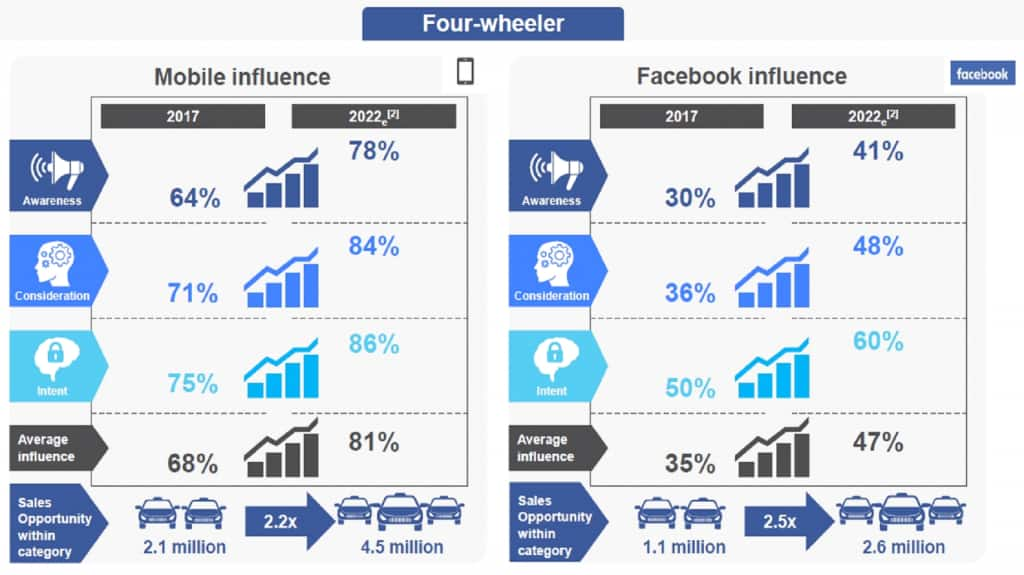

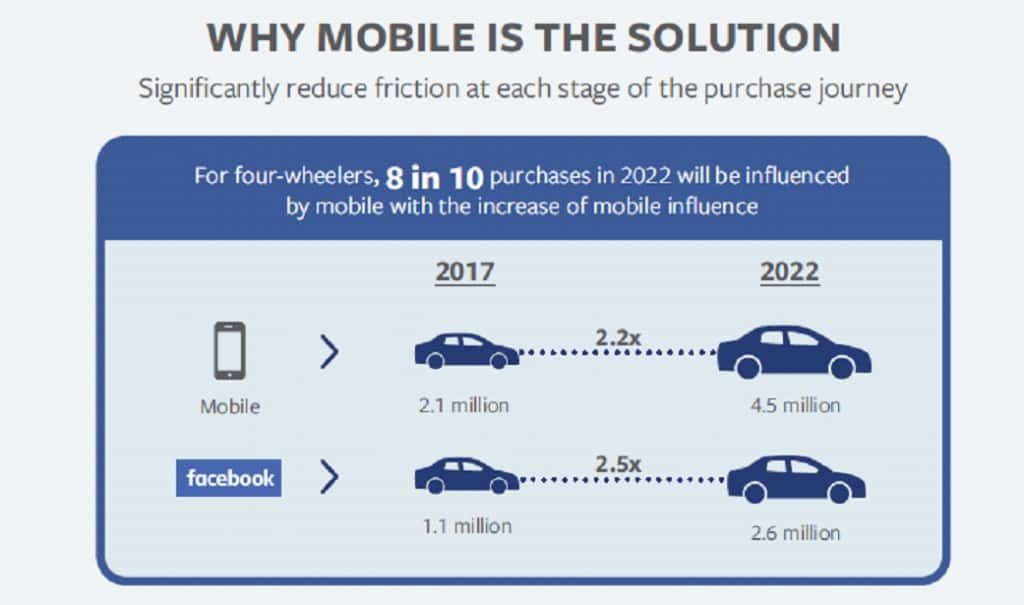

One of the most important purchase decisions in Indian households is buying a vehicle (either a two-wheeler or a four-wheeler). Buying a vehicle involves a lot of time spent in research, and there’s a lot of participation (sometimes from the whole family). Usually, you decide to buy a vehicle only when you are really sure about it. Yet, a lot of potential consumers give up the idea of buying a vehicle midway because of the problems, aka friction, they face at different stages of the buying process. This is a huge pain point for the auto industry. Facebook and KPMG believe mobiles and smartphones are the answer to this problem. As India spends more time on its phones, it is but natural that Indians will look to mobiles for answers. Facebook has come out with a report for the Indian automobile industry called Eliminating friction in automobile path to purchase, a research report under its programme Zero Friction Future. The report tries to understand the reasons that lead to drop-offs in the path to purchasing an automobile, referred to as ‘friction’, which leads to a potential loss of revenue for brands. Most of this friction (1/3 for four-wheelers and ½ for two-wheelers) is due to media. India is one of the largest four wheeler markets in the world today with a production of 29 million vehicles in 2018 and an estimated production of 60 million vehicles by 2022. That said, India also has one of the lowest vehicle penetration figures in the world at just 20 vehicles per 1,000 people. This means the potential for the auto industry is huge if they could only figure out how to eliminate those friction points. Here are some very interesting insights on consumer behaviour from the report. Losing potential consumers early in the buying process The highest drop off during the buying process for four-wheelers is with consumers who have considered buying a vehicle in the past year but decided not to. This person has a list of short-listed models in mind but then drops the plan. Take a look at the graph below. Almost 50% of consumers drop off between the awareness and consideration stages. Hardly 7% of people who want to buy cars end up buying them. For two-wheelers, almost half the buyers drop off when before they even short-list the models. Clearly, there’s something wrong in the media strategy that companies and agencies deploy. People are aware of the vehicles and consider buying them but don’t follow through to the end. Finding the connect with different genders Most car advertisements don’t target women. Consequently, women generally ignore car ads. The one-size fits all model is not very effective for them. Brands need to reach out to women and customise messages for them. These messages need to emphasize on brand connect. Sales teams need to establish a strong connection with them, instead of focusing on features. When men are exploring the option of buying a two-wheeler, they find that there are too many brands that are advertised, and most advertisements do not give enough information. There’s no expert advice or answers that comes their way.  Different age, different problems An older customer (35-49 years) doesn’t know what to do after watching ads, and they find it difficult to browse through a lot of information. One common complaint across age groups and genders were that the dealer/showroom does not respond to them after they have expressed interest. Young buyers (18-24 years) often give up when it comes to financing their vehicles. There’s just no clarity on financing options. Both 18–24 years and 25–34 years consumers seek information on financing options, as they are more likely to be either young professionals buying their first vehicle independently or students taking the role of decision makers while family supports the purchase financially. Innovative business models or alliances to offer and communicate attractive financing options could reduce the significant proportion of media friction at the final stages of the purchase. Similar problems faced by buyers from different socio-economic backgrounds Obviously, a consumer belonging to NCCS A is much more likely (10x) to buy a four-wheeler than an NCCS B person who will end up buying a two-wheeler. That’s where the differences end. When it comes to the buying process, members from both socio-economic backgrounds don’t get expert answers. They are both confused because the options and too many while information is too little. The NCCS A member is not able to contact the dealer while the NCCS B member is unable to get satisfactory answers from his dealer. Now, if the traditional marketing mix (using traditional media) for the consumer is all jumbled up, consumers have no option but to turn towards new media to find answers and solutions. Brands and companies have to make sure consumers are taken off every step of the way with information that is presented to them in a sequential manner that resolves their queries. Digital is a great medium to fill in the gaps that offline marketing strategies can’t fill. Mobile to the rescue  The report says that mobiles will decide nearly 8 in 10 four-wheeler purchases and approximately 7 in 10 two-wheeler sales by 2022. Approximately one in two four-wheeler purchases (47 per cent) and two-wheeler purchases (45 per cent) will be influenced by Facebook, according to the report. India is expected to sell 5.6 million four-wheelers and 30.9 million two-wheelers by 2022. The report says if companies manage to optimise mobile in the marketing strategy, it can create a sales opportunity of a whopping 3.6 million vehicles by 2022, 1 million extra four-wheelers at a 14.7% lower customer acquisition cost, and 2.6 million two-wheelers at 7.8% lower customer acquisition cost.  With digital playing an increasingly important role in the marketing mix, different pathways will be discovered, and a non-linear journey will emerge as the marketing mix undergoes changes. Customer analytics through AI, machine learning, and personalised offers will make the consumer’s path very smooth, and increase the ROI (return on investment) on marketing as brands move towards a frictionless future. For the complete Zero Friction Future report click here.

One of the most important purchase decisions in Indian households is buying a vehicle (either a two-wheeler or a four-wheeler). Buying a vehicle involves a lot of time spent in research, and there’s a lot of participation (sometimes from the whole family). Usually, you decide to buy a vehicle only when you are really sure about it. Yet, a lot of potential consumers give up the idea of buying a vehicle midway because of the problems, aka friction, they face at different stages of the buying process.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)